Company Summary

| BlackrockReview Summary | |

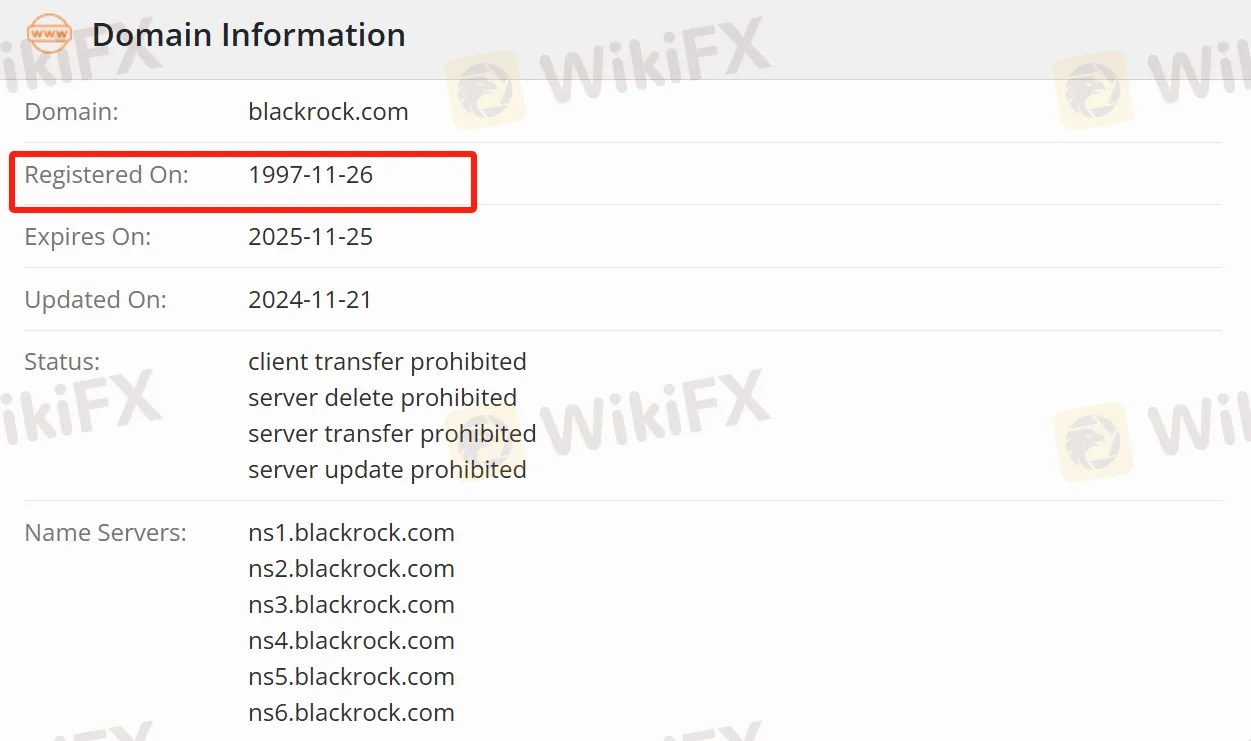

| Registered On | 1997-11-26 |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Products and Services | Equity, Fixed Income, Digital Assets, Commodities, Real Estate, and ETFS |

| Customer Support | 202-414-2100/302-797-2000 (Washington); +27 (0) 21 403 6441 (Africa); +57 (1) 319 2598 (Bogotá); 31 (0) 20 549 5200 (Amsterdam), etc. |

| Instagram, LinkedIn, Twitter, YouTube, TikTok | |

Blackrock Information

BlackRock is a global provider of investment, consulting, and risk management solutions, helping individuals achieve financial well-being. As a fintech provider, it has over 19,000 employees from diverse backgrounds speaking 135 languages, with operations in 42 countries. Its clientele includes individuals and families, financial advisors, educational and non-profit organizations, pension plans, insurance companies, governments, and more.

Pros and Cons

| Pros | Cons |

| Regulated | Unclear fee structure |

| Regulated | Lack of personalization due to large business scale |

| Abundant investment experience | |

| Diverse clientele |

Is Blackrock Legit?

BlackRock is a legal and compliant enterprise. It has operated in the global financial market for many years and is supervised and regulated by financial regulatory authorities in multiple countries.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| SFC | BlackRock Asset Management North Asia Limited | Dealing in futures contracts | AFF275 | Regulated |

| MAS | LACKROCK (SINGAPORE) LIMITED | Retail Forex License | Unreleased | Regulated |

| ASIC | BLACKROCK INVESTMENT MANAGEMENT (AUSTRALIA) LIMITED | Investment Advisory License | 000230523 | Exceeded |

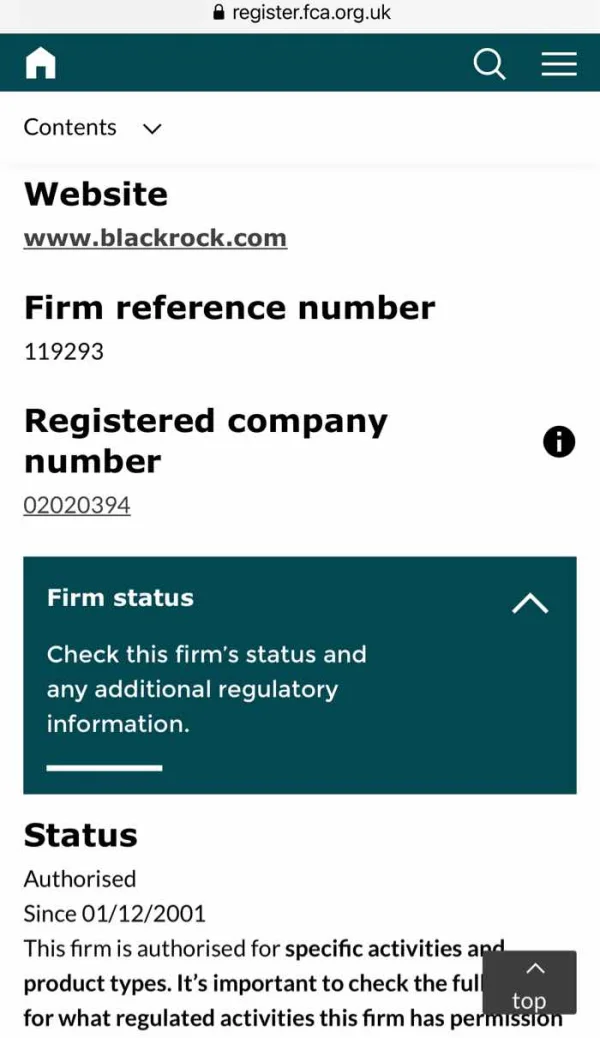

| FCA | BlackRock International, Limited | Investment Advisory License | 178638 | Exceeded |

What Products and Services Does Blackrock Provide?

At BlackRock, individuals and families can invest for goals such as retirement, home purchases, and children's education; financial advisors can leverage its platform to help clients of different income levels with investment planning; pension plans can manage retirement savings for various professionals; and governments can raise funds for infrastructure projects and other initiatives through BlackRock. Additionally, the clientele includes financial advisors and insurance companies.

Furthermore, investors can select various exchange-traded fund (ETF) products based on their region. For the U.S. market via iShares, offerings include Equity, Fixed Income, Digital Assets, Commodities, Real Estate, etc. For the U.S. market via BlackRock, products include iShares ETFs and Mutual Funds, while for Australia, offerings include Equity, Fixed Income, Real Estate, and more.

| Assets | Supported |

| Equity | ✔ |

| Fixed Income | ✔ |

| Digital Assets | ✔ |

| Commodities | ✔ |

| Real Estate | ✔ |

| ETFs | ✔ |

For more asset information, please click to visit the official website.

United States

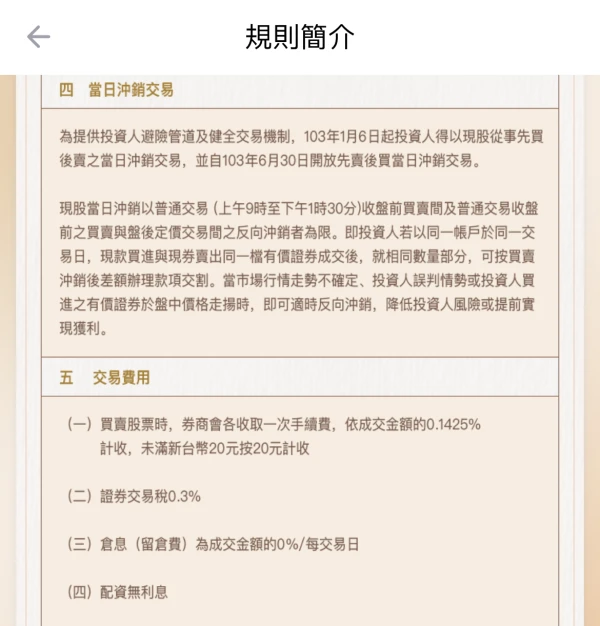

This company is regulated by FCA, please look at the following picture

Exposure

FX3248546053

Canada

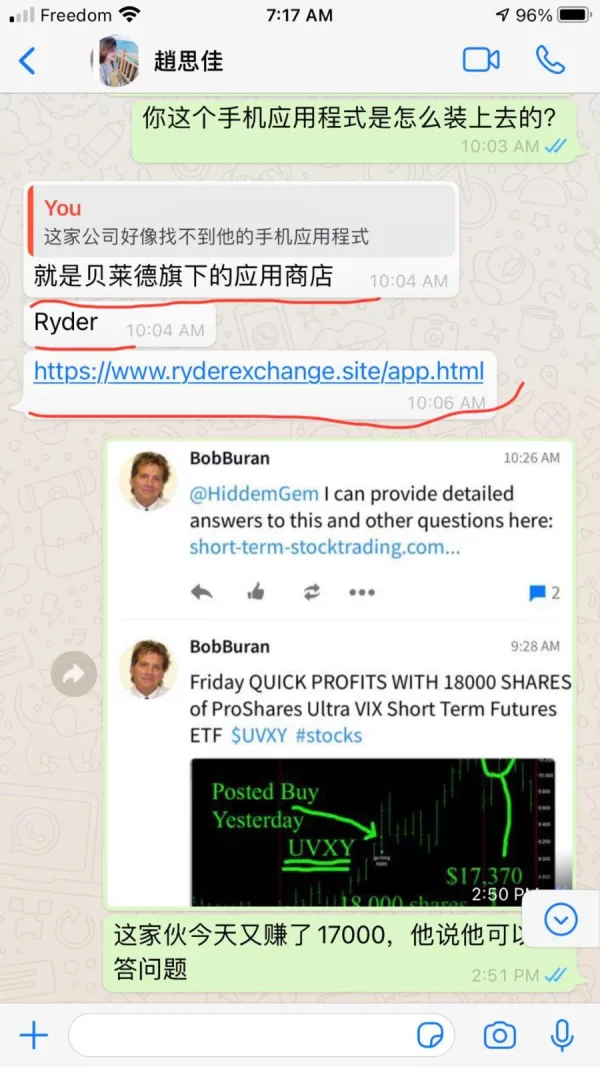

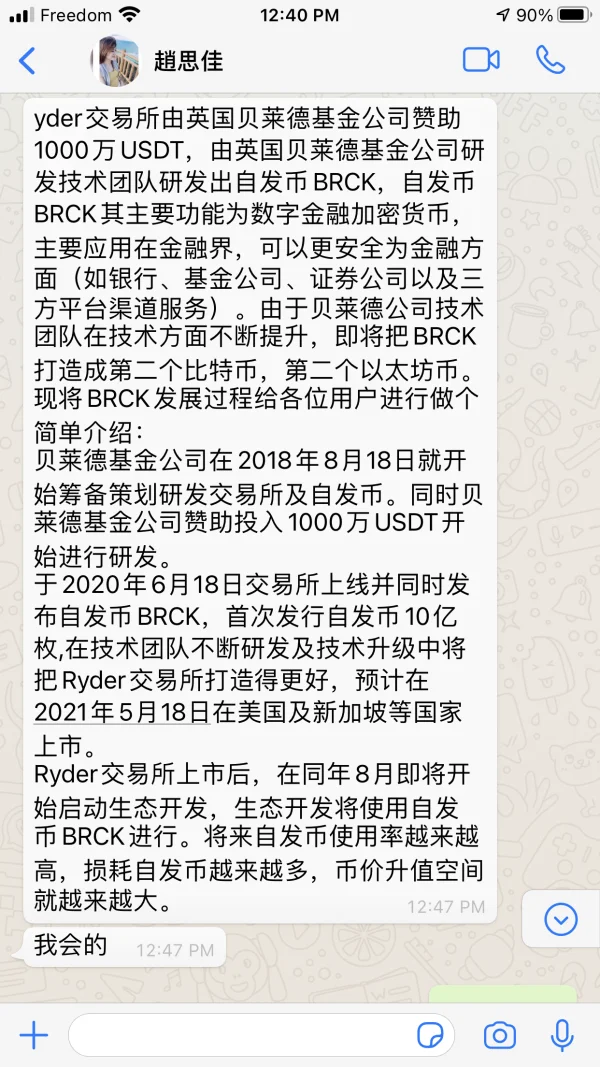

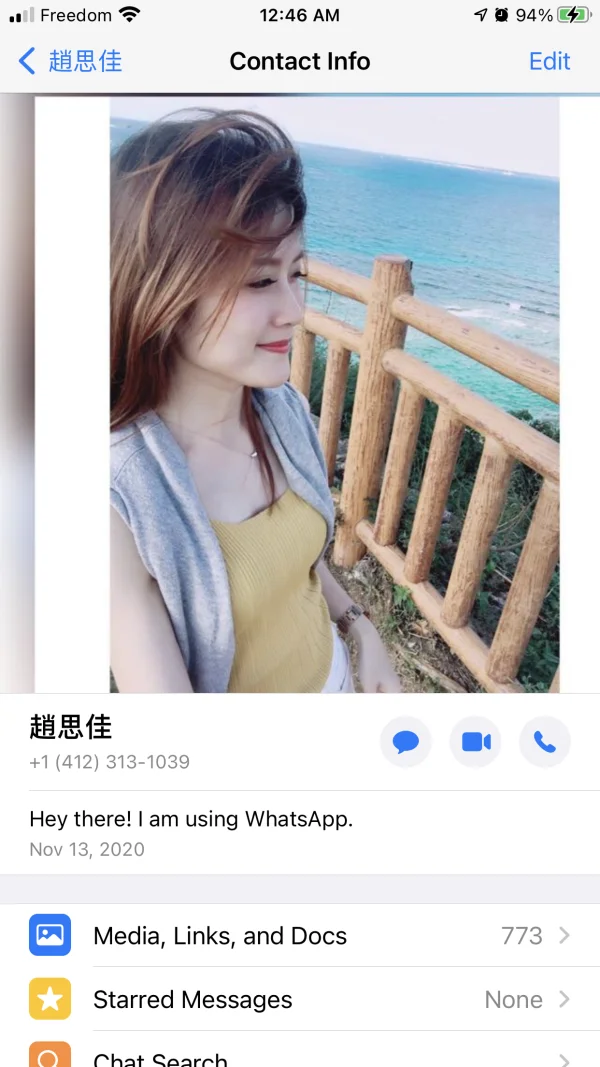

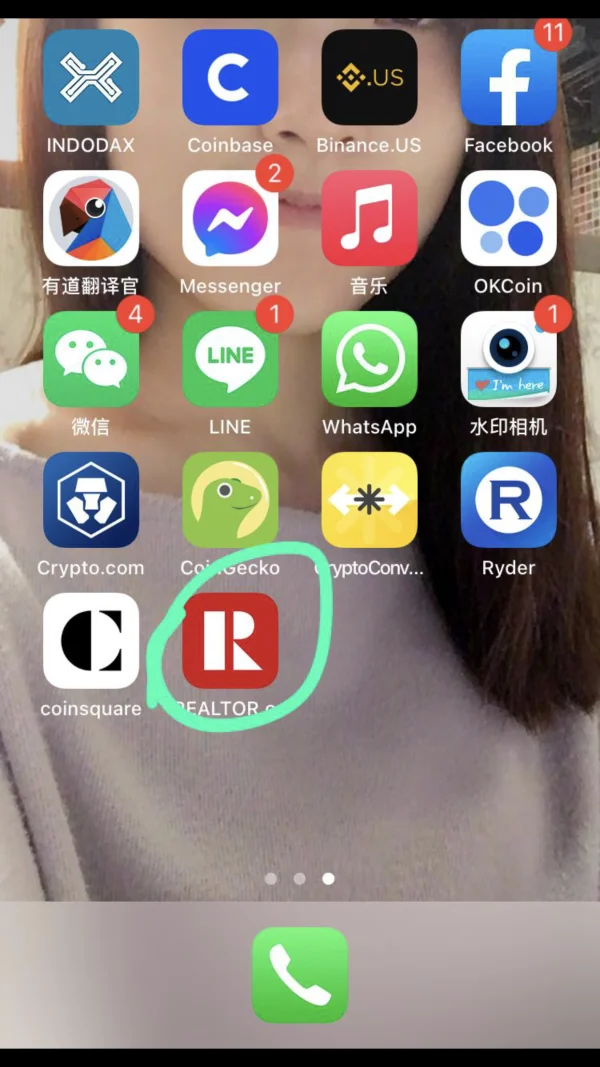

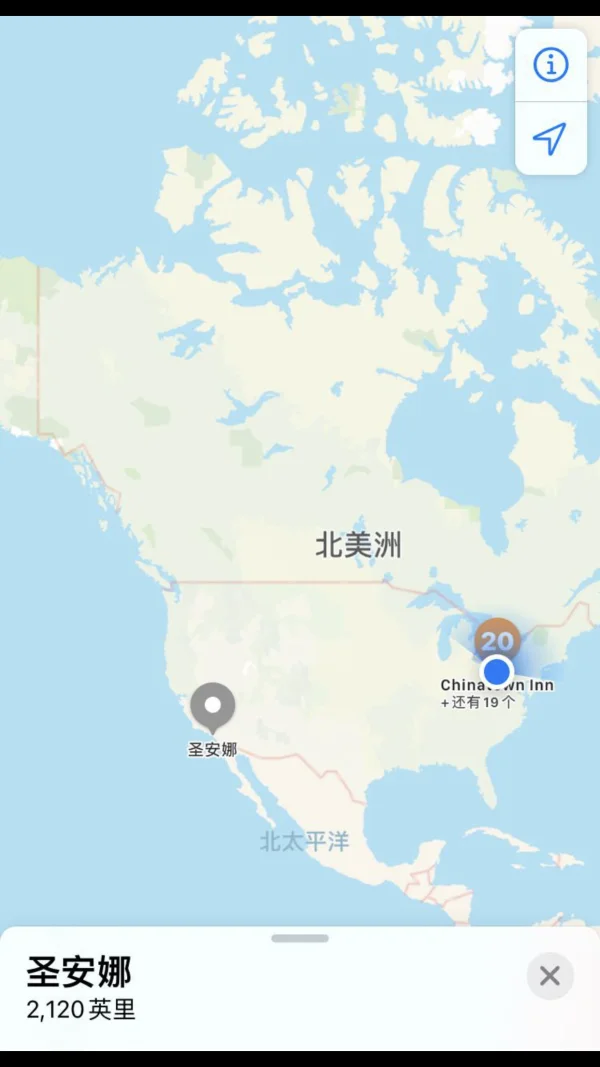

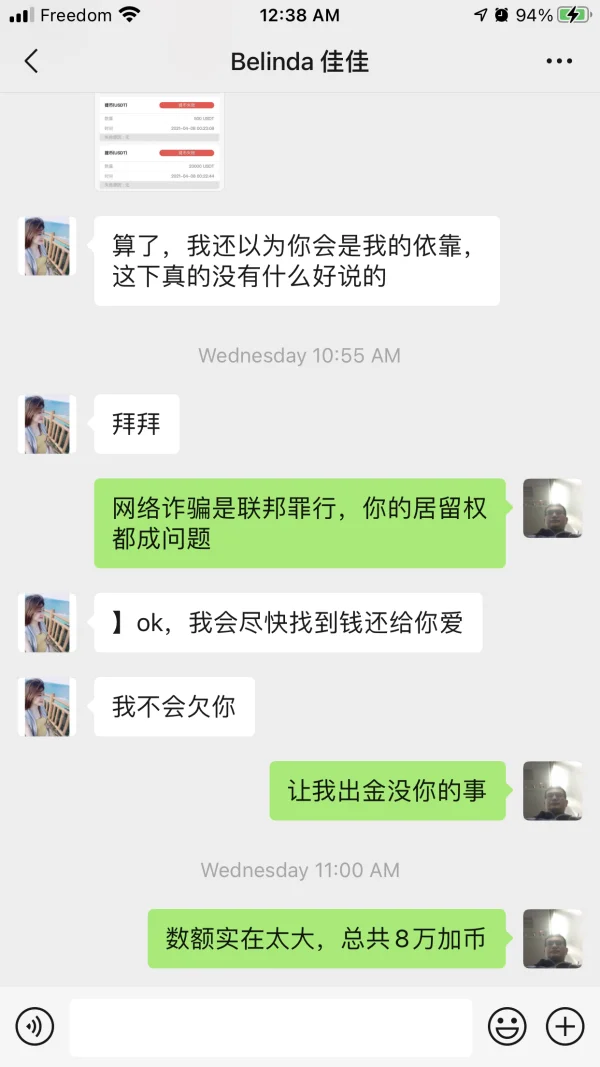

Nationality: Canada. I live in Calgary and knew Sijia Zhao via Facebook at the end of February of 2021. Her nationality is China and lives in America. We’ve changed our phone numbers. Hers is +1(412)313-1039. The platform she recommended: https://www.ryderexchange.site/wap, called 111. And they claimed it would list in May. I deposited 1,700 USDT and succeeded in withdrawing 500 USDT. I deposited 15,000 USDT and withdrew1,300USDT afterwards. Sijia Zhao asked me about the amount of my assets on grounds of building relationship with me. And I was asked to deposit 300,000 USDT an out common assets. I withdrew 3,200 USDT when my total account balance was 50,000 USDT. But I failed in withdrawing 32,000 USDT when my account balance was 80,000 USDT on grounds of abnormal IP address. So I have to verify my ID. After that, I was asked to pay 22,000 USDT as a tax fee to withdraw funds. Sijia Zhao told me that her money was also unable to withdraw. She said she called the local police and FBI. But then when I asked her gain, she said she withdrew many times. This is so paradox. So I asked for the screenshot about calling the police. No response. She ended our relationship on grounds of distrust. I recharged over 80,000 Canadian dollars till that time. She is a fraud, claiming that her father had a building company and the phone number of her doesn’t belong to her ID.

Exposure

FX3248546053

Canada

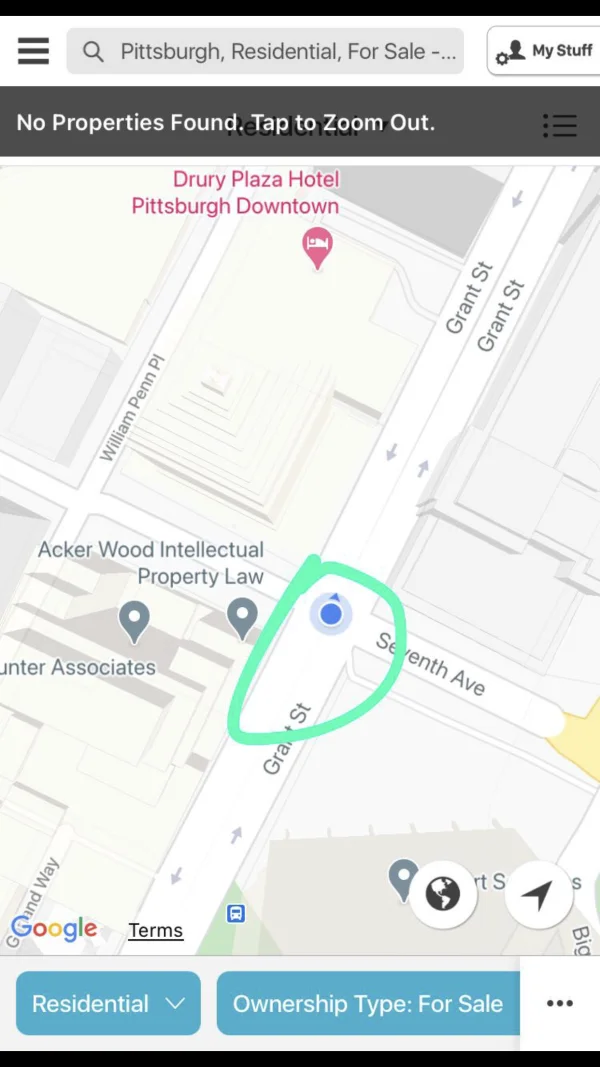

She lives near Chinatown in Pittsburgh, Pennsylvania, USA, claiming that the Ryder is supported 10 million USDT by a British company and the BRCK/USDT will be launched in May.

Exposure

tombita

Peru

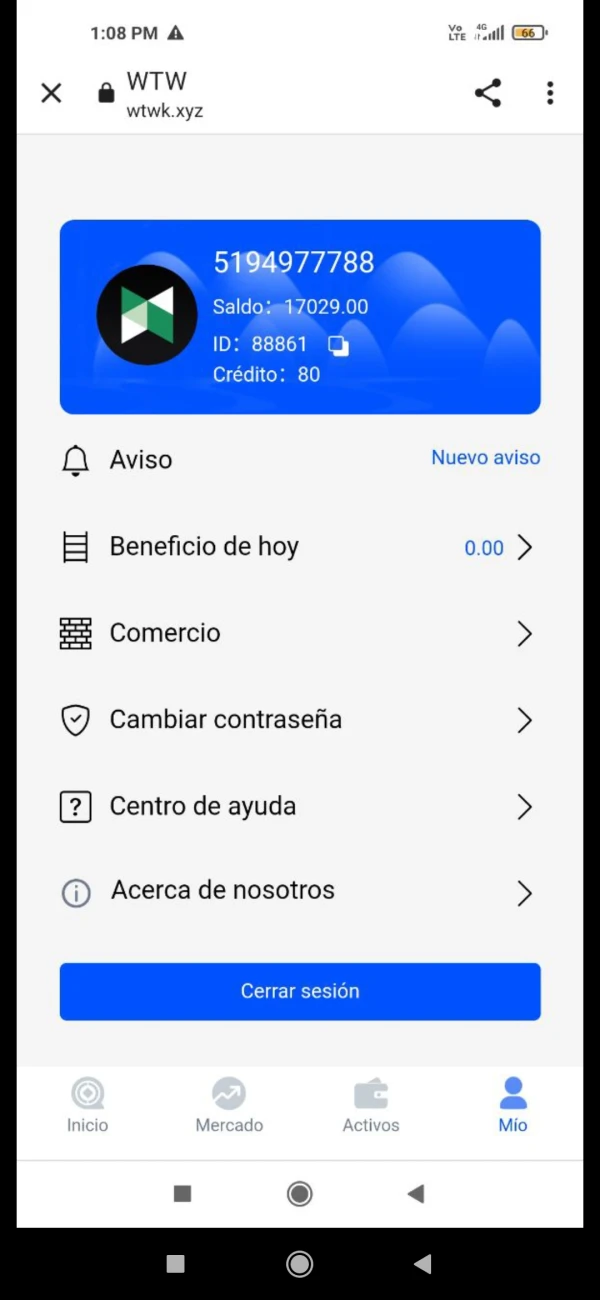

Withdrawal that should be given to me. But they tell me that I must make another, large amount withdrawal.

Exposure

FX1245234069

United States

It's hard to believe that this company that has been around for over 15 years is also a scammer. To be honest, if I hadn't habitually checked wikifx, I would have foolishly invested here.

Neutral

FX3644586767

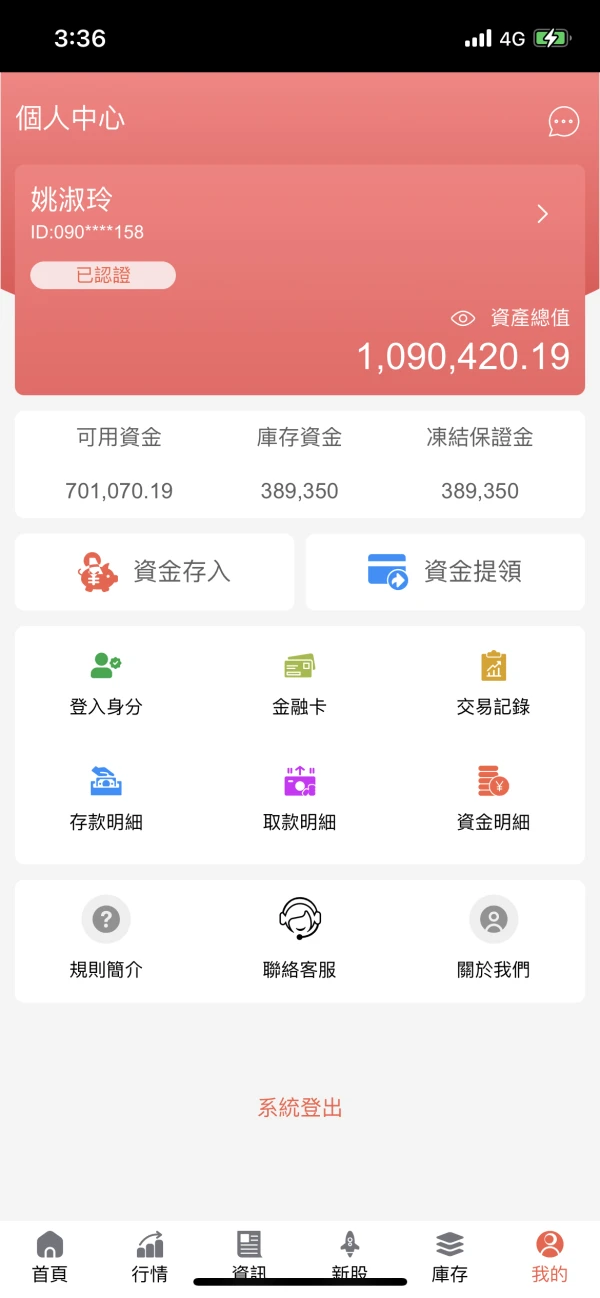

Taiwan

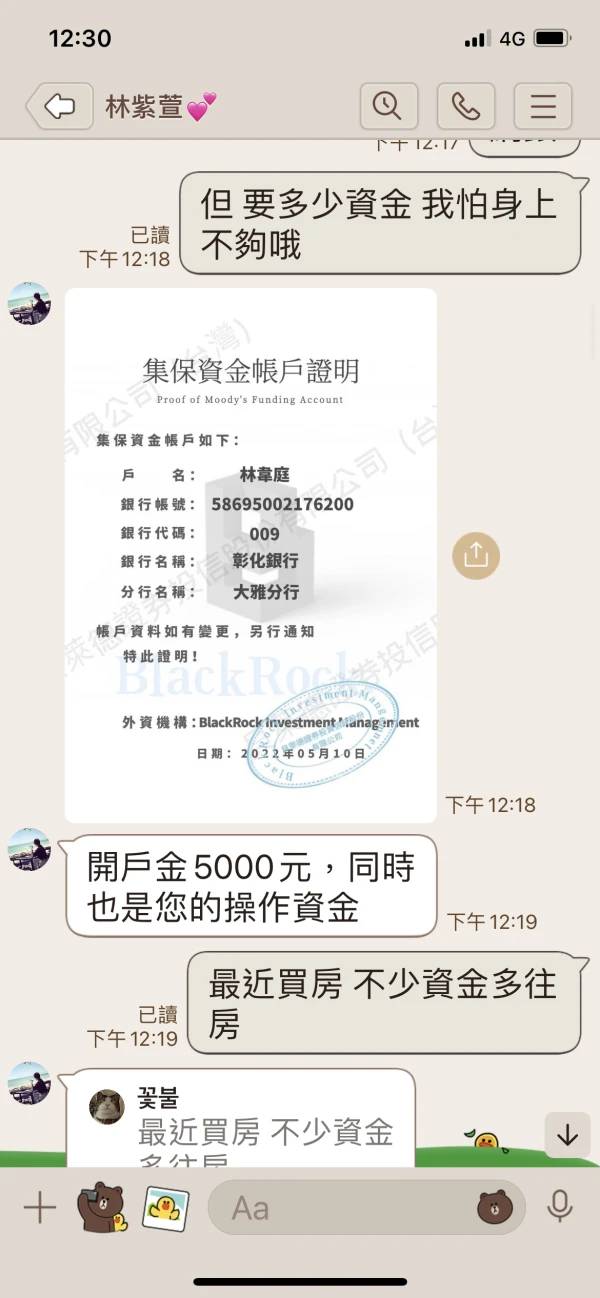

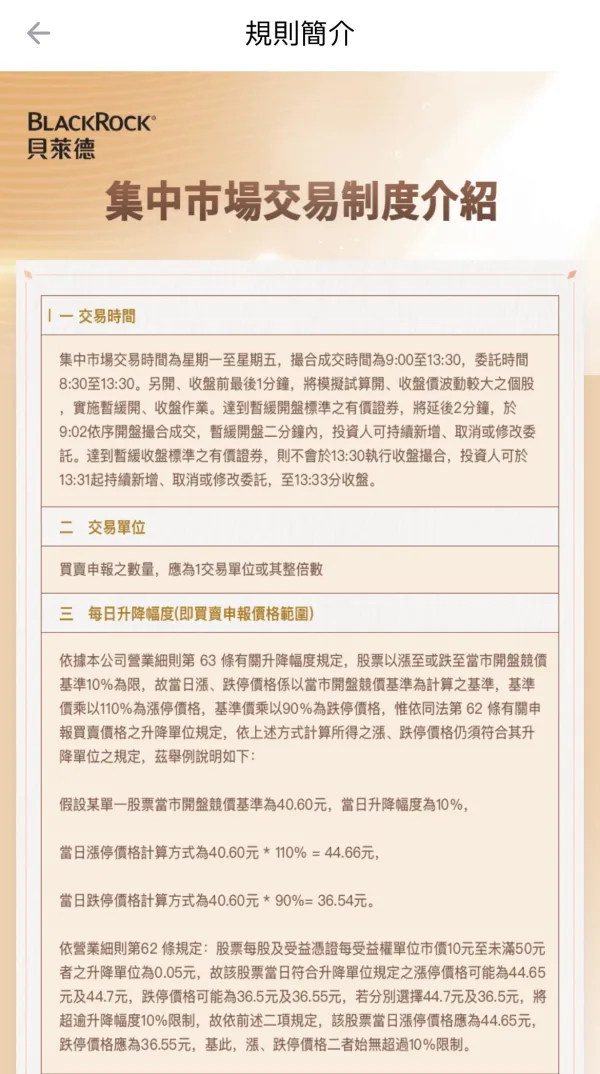

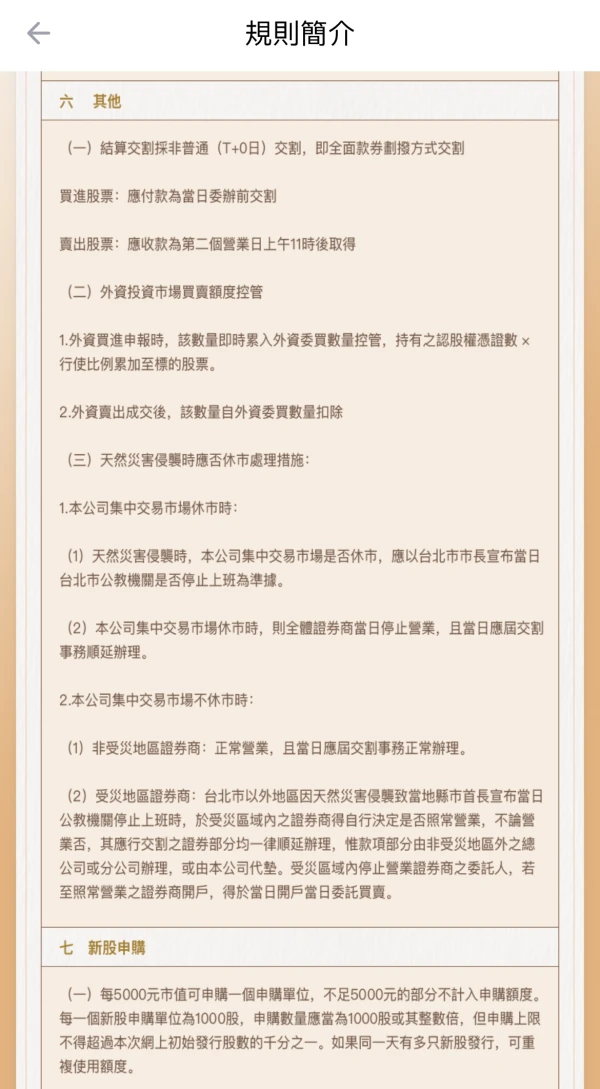

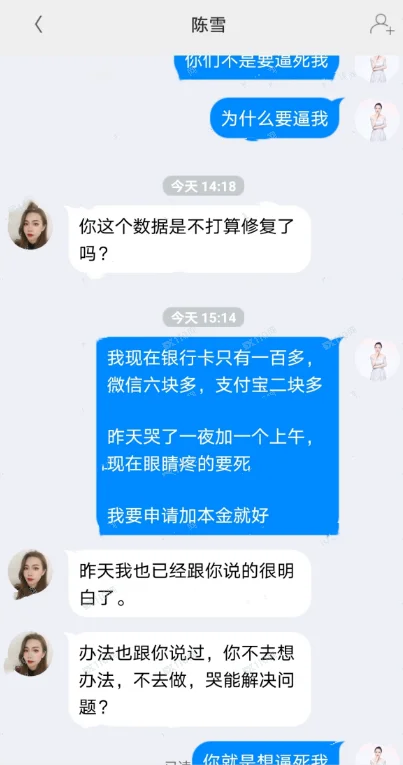

Beware of fake investment, real fraud. Requrie 5,000 deposit to open an account, and then redemption the next day, lottery shares and huge amounts, and then circle buy again, and keep forcing the victim to deposit money. When you want to withdraw money, you say that there is a problem with the other party's account and you need to pay a deposit or you cannot withdraw money for various reasons.

Exposure

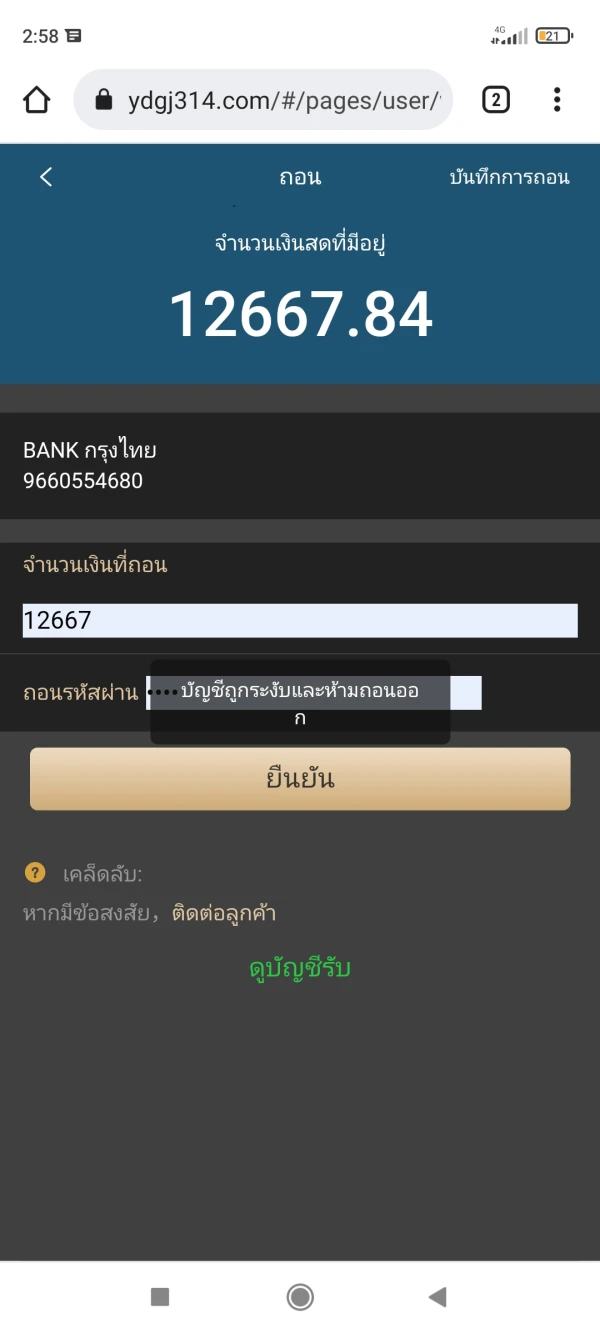

FX4802127712

Thailand

How can my id be suspended? then you say again 3 months, I will be able to withdraw. In conclusion, will I get a refund or not, or will the 12667? You tell yourself that it's removable.

Exposure

FX1305625852

Malaysia

Beware of it. The customer service asked you to deposit more money. Stay away.

Exposure

FX3248546053

Canada

I met "赵思佳" on Facebook, She recommended Ryder Exchange,I deposited 1700 USDT then successfully withdrew 500 USDT; I deposited 15000 USDT then successfully withdrew 1300 USDT.When my total assets were 50000 USDT and successfully withdrew 3200 USDT . When my total assets were 80000 USDT and failed to withdraw 32000 USDT.after I successfully completed advanced certification, I failed to withdraw 900 USDT and then no permission to withdraw.

Exposure