Basic Information

Spain

Spain

Score

Spain

|

5-10 years

|

Spain

|

5-10 years

| https://www.bankinter.com/broker

Website

Rating Index

Influence

AA

Influence index NO.1

Spain 9.46

Spain 9.46 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

Spain

Spain bankinter.com

bankinter.com Spain

Spain

| BANKINTERReview Summary | |

| Founded | 1999 |

| Registered Country/Region | Spain |

| Regulation | No regulation |

| Market Instruments | Actions, ETFs, Derivatives, Fixed Income, Listed Securities, Credit Operations |

| Demo Account | / |

| Leverage | / |

| Spread | / |

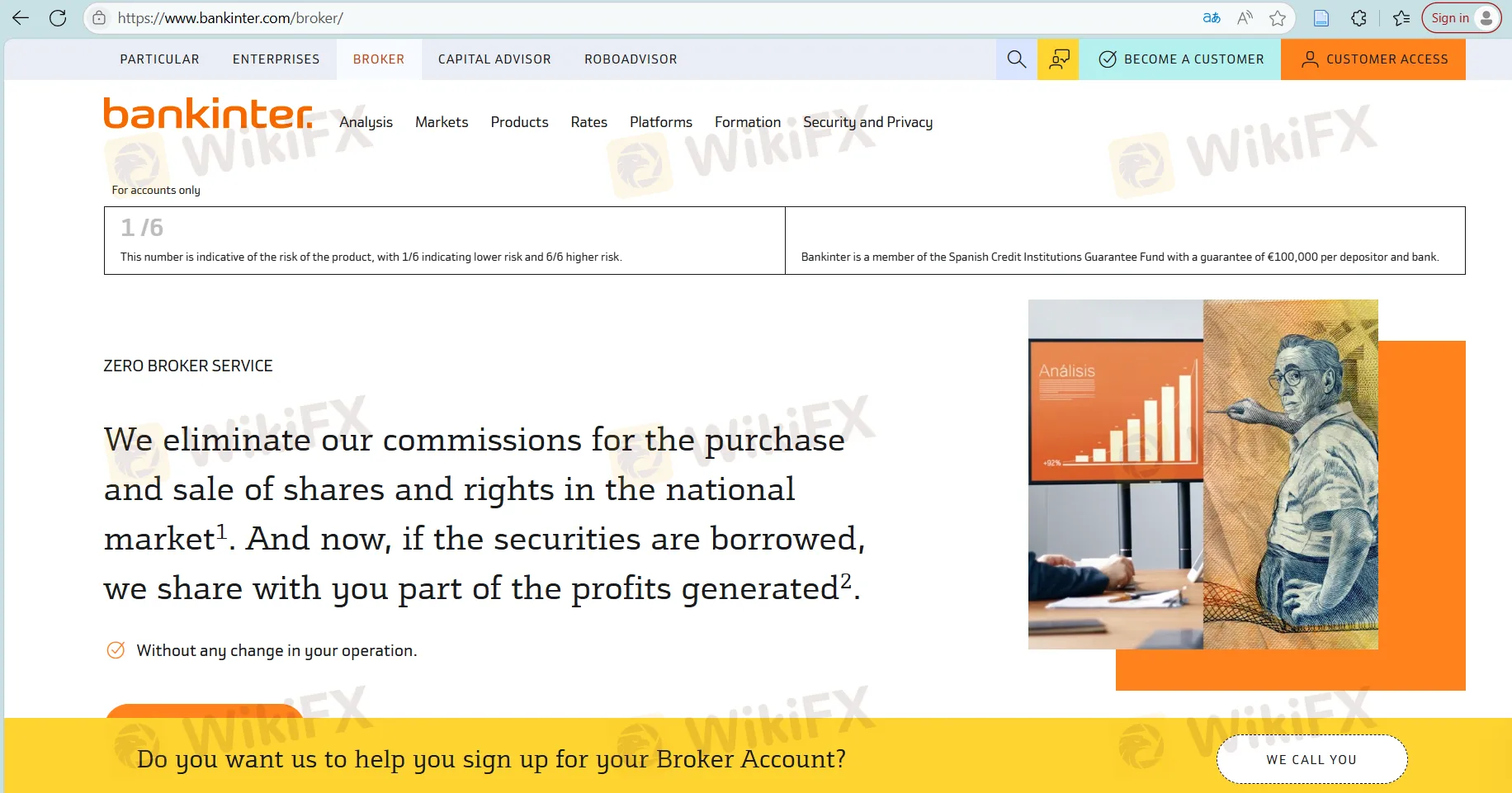

| Trading Platform | Web Broker, Graphic Broker, Plus Broker, Bankinter APP |

| Minimum Deposit | / |

| Customer Support | Contact Form |

| Email: incidencias_sac.bankinter@bankinter.com | |

| Phone: 900 80 20 81 | |

| Social Media: Instagram, YouTube, Facebook, LinkedIn, Telegram, Twitter, TikTok | |

| Address: C/ Pico San Pedro, 1. 28760 Tres Cantos (Madrid) | |

BANKINTER is a financial services platform founded in 1999, registered in Spain. It offers access to a range of market instruments, including actions (stocks), ETFs, derivatives, listed securities, fixed income products, and credit operations. In addition to trading services, BANKINTER provides banking solutions such as Smart Digital Accounts and Interest-Bearing Salary Accounts. The platform operates without regulatory oversight.

| Pros | Cons |

| Multiple customer support channels | Not regulated |

| Various tradable products | |

| Long operation history | |

| Four trading platforms |

BANKINTER operates as an unregulated platform. Trading activities on this platform may not be safe for you.

BANKINTER's investment products include Actions, ETFs, Derivatives, Fixed income, Listed Securities, and Credit Operations.

| Tradable Instruments | Supported |

| Actions | ✔ |

| Derivatives | ✔ |

| Listed Securities | ✔ |

| Fixed Income | ✔ |

| Credit Operations | ✔ |

| ETFs | ✔ |

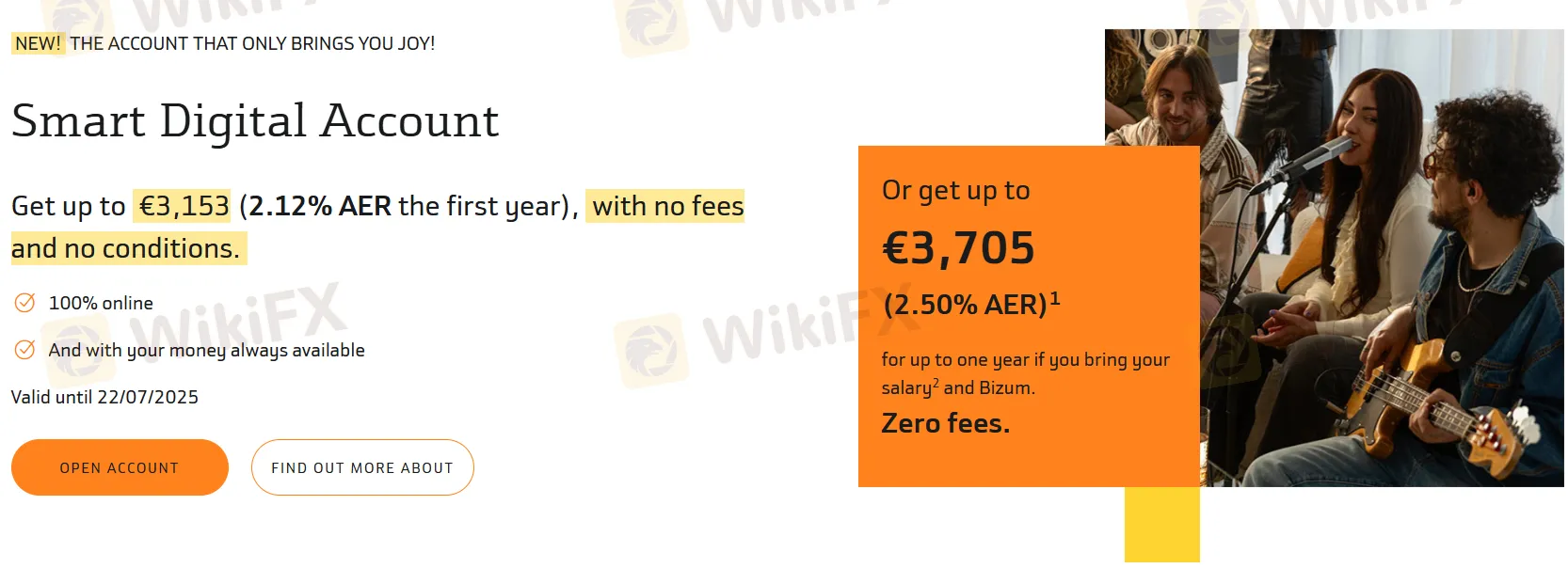

BANKINTER offers two types of accounts, neither of which requires a maintenance fee.

One account is a Smart Digital Account with the following key features:

Interest Rates:

Key Benefits:

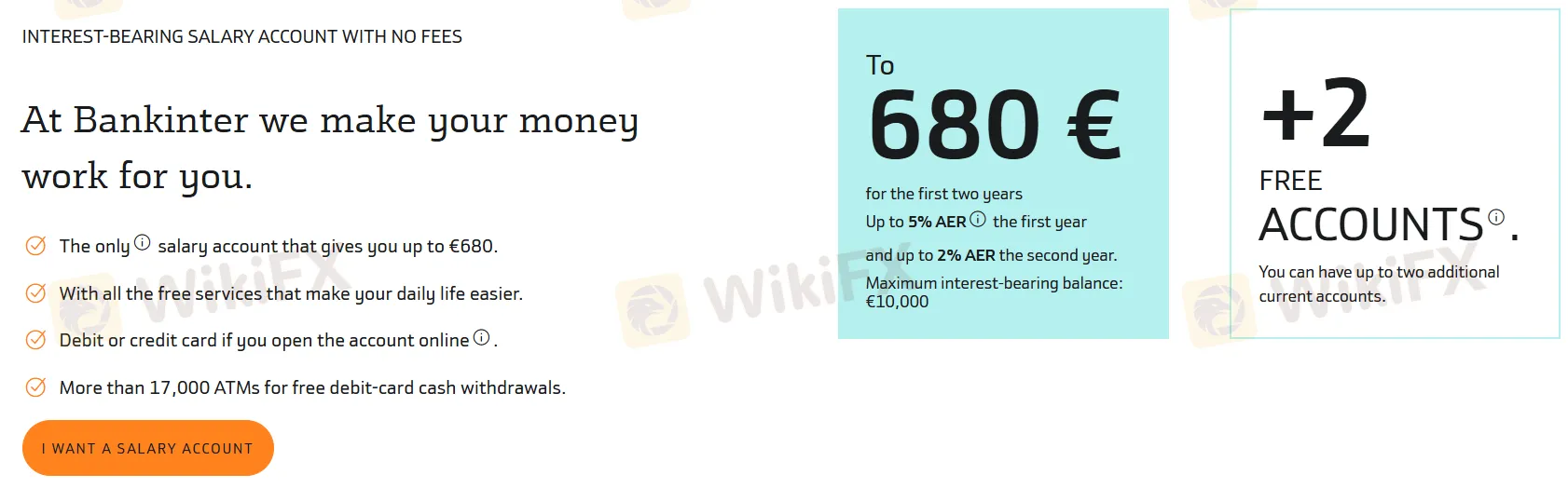

Furthermore, Bankinter offers an Interest-Bearing Salary Account with no fees. Here are the key features:

Interest Rates:

Key Benefits:

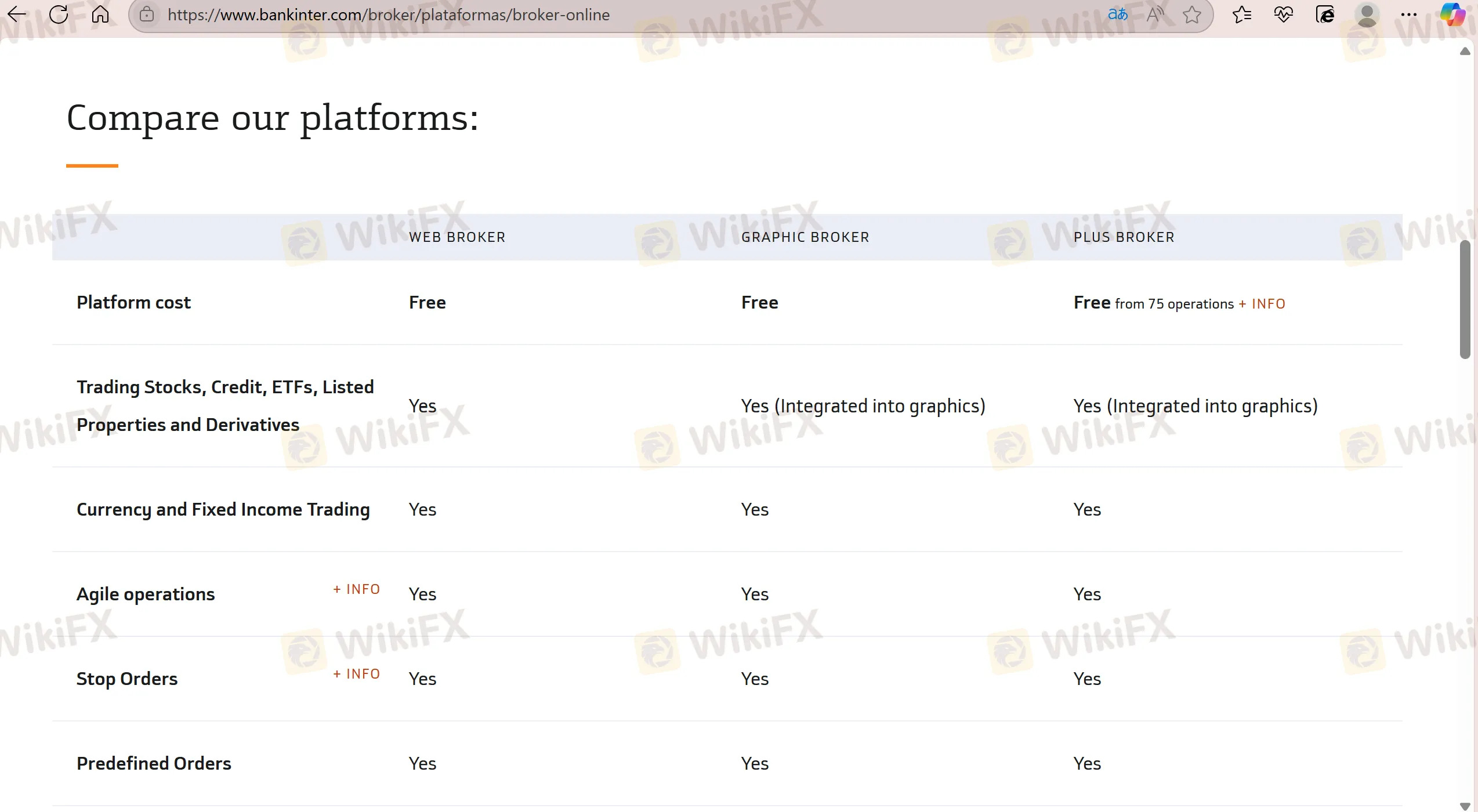

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Broker | ✔ | PC, web | / |

| Graphic Broker | ✔ | PC | / |

| Plus Broker | ✔ | PC | / |

| Bankinter APP | ✔ | Mobile | / |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now