Company Summary

| Aspect | Information |

| Company Name | Cyber Capital |

| Regulation | Not regulated; lacks valid regulatory oversight |

| Minimum Deposit | $250 USD (for Credit/Debit cards) |

| Maximum Leverage | Up to 1:200 |

| Spreads | Variable; Wider for less liquid instruments |

| Trading Platforms | MetaTrader |

| Tradable Assets | Cryptocurrency, Forex, Shares, Indices, Commodities |

| Account Types | Bronze, Silver, Gold, Platinum |

| Demo Account | Available |

| Customer Support | Email: support@cybercapital.ltd |

| Payment Methods | Credit/Debit Cards |

| Educational Tools | Tutorials, Webinars, Guides, Glossary |

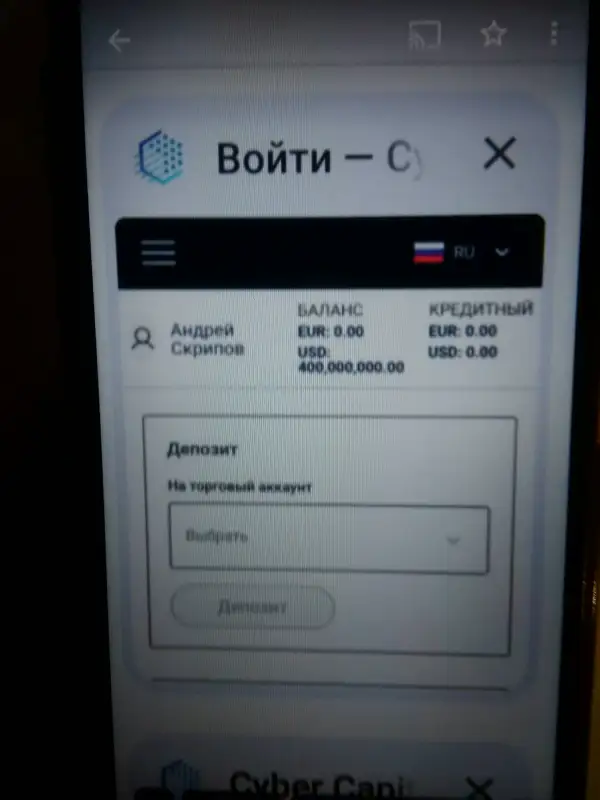

Overview of Cyber Capital

Cyber Capital is a trading platform that offers a range of opportunities for traders seeking to engage in various financial markets, including Cryptocurrency, Forex, Shares, Indices, Commodities. Cyber Capital provides accessibility with a relatively low minimum deposit requirement of $250 USD for Credit/Debit card transactions. Traders can benefit from a maximum leverage of up to 1:200, allowing for potential increased exposure to the markets.

Cyber Capital caters to traders of different expertise levels with its tiered account types: Bronze, Silver, Gold, and Platinum. A demo account is available for users to practice trading strategies without risking real funds. For customer support, traders can reach out via email at support@cybercapital.ltd.In terms of educational support, Cyber Capital provides some basic educational content like tutorials, webinars, guides, and a glossary to enhance traders' knowledge and skills.

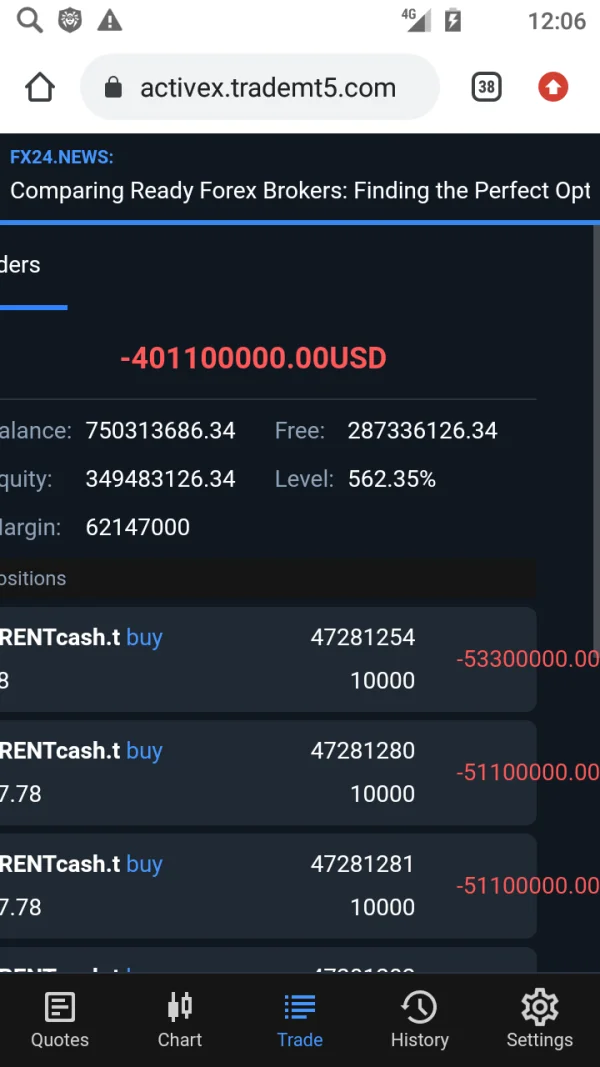

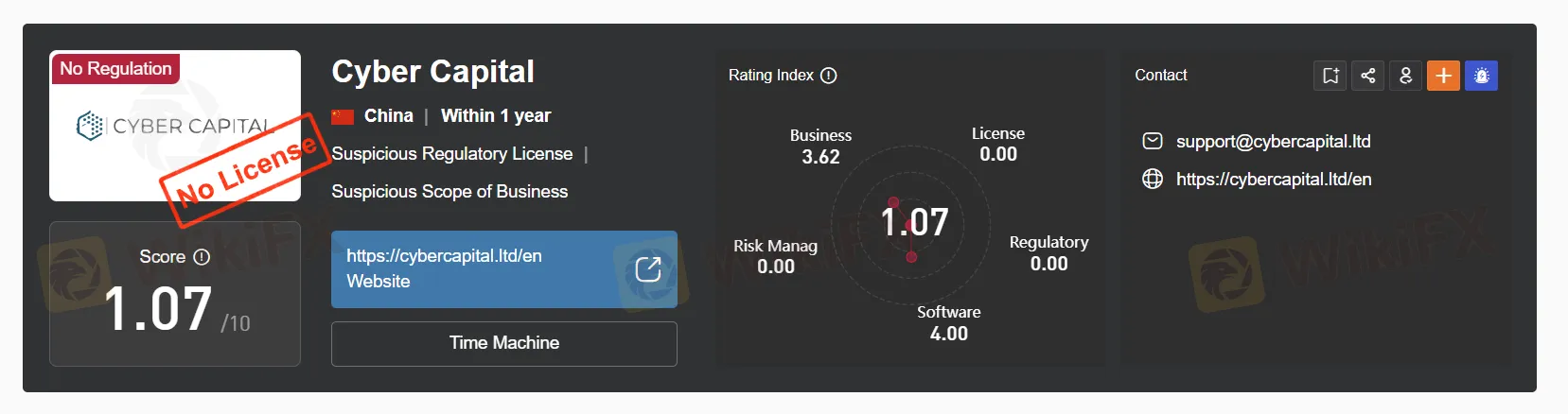

Is Cyber Capital legit or a scam?

Cyber Capital presently operates without being subject to any valid regulatory oversight, raising concerns about the transparency and security of its operations. Regulatory frameworks are instrumental in upholding industry standards and ensuring the fair and secure provision of financial services. In the absence of regulatory supervision, Cyber Capital may lack the stringent compliance measures and safeguards that regulated brokers are obliged to follow. Regulation typically entails adherence to guidelines that protect traders' interests, uphold fair business practices, and mitigate risks such as fraud and market manipulation.

Pros and Cons

Cyber Capital offers multiple account types, providing traders with flexibility and choice. The tiered trading accounts (Bronze, Silver, Gold, Platinum) cater to various trading preferences. The broker provides competitive leverage and a diverse range of tradable assets, making it appealing to a broad audience. However, Cyber Capital lacks regulatory oversight, and its educational resources are comparatively limited. The information on spreads and fees is not readily available, and there is no indication of inactivity fees. Traders benefit from transparent deposit and withdrawal processes, supported by responsive customer support. Cyber Capital could enhance its educational offerings and provide more detailed information on fees for a more comprehensive trading experience.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

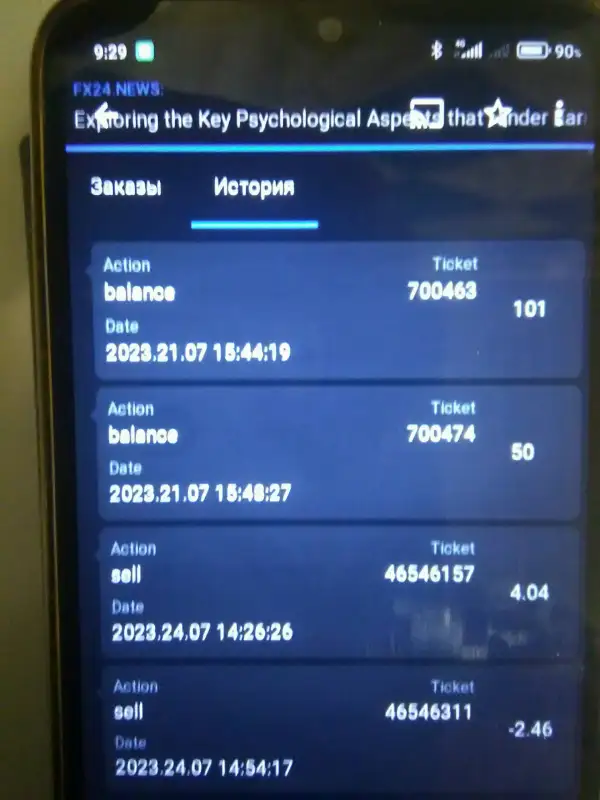

Market Intruments

Cyber Capital caters to a diverse range of traders with its comprehensive selection of market instruments. Whether you're a seasoned veteran or a curious newcomer, you'll find something to pique your interest amongst their offerings:

Cryptocurrency: Embark on the cutting edge with a robust selection of digital assets like Bitcoin, Ethereum, and Litecoin. Trade with leverage and tap into the dynamic world of cryptocurrencies, navigating both its volatility and potential for high returns.

Forex: Dive into the global currency market with major, minor, and exotic pairs available for trading. Leverage Cyber Capital's competitive spreads and flexible platform to exploit market movements and navigate the ever-evolving landscape of foreign exchange.

Shares and Indices: Take a position in established companies and broad market trends through a wide range of shares and indices. Gain exposure to diverse sectors and geographies, building a portfolio that reflects your investment goals and risk tolerance.

Commodities: From precious metals like gold and silver to energy giants like oil and gas, Cyber Capital offers access to a multitude of commodities. Capitalize on global events and economic fluctuations, diversifying your portfolio and hedging against potential market downturns.

Cyber Capital's commitment to providing a comprehensive and accessible trading experience is evident in its diverse instrument selection. Whether you're a technical trader seeking fast-paced action or a long-term investor building a diversified portfolio, you'll find the tools and instruments you need to navigate the financial markets with confidence.

Account Types

Cyber Capital presents a tiered approach to trading accounts, offering four distinct account types, each catering to varying levels of expertise and trading preferences. Here is an overview of the key features associated with each tier:

BRONZE Account:

Open Fees: This account likely features a lower initial deposit requirement, making it accessible for traders who are just starting.

Leverage: Bronze account holders can expect a moderate level of leverageto 1:50, allowing for increased exposure to the markets.

Spreads: While specific spread details are not provided, Bronze accounts may offer competitive spreads suitable for entry-level traders.

Features: Basic features may include access to the trading platform, a selection of tradable assets, and standard trading conditions.

2. SILVER Account:

Open Fees: The SILVER Account may involve a higher initial deposit compared to the BRONZE tier, reflecting an increased level of trading capability.

Leverage: Traders with a SILVER Account can likely benefit from enhanced leverage to 1:100, providing more flexibility in their trading strategies.

Spreads: Competitive spreads are expected, offering favorable trading conditions for intermediate-level traders.

Features: SILVER Account holders may enjoy additional features such as access to educational resources, market analysis, and potentially a dedicated account manager.

3. GOLD Account:

Open Fees: The GOLD Account likely requires a substantial initial deposit, indicating an account designed for more experienced and committed traders.

Leverage: GOLD Account holders can anticipate higher leverage to 1:150, allowing for increased exposure to the financial markets.

Spreads: Competitive and potentially tighter spreads are a characteristic of the GOLD tier, enhancing trading conditions.

Features: Advanced features may include priority customer support, exclusive market insights, and advanced educational materials.

4. PLATINUM Account:

Open Fees: The PLATINUM Account represents the pinnacle of Cyber Capital's offerings, requiring a significant initial deposit for elite traders.

Leverage: Traders with a PLATINUM Account can likely access the highest level of leverage to 1:200, providing maximum flexibility in their trading strategies.

Spreads: Platinum account holders can expect the most favorable spreads, creating optimal trading conditions.

Features: Exclusive benefits may include VIP customer support, personalized trading strategy consultations, and invitations to premium events.

How to open an account?

Opening an account with Cyber Capital involves a straightforward process. Here is a step-by-step guide on how to initiate your trading journey with Cyber Capital:

1. Visit Cyber Capital's Official Website:

Navigate to Cyber Capital's official website by entering the URL into your web browser. The website should provide clear and concise information about the services they offer.

2. Account Registration:

Click on the “Register” or “Sign Up” button prominently displayed on the website.

Complete the online registration form with accurate and up-to-date personal information. This typically includes your full name, email address, phone number, and a secure password.

3. Select Account Type:

After completing the registration, you will likely be prompted to choose the type of trading account you wish to open (e.g., BRONZE, SILVER, GOLD, PLATINUM).

Each account type has specific features, benefits, and minimum deposit requirements. Select the one that aligns with your trading goals and preferences.

4. Complete KYC Verification:

Proceed to complete the Know Your Customer (KYC) verification process. This involves providing necessary identification documents to comply with regulatory requirements.

Prepare a government-issued ID (such as a passport or driver's license), proof of address (utility bill or bank statement), and any other documents requested by Cyber Capital.

5. Deposit Funds:

Once your account and identity are verified, log in to your newly created account.

Navigate to the “Deposit” or “Fund Your Account” section.

Choose your preferred payment method (bank transfer, credit/debit card, e-wallet) and follow the instructions to deposit funds into your trading account.

6. Explore the Trading Platform:

After funding your account, you can access the trading platform provided by Cyber Capital. This may include popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

Familiarize yourself with the platform's features, tools, and available instruments.

7. Start Trading:

With funds in your account, you are now ready to start trading. Analyze the markets, implement your trading strategy, and execute trades as desired.

Monitor your positions, manage risk, and take advantage of the resources provided by Cyber Capital, such as educational materials and market analysis.

8. Customer Support and Assistance:

Should you encounter any issues or have questions during the account opening process or while trading, reach out to Cyber Capital's customer support.

Utilize the available support channels, which may include live chat, email support, or phone assistance.

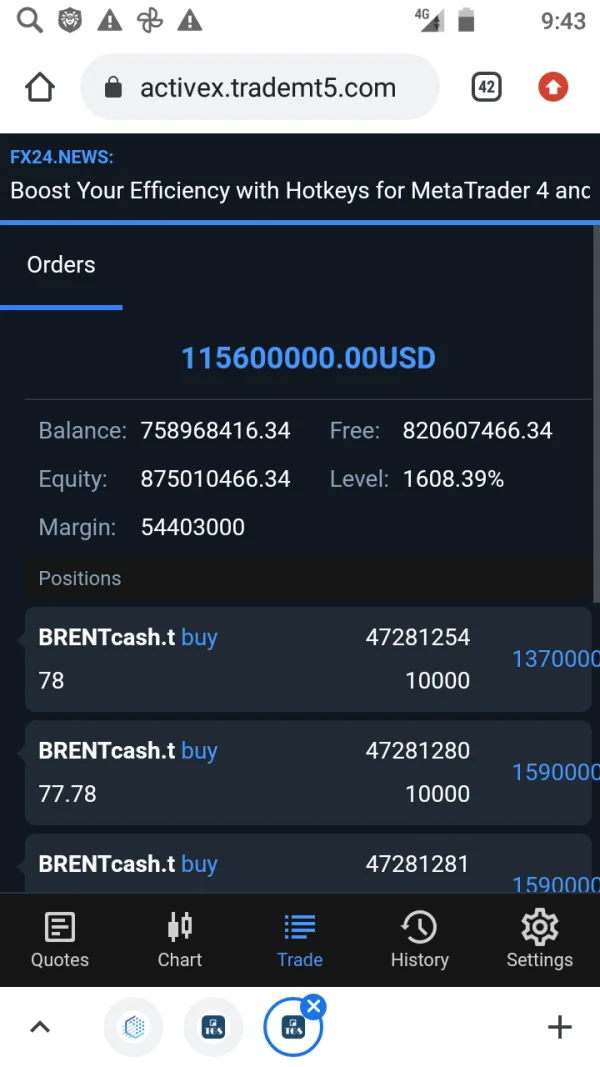

Leverage

Cyber Capital offers a maximum trading leverage of up to 1:200. This means that traders using the platform can potentially control a position size up to 200 times the amount of their trading capital. While high leverage can amplify both profits and losses, it's essential for traders to exercise caution and fully understand the risks involved. It's recommended to trade with leverage levels that align with individual risk tolerance and experience in the financial markets. Additionally, traders should stay informed about the specific leverage offered for different instruments and account types on the Cyber Capital platform.

Spreads & Commissions (Trading Fees)

Cyber Capital offers different fee structures depending on your account type. Here's a breakdown to help you choose the right fit:

| Account Type | Spreads | Commissions |

| BRONZE | Variable | Yes |

| SILVER | Variable | Yes |

| GOLD | Tight | No |

| PLATINUM | Tightest | No |

Spreads:

Variable: These spreads can fluctuate depending on market conditions and the specific asset you're trading. They tend to be wider for less liquid instruments or during periods of high volatility.

Tight: These spreads are consistently narrower than variable spreads, offering potentially better value for frequent traders.

Tightest: Platinum accounts enjoy the most competitive spreads on Cyber Capital's platform, ideal for high-volume traders seeking maximum efficiency.

Commissions:

Yes: Bronze and Silver accounts incur a commission fee on each trade, charged as a percentage of the notional value. This fee can add up for frequent traders.

No: Gold and Platinum accounts benefit from commission-free trading, simplifying their fee structure and potentially increasing profitability.

Choosing the Right Account:

For beginners or occasional traders: BRONZE or SILVER accounts might be suitable, as the wider spreads are offset by lower minimum deposits and the potential for guidance.

For active traders: GOLD or PLATINUM accounts offer tighter spreads and commission-free trading, potentially saving money on frequent trades. Consider your trading volume and risk tolerance when making your choice.

Non-Trading Fees

If the receiving bank uses an intermediary bank to send/receive funds, you may incur additional fees charged by the intermediary bank. These charges are usually placed for transmitting the wire to your bank. We are not involved with and nor have any control over these additional fees. Please comply with your financial institution for more information. All deposits to the company either by Credit Card or Wire Transfer are not subject to fees from the company. Clients may see fees charged to them and these charges will be from the client's bank. Per the working regulations, your trading account might be charged an inactivity fee. Commissions will be deducted from your account balance monthly, un/l you resume your account activity, or un/l the balance reaches zero. Please contact your manager for more details.

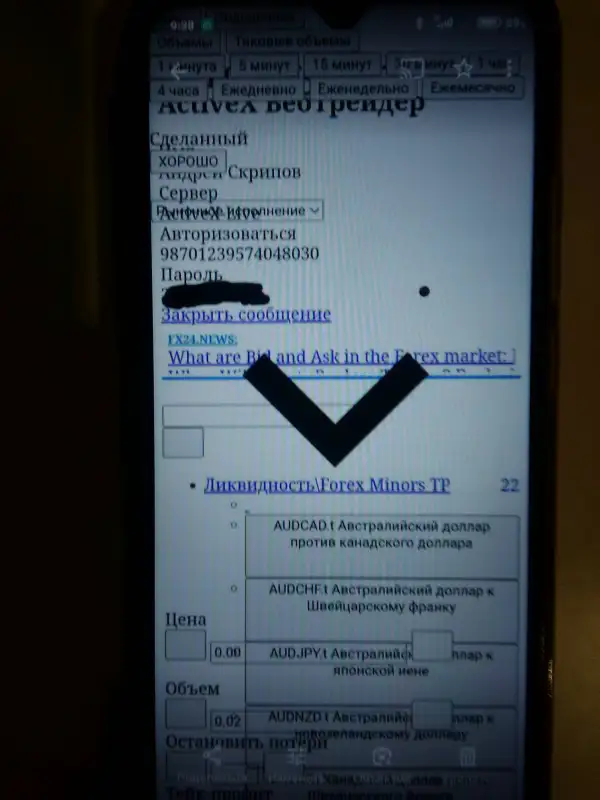

Trading Platform

Cyber Capital claims to provide Metatrader, yet, it does not disclose if MetaTrader 4 or MetaTrader 5 is provided, which is quite strange.

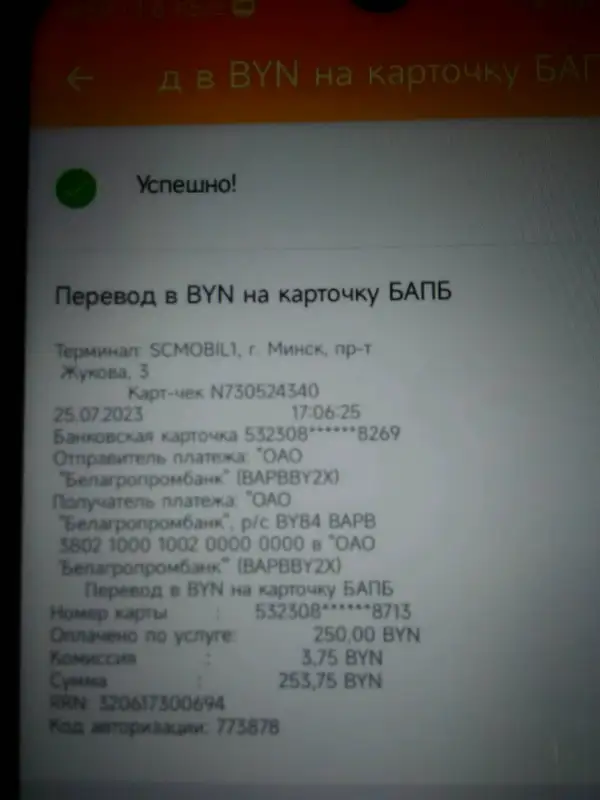

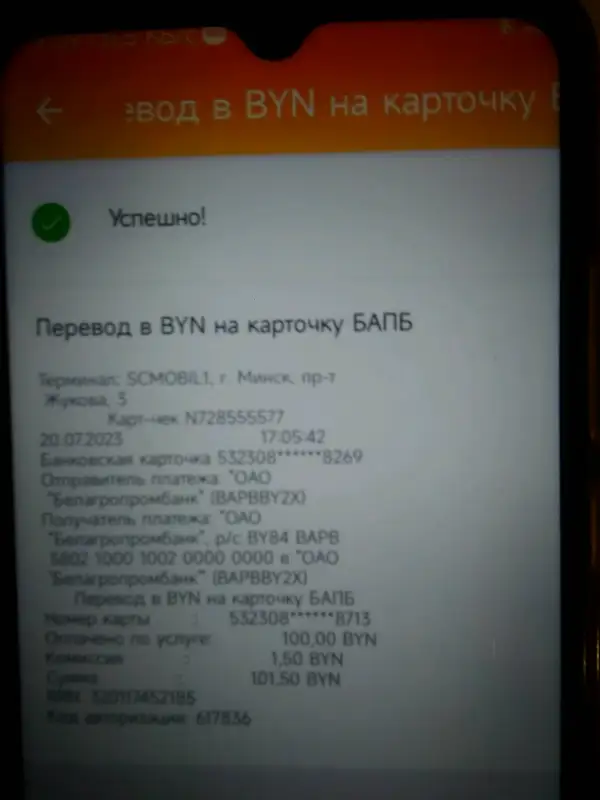

Deposit & Withdrawal

Cyber Capital maintains a minimum deposit requirement of $250 USD for Credit/Debit card transactions. This signifies that individuals looking to fund their accounts using Credit or Debit cards need to adhere to this minimum deposit threshold. It's important to note that deposit amounts may vary based on the chosen payment method, and this specific requirement applies to Credit/Debit card transactions.

Withdrawals must be performed only through the same bank account or Credit / Debit card that the customer used to deposit the funds.When you deposit or withdraw money for trading purposes using alternative FIAT payment methods, you should be aware that additional fees and restrictions may apply. Withdrawals are subjected to withdrawal processing and handling fees. Those fees will be deducted from the transferred withdrawn amount.

Customer Support

Cyber Capital prioritizes responsive and client-focused customer support, ensuring traders have access to assistance whenever needed. The broker can be reached through the dedicated support email address: support@cybercapital.ltd. This email channel serves as a direct communication link, allowing users to submit inquiries, seek clarification on various matters, or receive assistance with any challenges they encounter.

By providing a direct support email, Cyber Capital facilitates efficient and timely communication between traders and their support team. This channel is particularly useful for addressing specific queries, account-related concerns, or seeking guidance on the broker's services. The support team at Cyber Capital is committed to delivering prompt and helpful responses to ensure a smooth and satisfactory trading experience for their clients.

For a more comprehensive understanding of the broker's support services, users may also explore additional support channels or consult the FAQ section on Cyber Capital's official website. The broker's commitment to effective communication and client assistance underscores its dedication to maintaining a high standard of customer service. Traders can rely on the provided email address to connect with Cyber Capital's support team and receive the necessary support throughout their trading journey.

Educational Resources

Cyber Capital provides some basic educational materials , including informative articles, video tutorials, and guides covering market analysis, technical analysis, fundamental analysis, risk management, and trading psychology.

Traders can access these resources to deepen their understanding of trading concepts, refine their strategies, and stay updated on market trends. Whether navigating through the intricacies of risk disclosure or delving into educational materials to hone trading skills, Cyber Capital provides a comprehensive educational framework to support its clients throughout their trading journey. This commitment to education and transparency aligns with Cyber Capital's mission to empower traders and foster a conducive trading environment.

Conclusion

In conclusion, Cyber Capital presents itself as a brokerage platform that offers traders the opportunity to engage in financial markets with a maximum trading leverage of up to 1:200. The platform provides access to various trading instruments, and users can trade with a minimum deposit amount of $250 for Credit/Debit cards. The inclusion of popular and widely-used payment methods contributes to the accessibility of the platform. However, this broke is an unregulated broker, which traders should exercise extra caution when trading with it.

FAQs

Q: What is the minimum deposit required to start trading on Cyber Capital?

A: The minimum deposit amount for trading on Cyber Capital is $250 USD.

Q: What is the maximum trading leverage offered by Cyber Capital?

A: Cyber Capital provides a maximum trading leverage of up to 1:200.

Q: Which payment methods are accepted for deposits and withdrawals on Cyber Capital?

A: Cyber Capital accepts Credit/Debit cards for deposits and withdrawals.

Q: Are there any fees associated with deposits or withdrawals on Cyber Capital?

A: While Cyber Capital generally does not charge fees for deposits or withdrawals, users should be aware of potential fees from their payment providers.

Q: What trading instruments are available on the Cyber Capital platform?

A: Cyber Capital offers a variety of trading instruments, including stocks, futures, crude oil, gold, Bitcoin, and currencies.

Q: Is there a demo account available on Cyber Capital?

A: Yes, Cyber Capital provides a demo account option for users to practice trading without risking real funds.

Q: How can I contact Cyber Capital's customer support?

A: Cyber Capital offers customer support through live chat, email, and phone support. Contact details can be found on their official website.

Q: Is Cyber Capital regulated by any financial authority?

A: Cyber Capital's regulatory status may vary, and users should check the latest information on the platform's website. As of the last available information, specific regulation details were not provided.

Q: Can I trade on Cyber Capital using a mobile device?

A: Yes, Cyber Capital offers a mobile trading app, providing users with the flexibility to trade on the go.

Q: Does Cyber Capital provide educational resources for traders?

A: Yes, Cyber Capital offers educational tools such as tutorials, webinars, and a glossary to help traders enhance their knowledge and skills.