Company Summary

Note: CMS's official website: http://www.cmschina.com.hk/en/ is currently inaccessible normally.

| CMSReview Summary | |

| Founded | / |

| Registered Country/Region | Hong Kong |

| Regulation | Regulated |

| Market Instruments | FuturesCommoditiesFundsStocksBondsOptionsETFIndices |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | CMS Hong Kong App platformCQ Key appCQG Trader Futures Trading softwareCQG Web Futures TradingSPTraderPro HD mobile appSharp Point Futures Trading software |

| Min Deposit | / |

| Customer Support | Phone: (852)31896368400 1200 3684008888 199(852)31896191 |

| Email: online@cmschina.com.hkcmsuk@cmschina.co.ukcmskorea@cmschina.co.kr | |

| Physical Address: Central, Hong Kong and Kwun Tong, Kowloon | |

CMS Information

CMS is a securities company registered in Hong Kong, China and regulated by SFC. It supports the trading of Futures, Commodities, Funds, Stocks, Bonds, Options, ETFs, Indices, etc. It provides 6 trading platforms and 3 accounts.

Pros and Cons

| Pros | Cons |

| Be regulated | No account details |

| 6 trading platforms | Official website unavailable |

| Demo accounts are not available |

Is CMS Legit?

| Regulated Country/Region |  |  |

| Regulated Authority | SFC | FCA |

| Regulated Entity | China Merchants Securities (HK) Co., Limited | conChina Merchants Securities (Uk) Limited |

| License Type | Dealing in futures contracts | Investment Advisory License |

| License Number | AAI650 | 610534 |

| Current Status | Regulated | Exceeded |

What Can I Trade on CMS?

CMS offers Hong Kong futures trading, including Hang Seng Index futures, Mini Hang Seng Index futures, etc. CMS also offers bond trading, trading of various funds, including equity funds, bond funds and balanced funds, and ETFs. In addition, there are Hong Kong stocks, overseas stocks in 12 different markets, stock options, global commodities, futures and indices.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Commodities | ✔ |

| Funds | ✔ |

| Stocks | ✔ |

| Bonds | ✔ |

| Options | ✔ |

| ETF | ✔ |

| Indices | ✔ |

| Forex | ❌ |

Account Types

CMS offers two main types of securities accounts: cash account and margin account. A futures account dedicated to trading futures contracts is also available.

CMS Fees

Securities trading charges include 0.25% brokerage commission (minimum HK $100), transaction levy 0.0027%, transaction fee 0.00565%. A stamp duty of 0.13% is imposed on banknotes sold.

Stock options trading involves a commission of HK $40 per contract per party, with a minimum of HK $100 for executed orders.

CMS charges an annual custodial fee of 0.04 percent of market value for its bond trading services, as well as a $30 transaction fee and an $80 early redemption fee.

| Trading Type | Charge Details | Rate/Amount |

| Securities Trading | Brokerage Commission | 0.25% (minimum HK $100) |

| Transaction Levy | 0.00% | |

| Transaction Fee | 0.01% | |

| Stamp Duty on sold banknotes | 0.13% | |

| Stock Options | Commission per contract per party | HK $40 (minimum HK $100 for executed orders) |

| CMS Bond Trading | Annual Custodial Fee | 0.04% of market value |

| Transaction Fee | $30 | |

| Early Redemption Fee | $80 |

Trading Platform

CMS can use CMS Hong Kong App platform and CQ Key app for stock trading, which is available for mobile devices.

CMS offers a variety of software options for futures trading: CQG Trader Futures Trading software, CQG Web Futures Trading, SPTraderPro HD mobile app, and Sharp Point Futures Trading software.

| Trading Platform | Supported | Available Devices | Suitable for |

| CMS Hong Kong App platform | ✔ | Mobile | All traders |

| CQ Key app | ✔ | Mobile | All traders |

| CQG Trader Futures Trading software | ✔ | - | All traders |

| CQG Web Futures Trading | ✔ | Web | All traders |

| SPTraderPro HD mobile app | ✔ | Mobile | All traders |

| Sharp Point Futures Trading software | ✔ | - | All traders |

| MT4 | ❌ | ||

| MT5 | ❌ |

Deposit and Withdrawal

There are 4 deposit methods supported by CMS:

Transfer to designated bank account (e.g. Standard Chartered Bank, Bank of China)

Online banking through China Merchants Bank Hong Kong Branch (CMBHK)

Checking deposit

Same day bank transfers from selected local banks

Withdrawals can be made through online trading platforms or by check and remittance. In addition, bank account authorization and deposit of funds are free of charge.

FX1827755453

Hong Kong

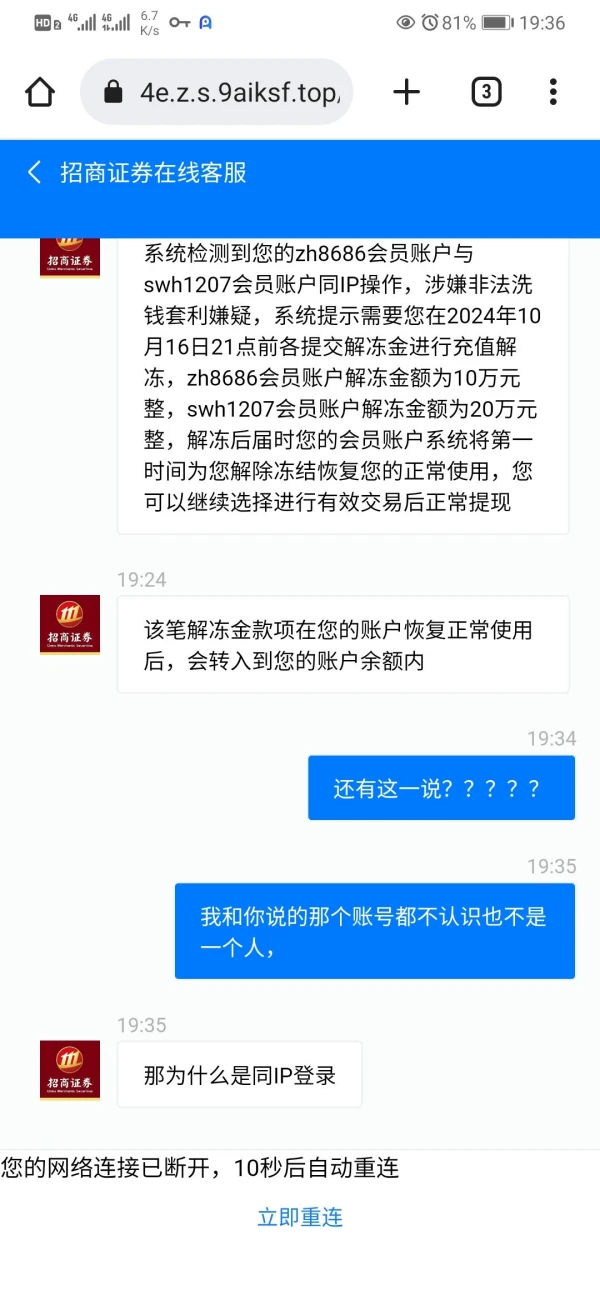

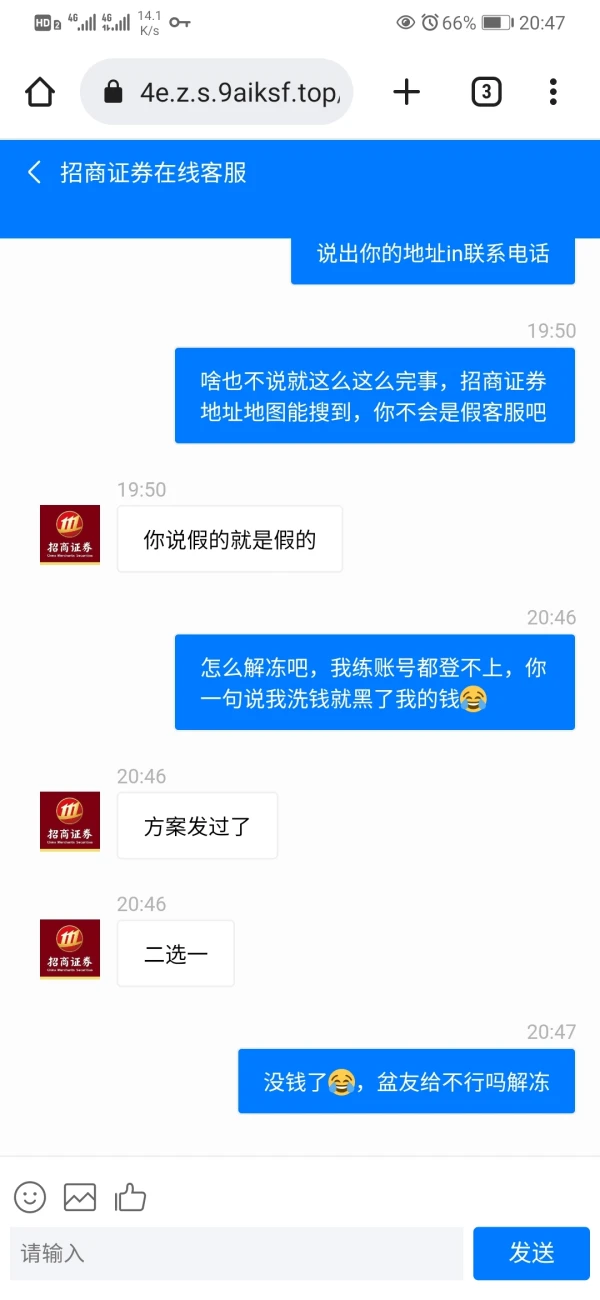

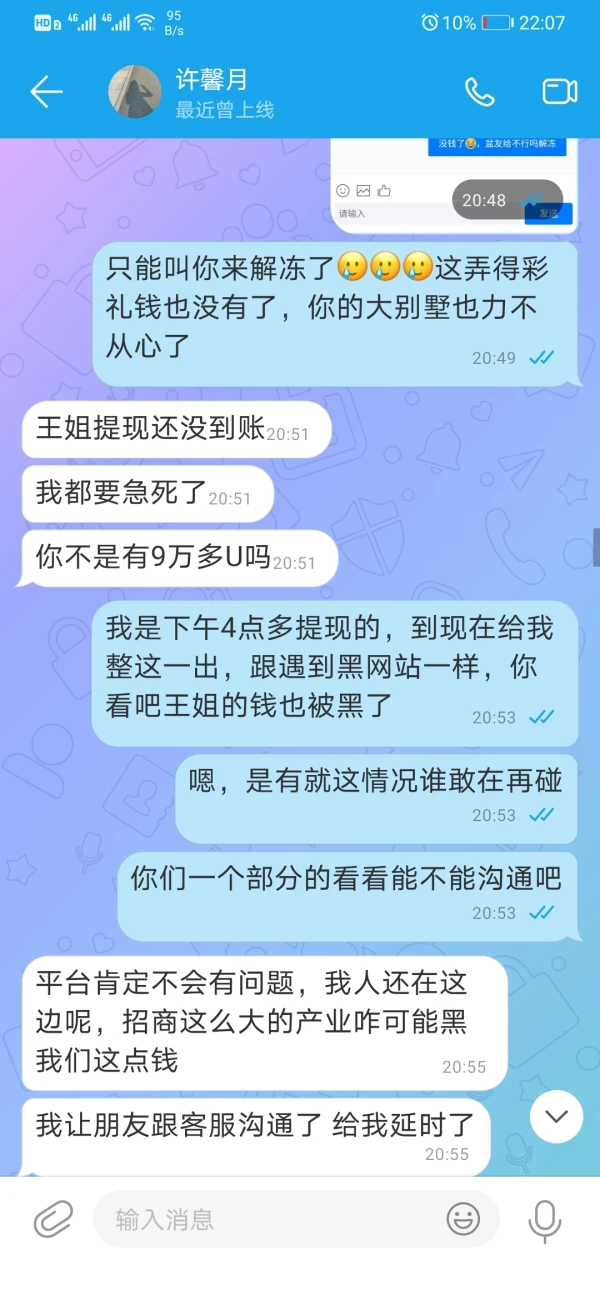

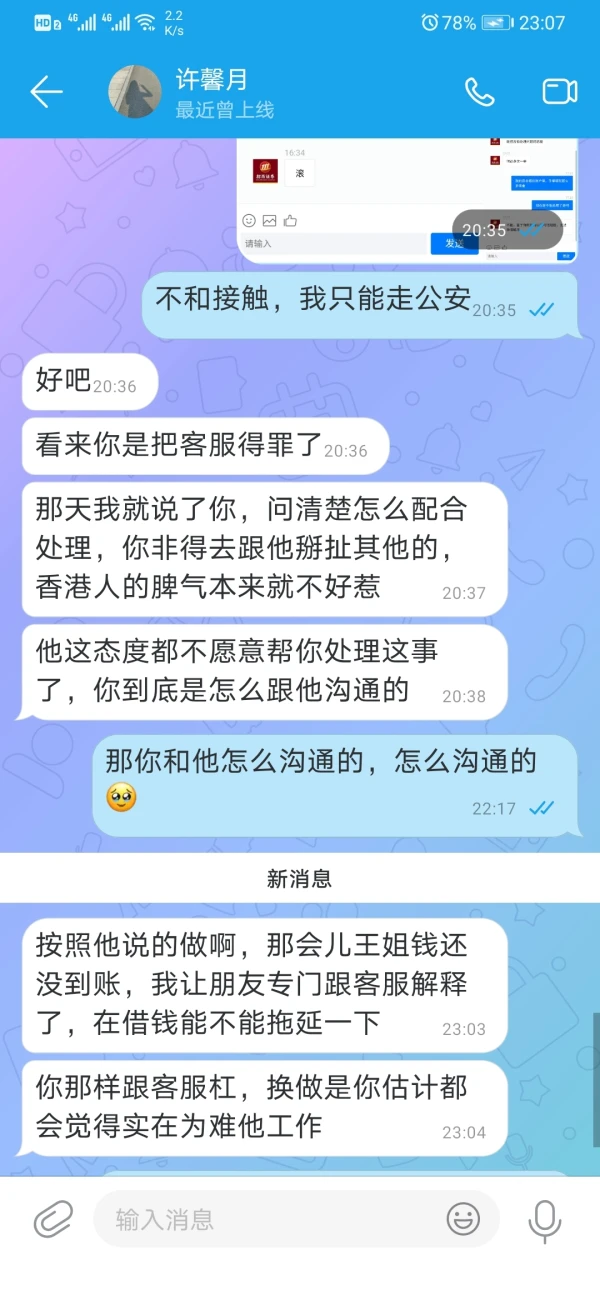

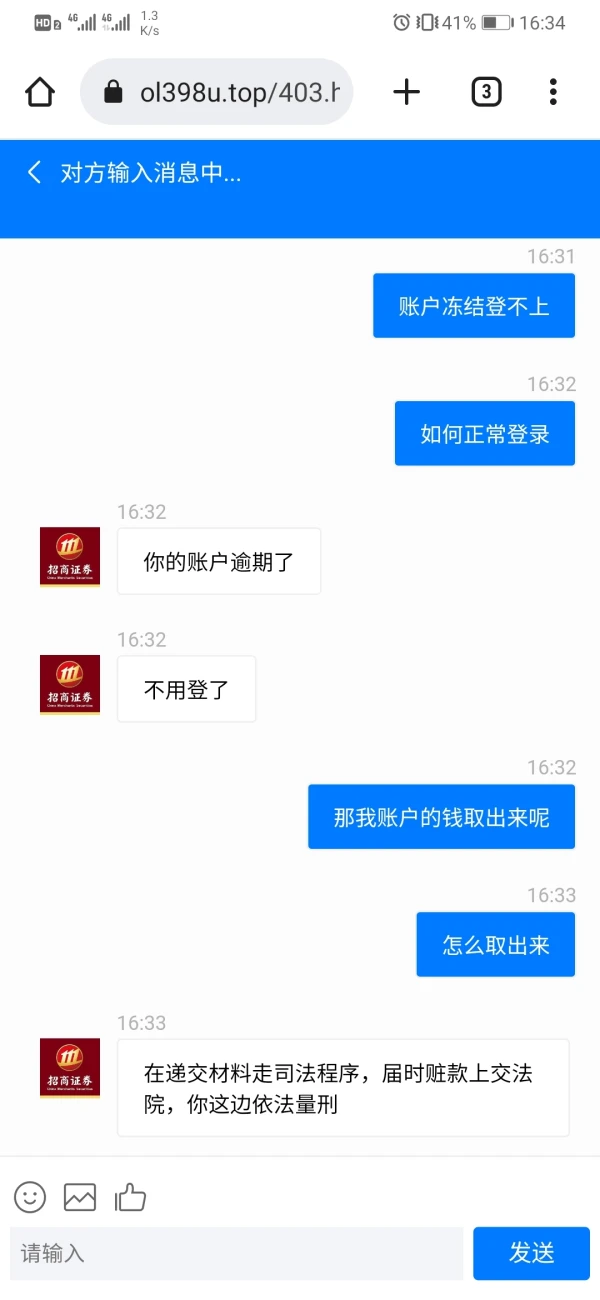

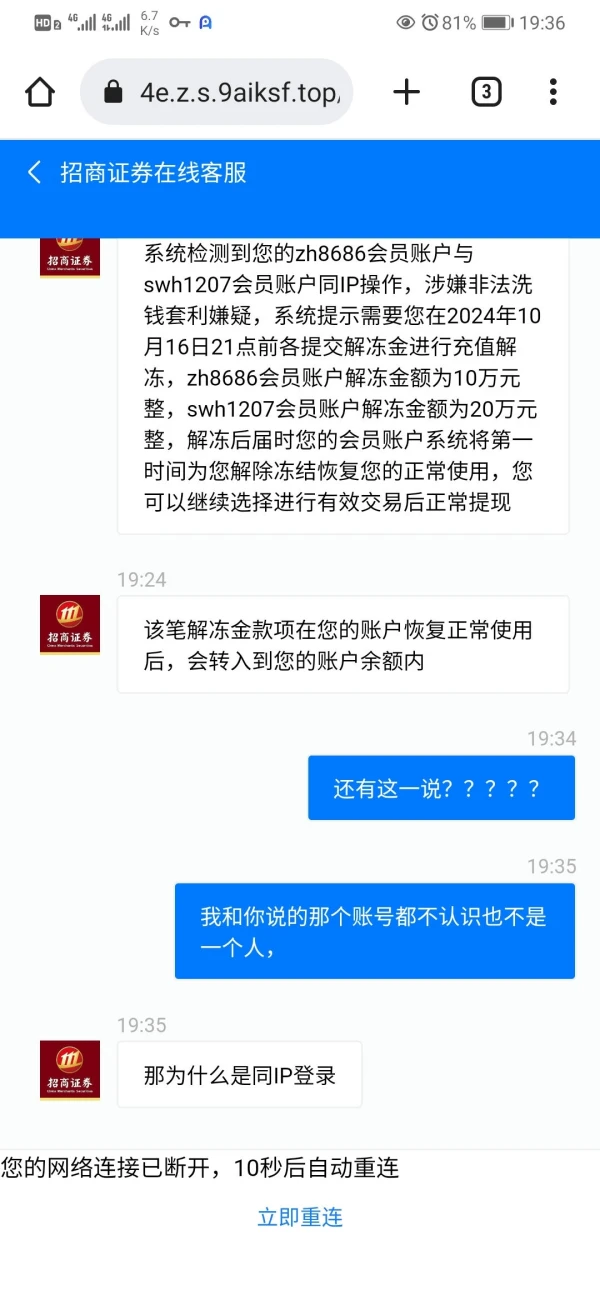

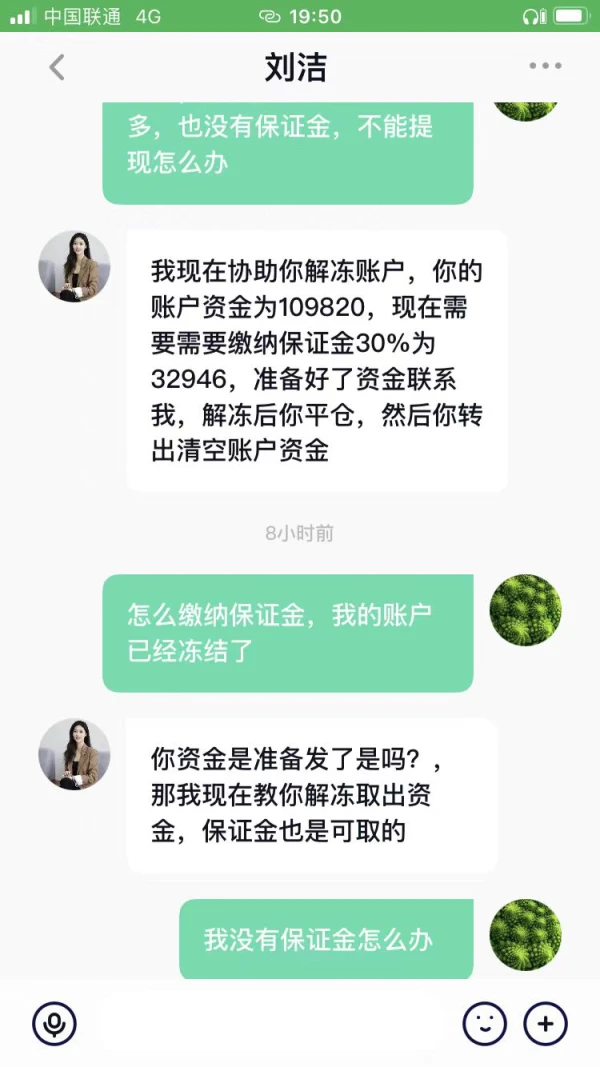

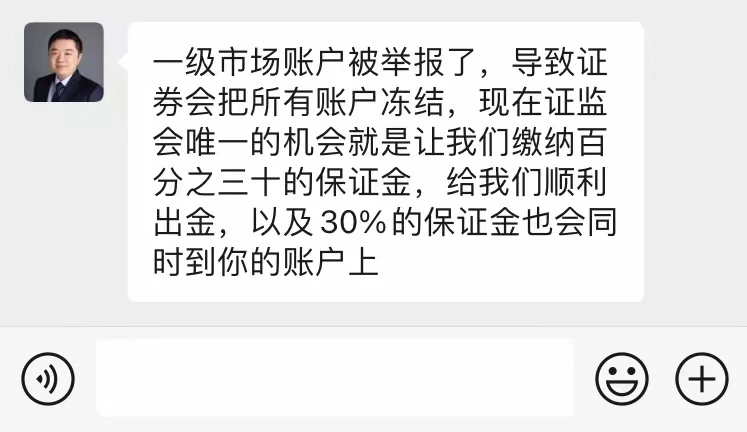

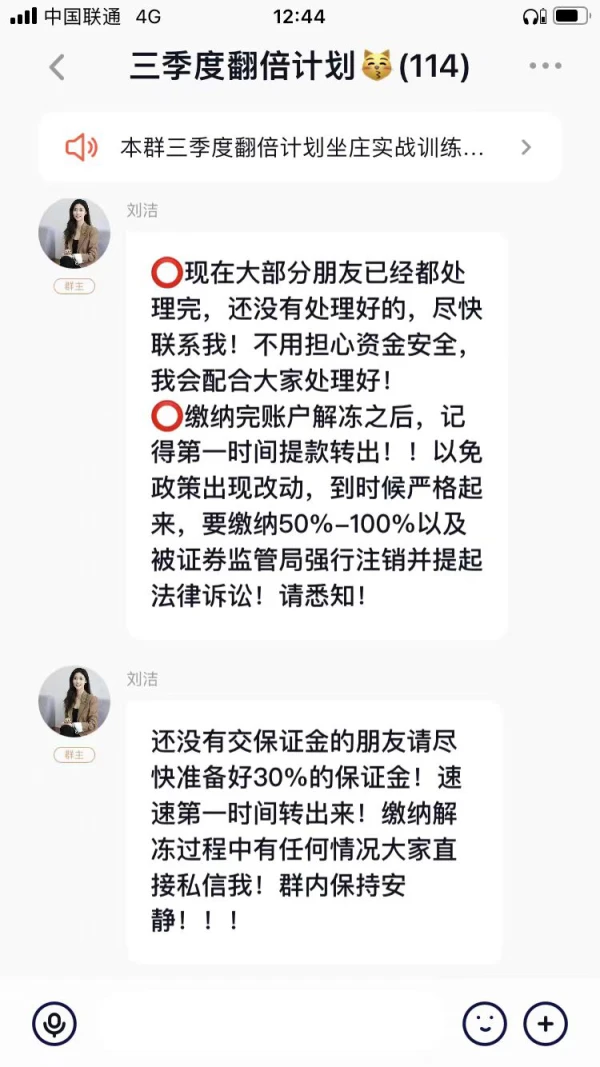

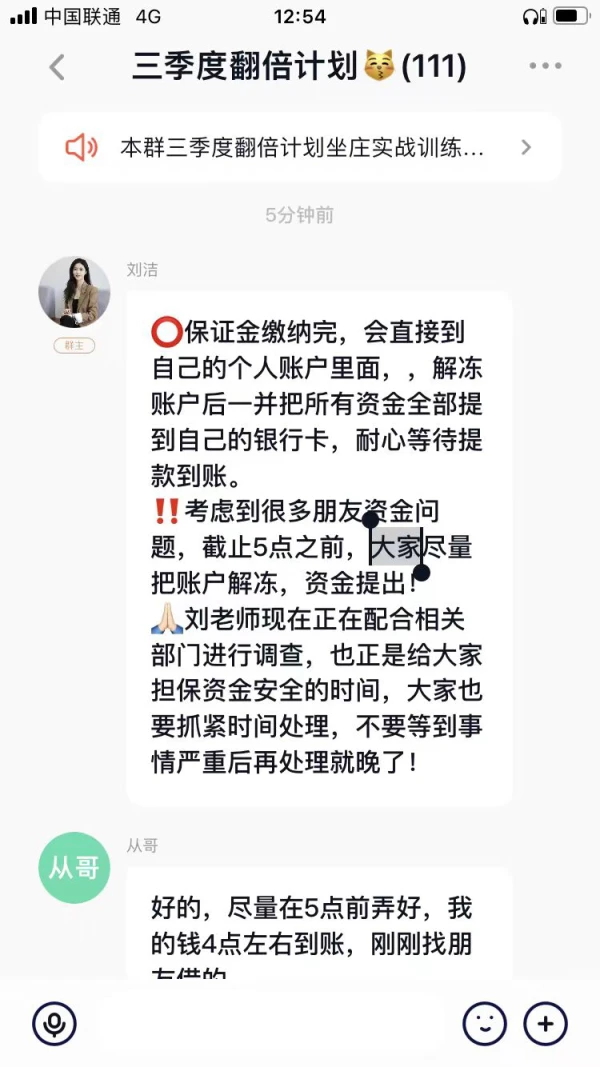

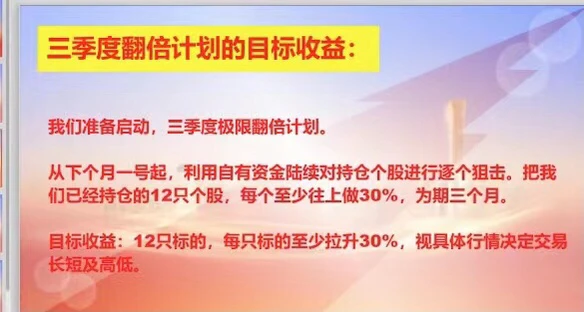

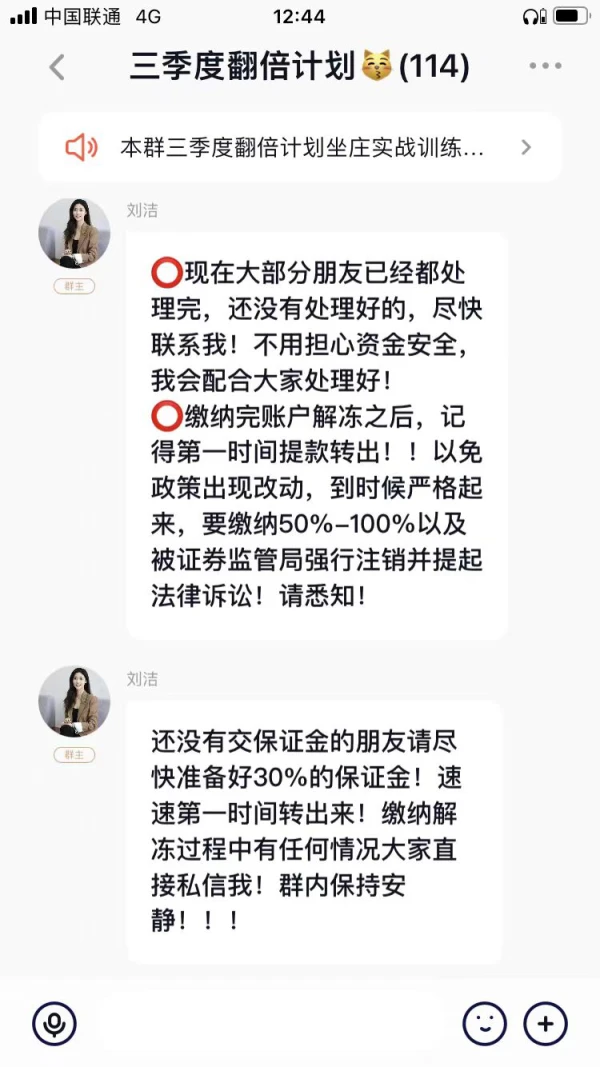

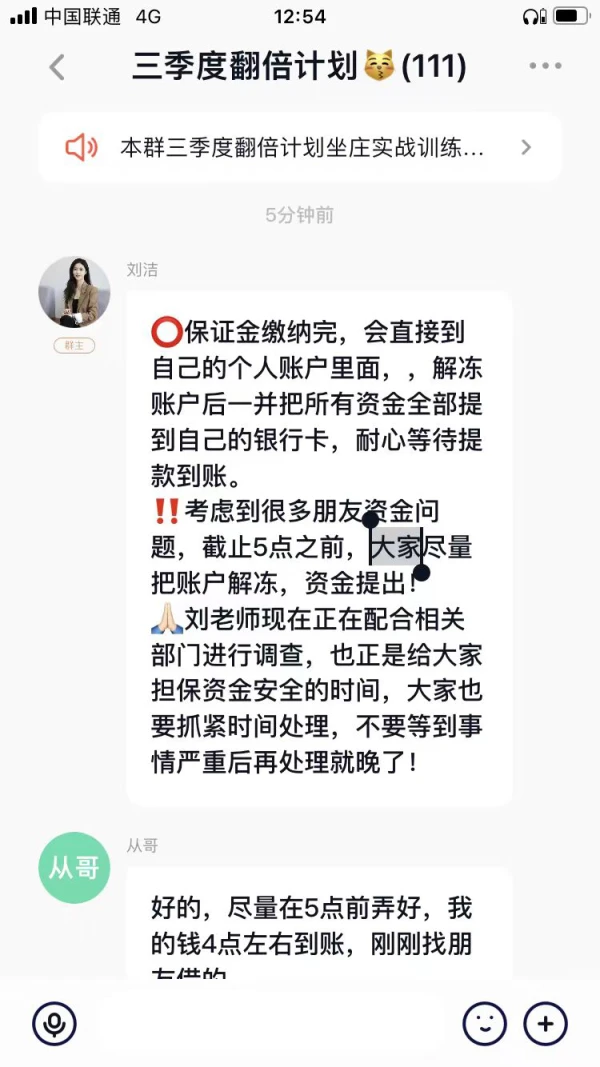

From 2024.9.24 to 10.20, mainland employees such as Xu Xinyue went to Hong Kong for exchange and learning training. A foreign exchange investment sector was temporarily developed, with Hong Kong providing the platform and mainland employees responsible for recruiting investors. Once a certain amount of funds is obtained, the accounts will be frozen! They exploit legal loopholes by using Hong Kong law to induce traders to continue depositing money to unfreeze their accounts! It's a never-ending cycle. Exploiting legal loopholes!

Exposure

FX1827755453

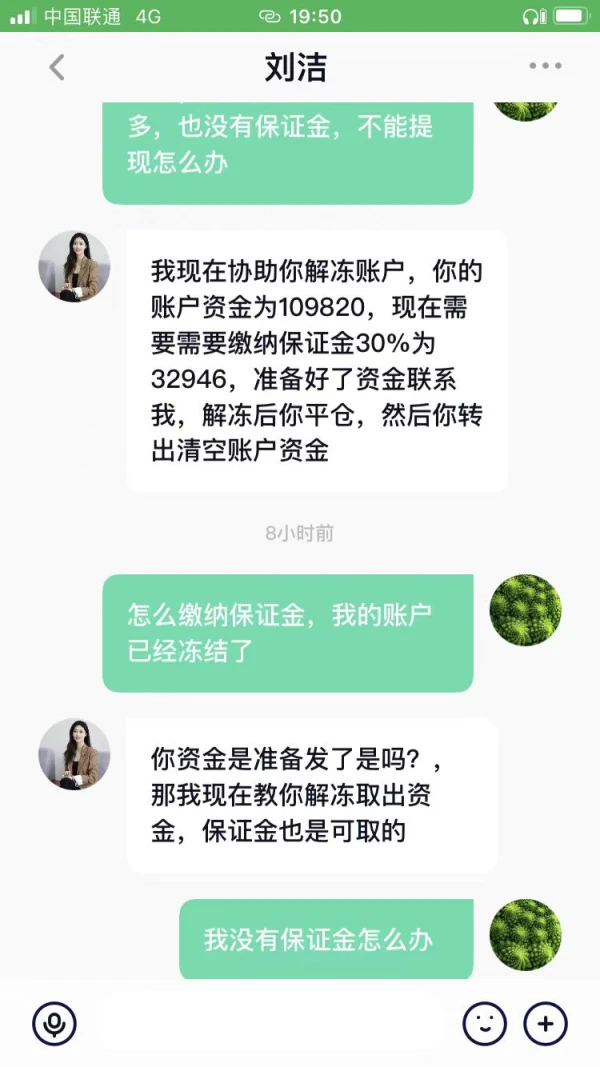

Hong Kong

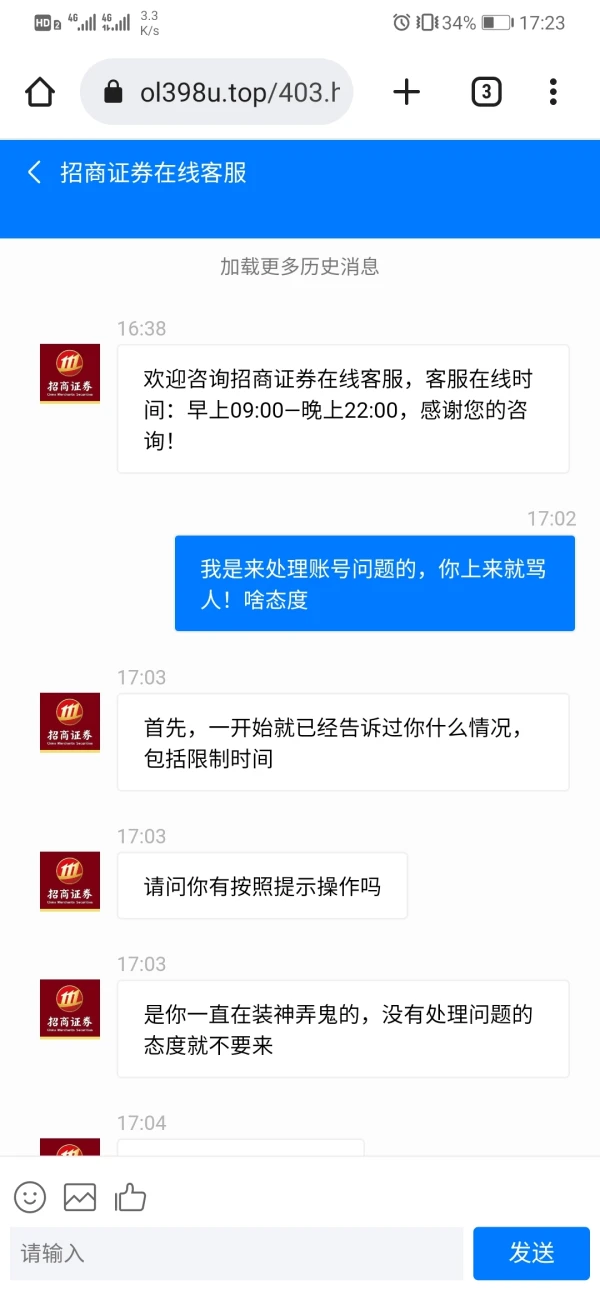

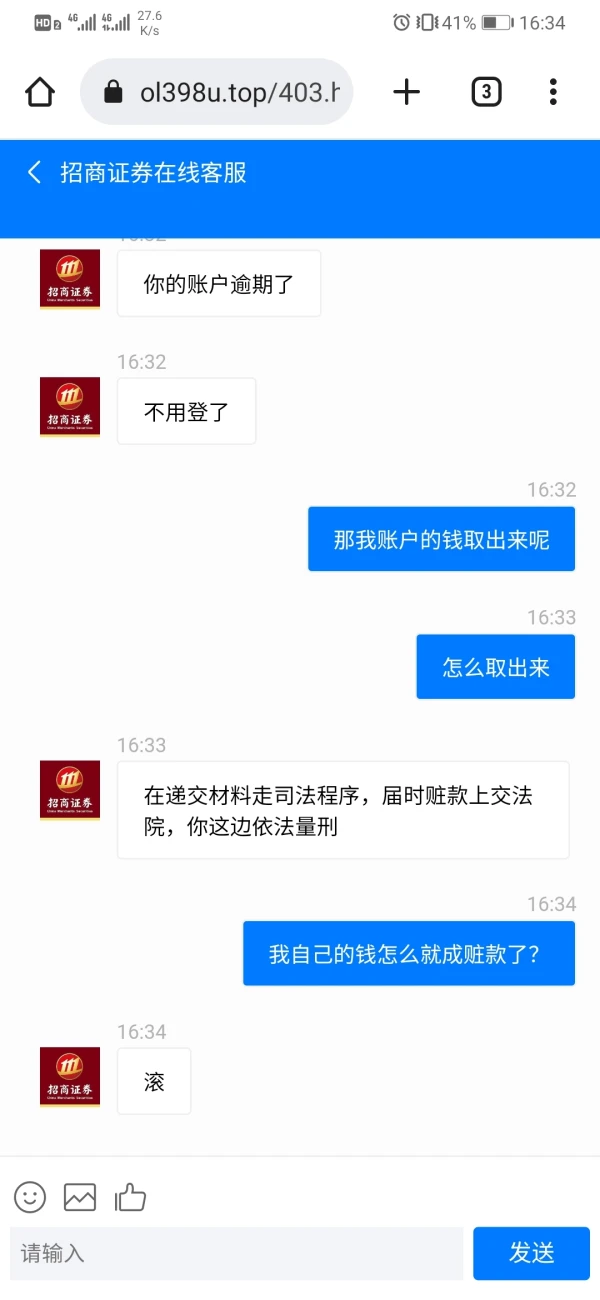

Fraud, unable to withdraw funds. The first time I could withdraw 3000, but the second time they said I was maliciously withdrawing and insisted that I keep 10 in my account. I said I needed it urgently, so they found various reasons to freeze my account, and then induced me to deposit 100,000 to unfreeze it so that my account could trade normally! The customer service scolded me for not depositing.

Exposure

盈赢

Hong Kong

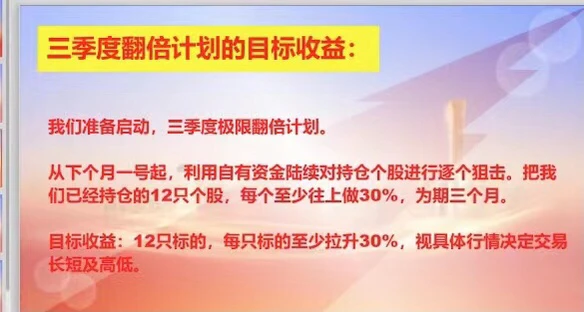

At the beginning, they recommended stocks, but as a result, they lost more and more. Later, market makers were opened, and they said it was cheaper than the transaction price in the primary market. In the end, the locked account cannot be opened and the funds cannot be withdrawn (need to pay a deposit) and run away.

Exposure

June

United Kingdom

Very impressive. They offer a wide range of services from IPOs to personal investments in stocks and bonds. Their brokerage options are vast, perfect for diversifying investments globally. The research insights are incredibly helpful, especially for HK and US-listed Chinese stocks. If you're looking for a one-stop shop for diverse financial services, CMS is a great bet.

Positive

FX1475574124

Cyprus

Having used CMS services for some time now, I can confidently say that they stand out in terms of their comprehensive array of services. Whether it's IPO sponsorship, equity trading, debt capital market fundraising, or mergers and acquisitions, they've got an expert team ready to assist. Moreover, their global commodities service is excellent, providing access to over-the-counter metals and energy derivatives in a seamless manner. What impressed me most was their research team, whose in-depth market analysis has frequently guided my investment decisions. Their customer service is always prompt and helpful. It's been a pleasure to open and operate my account with them. I would highly recommend China Merchants Securities for anyone looking for holistic and professional financial services.

Positive

盈赢

Hong Kong

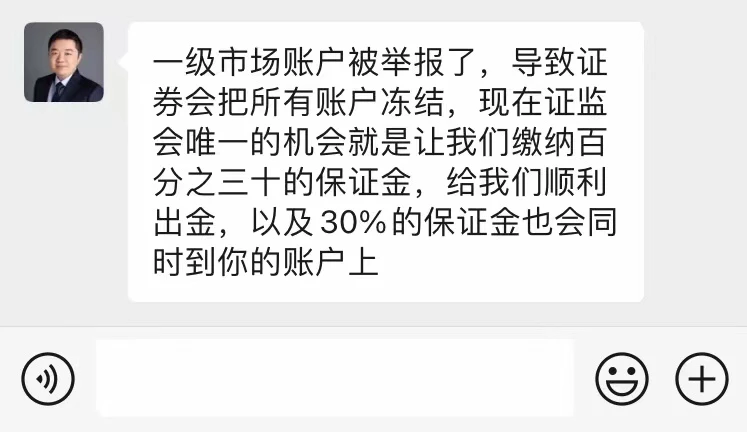

The recommended stocks have been making no money, let me invest in their business: as for Market Maker, they claim that the capital will be protected even if losing money. This is cheaper than the purchase price of investors in the primary market. I made a few orders, and the book profits are indeed increasing. I want to withdraw cash later, they said that they require a 30% deposit. If the payment is overdue, the security deposit will be doubled. That's when I knew I had been duped. The scammer pays back the money quickly.

Exposure

IntJ

Australia

I have been trading with this securities company for 4 months, so far I am very satisfied and will continue to trade. It is a well-known financial company in China.

Positive