Company Summary

| FUJITOMI Review Summary | |

| Founded | 1946 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Products & Services | Exchange FX (Click365), Exchange CFDs (Click Stocks 365), Commodities (Commodity Futures Trading), Systre Select 365, Investment Advisory, Real Estate |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: 0120-60-2413 |

| Address: 〒103-0014 1-15-5 Japan Hashikaga-cho, Chuo-ku, Tokyo | |

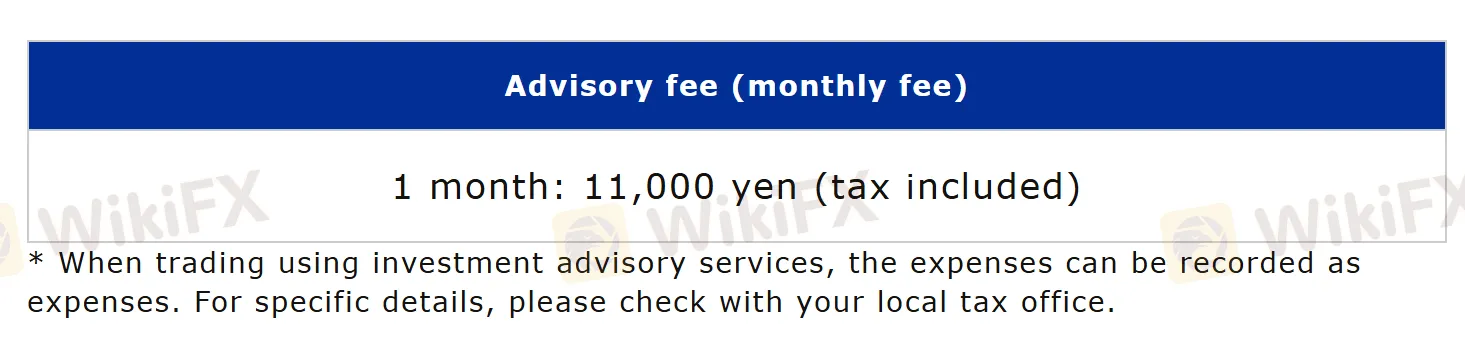

Founded in Japan in 1946 and regulated by the FSA with a Retail Forex License, FUJITOMI offers diverse products and services like Exchange FX (Click365), Exchange CFDs (Click Stocks 365), Commodities (Commodity Futures Trading), Systre Select 365, Investment Advisory, and Real Estate. The firm charges a monthly advisory fee of 11,000 yen.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited info on accounts |

| A wide range of products and services | Limited info on trading fees |

| No demo accounts | |

| Lack of info on trading platforms |

Is FUJITOMI Legit?

Yes, FUJITOMI is currently regulated by FSA, holding a Retail Forex License.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | フジトミ証券株式会社 | Regulated | Retail Forex License | 関東財務局長(金商)第1614号 |

Products and Services

FUJITOMI provides clients with Exchange FX (Click365), Exchange CFDs (Click Stocks 365), Commodities (Commodity Futures Trading), Systre Select 365, Investment Advisory, and Real Estate.

Fees

The monthly fee is 11,000 yen. The associated expenses might be recorded as expenses for tax purposes, and clients should consult your local tax office for specific details.