Company Summary

| Oubo Global Pty. Ltd | Basic Information |

| Registered Country/Area | Canada |

| Founded year | 1-2 yearss ago |

| Company Name | Oubo Global Pty. Ltd |

| Regulation | Suspicious regulatory license |

| Minimum Deposit | $1,000 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Not specific |

| Trading Platforms | Not specific |

| Tradable assets | Forex, CFDs on stocks, indices, commodities, cryptocurrencies |

| Account Types | Standard (only) |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | cs@wintersoubo.com |

| Payment Methods | VISA, MASETRCARD, cryptos |

| Educational Tools | No |

Overview of Oubo Global

Oubo Global Pty. Ltd is a forex broker based in Canada, operating for approximately 1-2 years. The company offers its services under the name Oubo Global Pty. Ltd. However, it is worth noting that there are concerns regarding its regulatory license, which has raised suspicions.

The minimum deposit required to open an account with Oubo Global is $1,000, providing access to the Standard account type. While the maximum leverage offered is up to 1:1000, specific information about spreads and trading platforms is not disclosed, leaving traders with limited insights into the trading conditions and available features.

Oubo Global provides a range of tradable assets, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. This diverse selection allows traders to access various markets and potentially diversify their investment portfolios.

It is important to highlight that Oubo Global does not offer a demo account for traders to practice and test their strategies in a risk-free environment. Additionally, the absence of an Islamic account option means that traders seeking Sharia-compliant trading may need to explore alternative brokers.

Customer support for Oubo Global can be reached via email at cs@wintersoubo.com. However, it is advisable to consider the limitations of email-based support and potential delays in response times. Traders interested in Oubo Global should approach its offerings with caution, considering the suspicious regulatory license and the lack of transparency regarding trading conditions, spreads, and trading platforms.

Is Oubo Global legit or a scam?

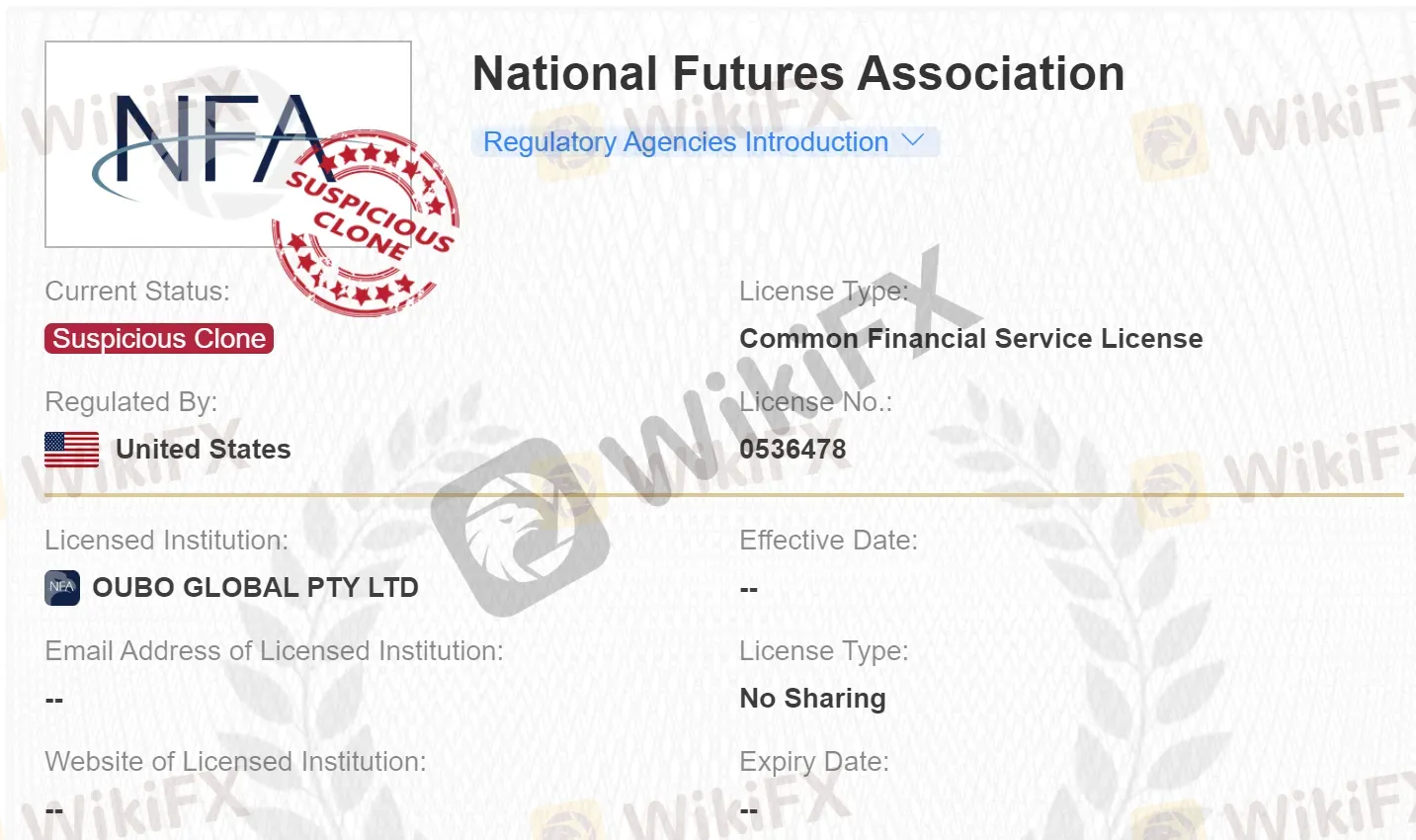

Oubo Global claims to be regulated by the NFA (National Futures Association) and holds a financial service license with license number 0536478. However, upon conducting a verification check on the NFA website, it becomes apparent that this broker is not listed as a member of the NFA. This discrepancy raises doubts about the regulatory status and oversight of Oubo Global.

Pros and Cons

| Pros | Cons |

| Up to 1:1000 leverage offered | Lack of regulatory transparency |

| Suspicious regulatory license | |

| Higher minimum deposit requirement | |

| Limited customer support options | |

| Absence of demo accounts and comprehensive education | |

| Only one account supported | |

| Numerous details concerning spreads, trading platform missing |

Market Intruments

Oubo Global offers a diverse range of market instruments, allowing traders to access various financial markets and broaden their investment opportunities. The available instruments include Forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Forex, the largest and most liquid market globally, enables traders to engage in currency trading. Oubo Global provides access to major, minor, and exotic currency pairs, allowing traders to speculate on exchange rate fluctuations and potentially benefit from currency movements.

In addition to Forex, Oubo Global offers CFDs (Contracts for Difference) on stocks, providing traders with exposure to a wide range of company shares. By trading CFDs on stocks, traders can speculate on price movements without owning the underlying asset. This allows for flexibility and the potential to profit from both rising and falling markets.

Indices CFDs are another market instrument available through Oubo Global. Traders can access a selection of global stock market indices, such as the S&P 500, FTSE 100, or Nikkei 225. Trading indices CFDs allows traders to gain exposure to the overall performance of specific markets, offering diversification and opportunities based on market trends.

Commodity trading is also accessible through Oubo Global. Traders can engage in CFDs on various commodities, including precious metals like gold and silver, energy products like oil and natural gas, and agricultural products such as wheat and corn. Commodities provide traders with the opportunity to participate in markets influenced by global supply and demand dynamics.

Furthermore, Oubo Global includes cryptocurrencies as part of its market instruments. Traders can trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, or Ripple. The cryptocurrency market offers unique opportunities for traders seeking potentially high volatility and alternative investment options.

Account Types

Oubo Global presents traders with a singular account option known as the Standard account, which serves as the primary gateway to their trading platform. While specific details about the features and advantages of this account remain undisclosed, it is important to note that the account operates under a minimum deposit requirement of $1000.

The minimum deposit threshold acts as a foundational step for traders, allowing them to initiate their trading journey with Oubo Global. However, it is worth mentioning that the absence of a demo account limits traders' ability to practice and acquaint themselves with the platform's functionalities without the need to risk real capital. Demo accounts serve as invaluable tools for traders, particularly those new to the markets, seeking to refine their strategies and build confidence.

How to open an account?

Visit the official Oubo Global website and click on “Open Account” or “Sign Up.”

Fill out the registration form with accurate personal information.

Agree to the terms and conditions presented by Oubo Global.

Submit any required verification documents for identity and address verification.

Upon completion, your account application will be processed, and you will receive further instructions from Oubo Global for funding and accessing the trading platform. Keep your account details secure and follow any recommended security measures.

Leverage

Oubo Global offers leverage of up to 1:1000 to its traders. Leverage, in the context of forex trading, is a mechanism that allows traders to control larger positions in the market with a smaller amount of capital. This high leverage ratio of 1:1000 implies that for every dollar of capital invested, traders can access up to a thousand times that amount in trading volume.

While leverage can potentially amplify profits, it is important to recognize that it also increases risk exposure. Trading with high leverage carries the potential for significant gains but equally significant losses.

Spreads & Commissions (Trading Fees)

Oubo Global does not disclose specific details regarding spreads and commissions on its platform, leaving traders with limited transparency regarding these crucial aspects of trading.Given the absence of information about spreads and commissions, there may be an assumption that Oubo Global intentionally hides its trading fees.

Non-Trading Fees

Oubo Global does not provide specific information about non-trading fees on its platform, leaving traders with limited visibility into the potential costs associated with various non-trading activities. Non-trading fees typically include charges related to account maintenance, deposits, withdrawals, inactivity, and other administrative or operational aspects.

Trading Platform

Oubo Global does not provide specific information about its trading platform, which leaves traders with limited visibility into the features and functionalities of the platform. The trading platform is a vital component of a trader's experience, as it serves as the interface through which trades are executed, market analysis is conducted, and account management takes place.

Many reputable brokers in the industry offer the popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms. These platforms have gained widespread recognition and popularity among traders due to their advanced features, user-friendly interfaces, and extensive range of trading tools and indicators.

Deposit & Withdrawal

Oubo Global allows clients to make deposits and withdrawals using various payment methods, including VISA, MASTERCARD, and cryptocurrencies. However, the broker does not provide specific details regarding associated fees, processing times, or any other relevant information regarding these transactions.

The minimum deposit requirement of $1000 may be a significant consideration for potential clients. Such a high minimum deposit could limit accessibility for traders with smaller capital amounts or those who prefer to start with a lower initial investment. Without detailed information about deposit fees, traders are unable to assess the potential costs associated with funding their trading accounts.

Customer Support

Oubo Global's customer support appears to be limited, as the only available contact method provided is through an email address: cs@wintersoubo.com. The absence of alternative communication channels such as live chat or phone support raises concerns about the level of customer assistance and responsiveness offered by the broker.

Is Oubo Global suitable for beginners?

Oubo Global may not be ideal for beginners due to the following reasons. Firstly, the relatively high minimum deposit requirement of $1000 could pose a significant financial commitment for novice traders. Additionally, the absence of a demo account deprives beginners of a risk-free learning environment. Furthermore, the lack of comprehensive educational resources hinders beginners from acquiring essential knowledge and developing effective trading strategies.

To ensure a smooth and supportive start in trading, beginners are encouraged to explore alternative brokers that offer lower minimum deposit requirements, provide demo accounts for practice, and offer comprehensive educational resources.

Is Oubo Global suitable for experienced traders?

Oubo Global may not be the most suitable choice for experienced traders due to certain factors. Firstly, the broker's lack of transparency in terms of regulation raises concerns about the reliability and credibility of its services. Experienced traders often prioritize working with regulated brokers that provide a level of oversight and protection for their investments.

Furthermore, the absence of detailed information about spreads, commissions, and non-trading fees limits the ability of experienced traders to assess the overall cost and competitiveness of trading with Oubo Global.

Moreover, the limited customer support options, solely relying on email communication, may not meet the expectations of experienced traders who prefer timely and responsive assistance

Educational Resources

Oubo Global, unfortunately, does not provide any educational resources to support traders in their journey.

Conclusion

In summary, Oubo Global raises significant concerns that warrant careful consideration from traders. The lack of regulatory transparency and the presence of a suspicious regulatory license undermine the broker's credibility and reliability. The absence of detailed information regarding spreads, commissions, and non-trading fees leaves traders uncertain about the overall cost and competitiveness of trading with Oubo Global. Moreover, the limited customer support options, relying solely on email communication, may fail to meet the expectations of traders seeking prompt and effective assistance. Considering these substantial concerns, traders are advised to exercise caution and thoroughly evaluate alternative brokers.

FAQs

Q: Is Oubo Global a regulated broker?

A: Oubo Global's regulatory status is not transparent, as it provides a suspicious regulatory license without disclosing the regulatory body.

Q: What is the minimum deposit requirement for opening an account with Oubo Global?

A: The minimum deposit requirement for Oubo Global is $1000.

Q: Does Oubo Global offer a demo account for practice trading?

A: Unfortunately, Oubo Global does not provide a demo account.

Q: Are Islamic accounts available with Oubo Global?

A: No, Oubo Global does not offer Islamic accounts tailored to the needs of Muslim traders who adhere to Islamic finance principles.

Q: What customer support options are available with Oubo Global?

A: Oubo Global offers customer support exclusively through email communication. Traders can reach the support team at cs@wintersoubo.com.

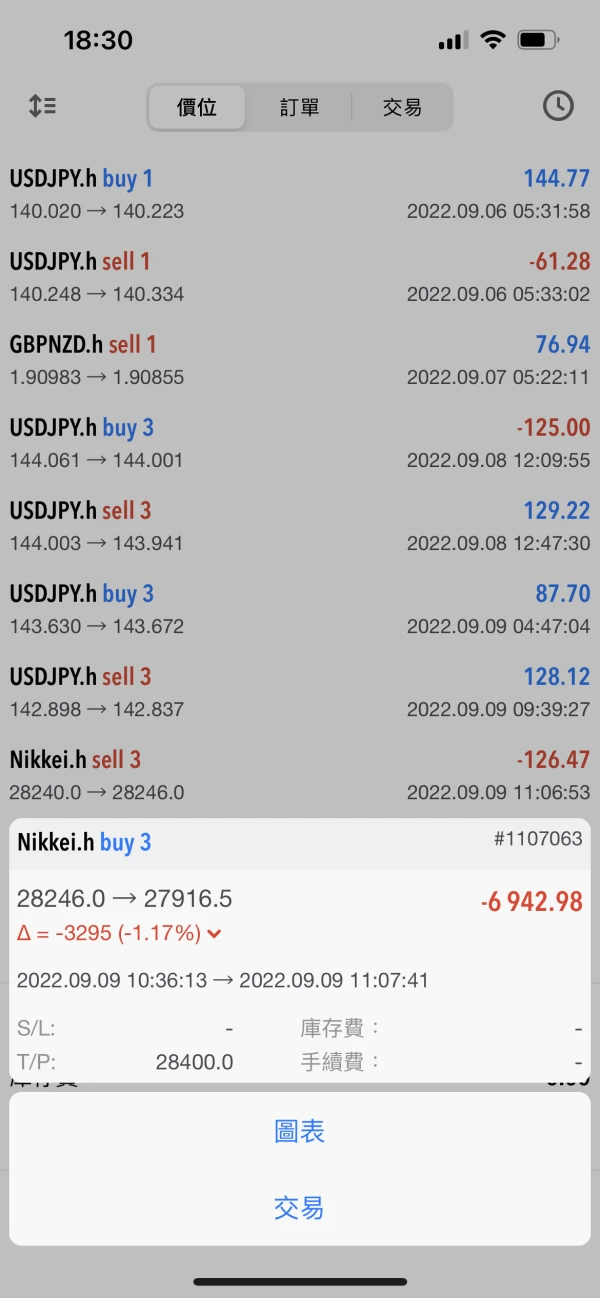

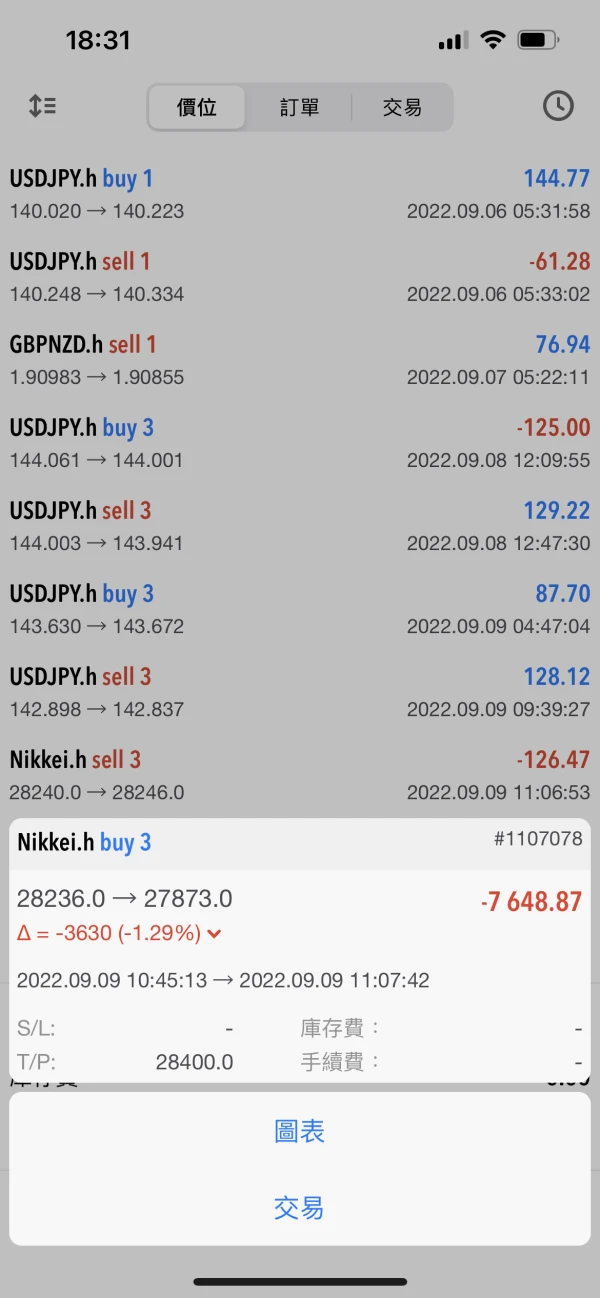

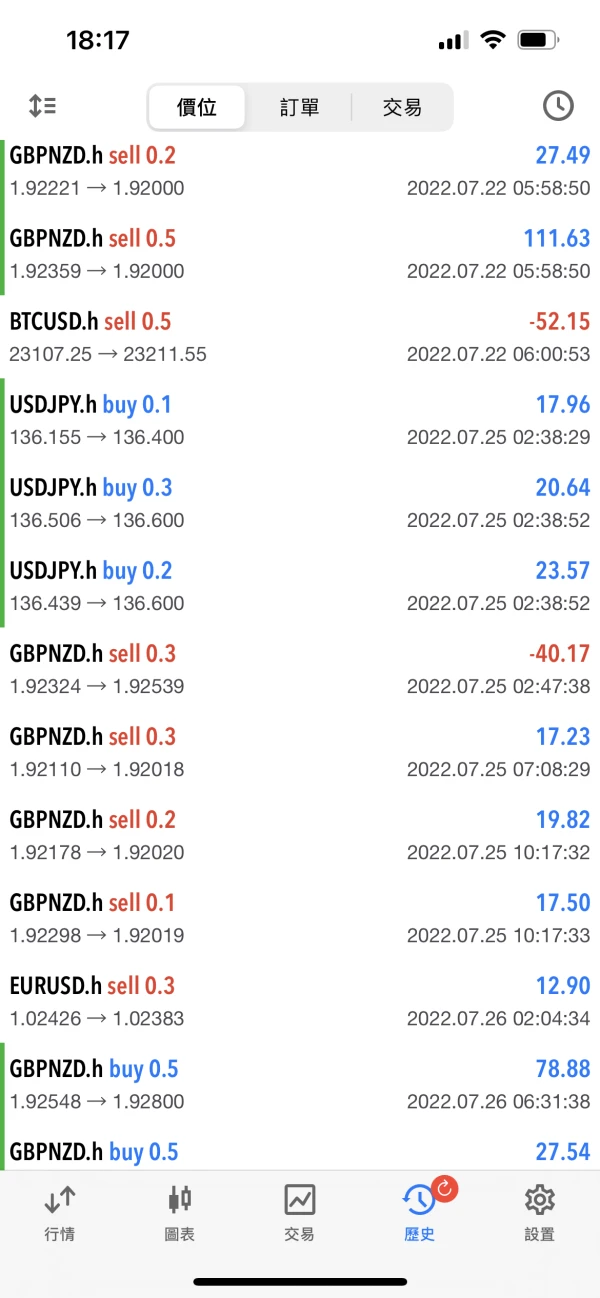

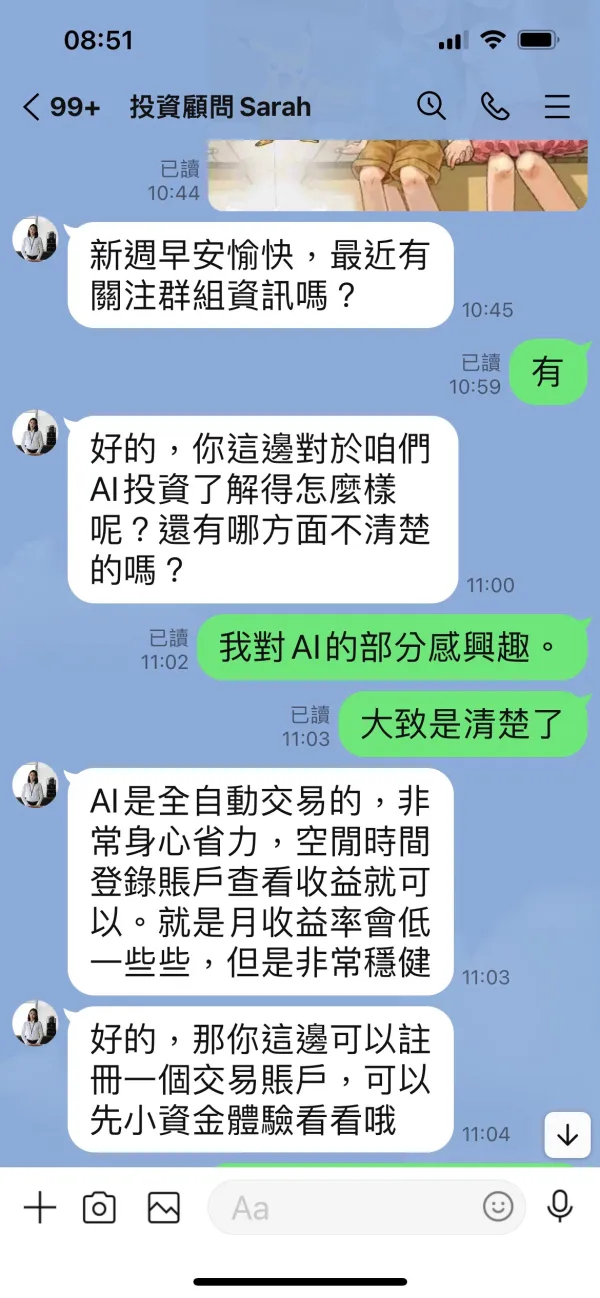

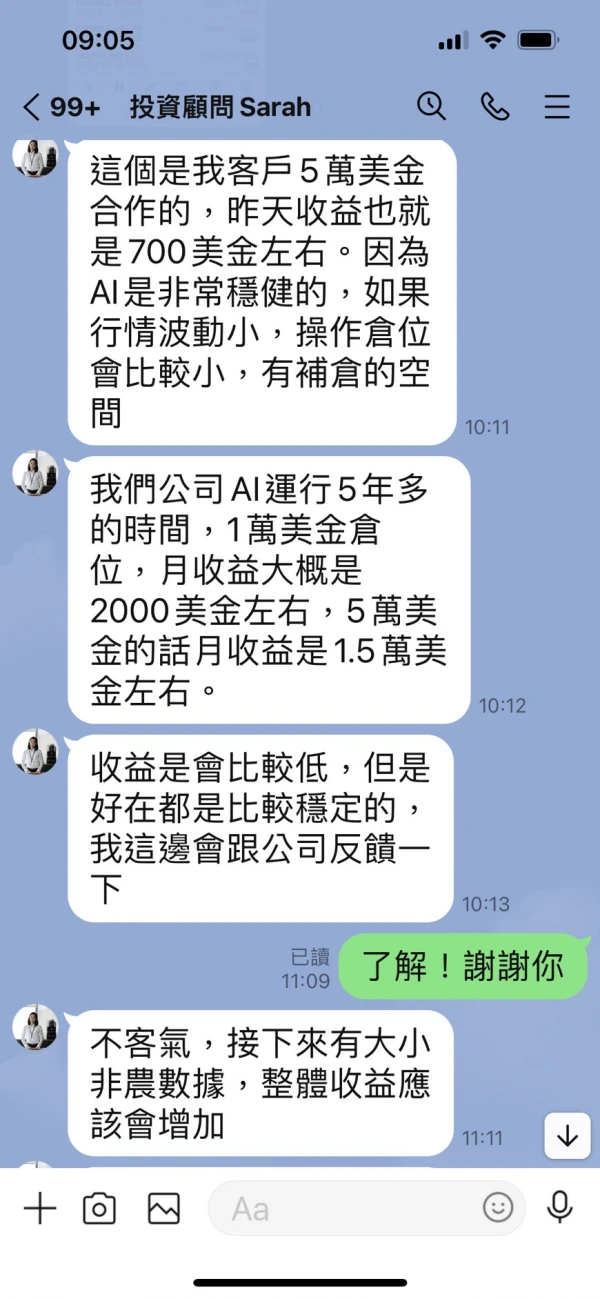

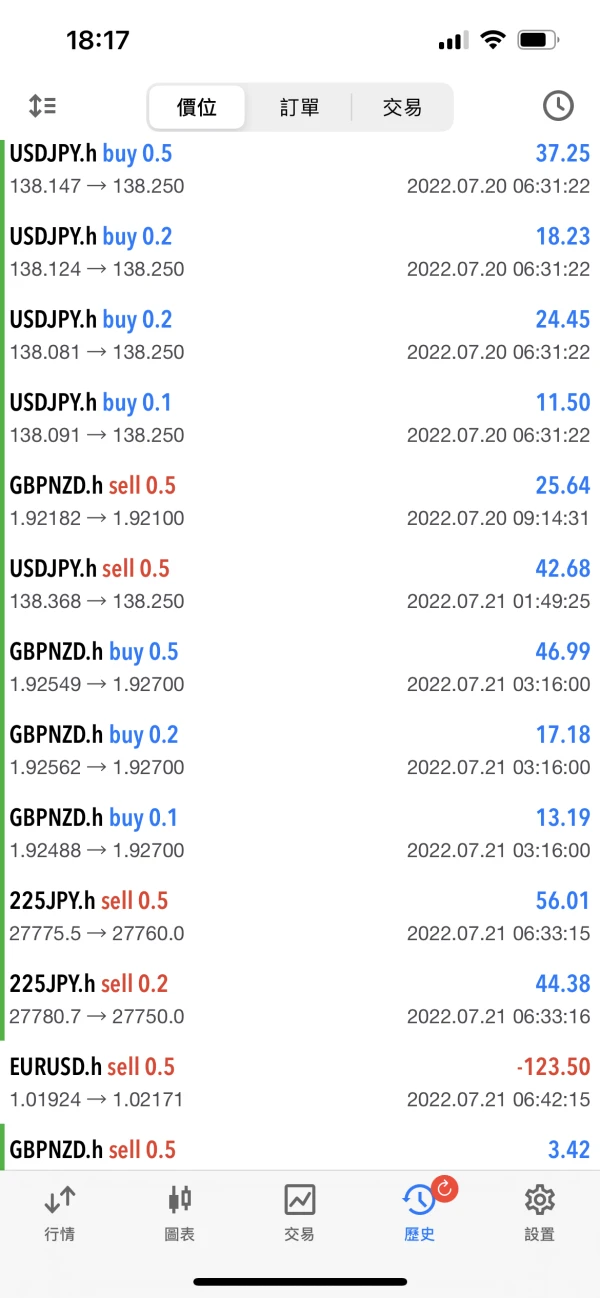

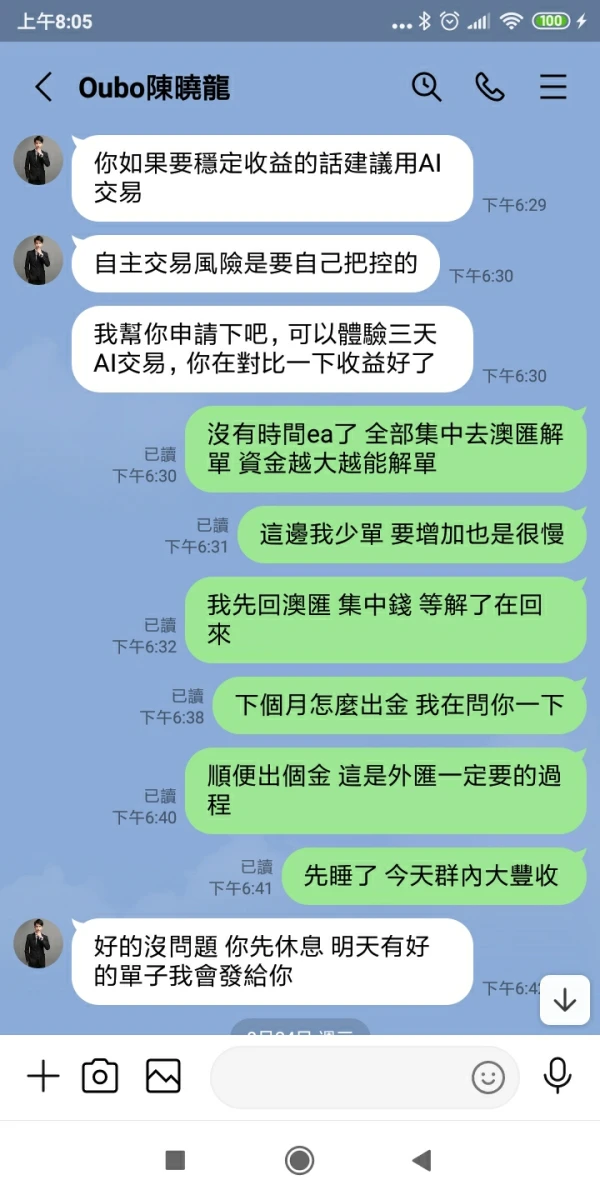

Lily94810

Taiwan

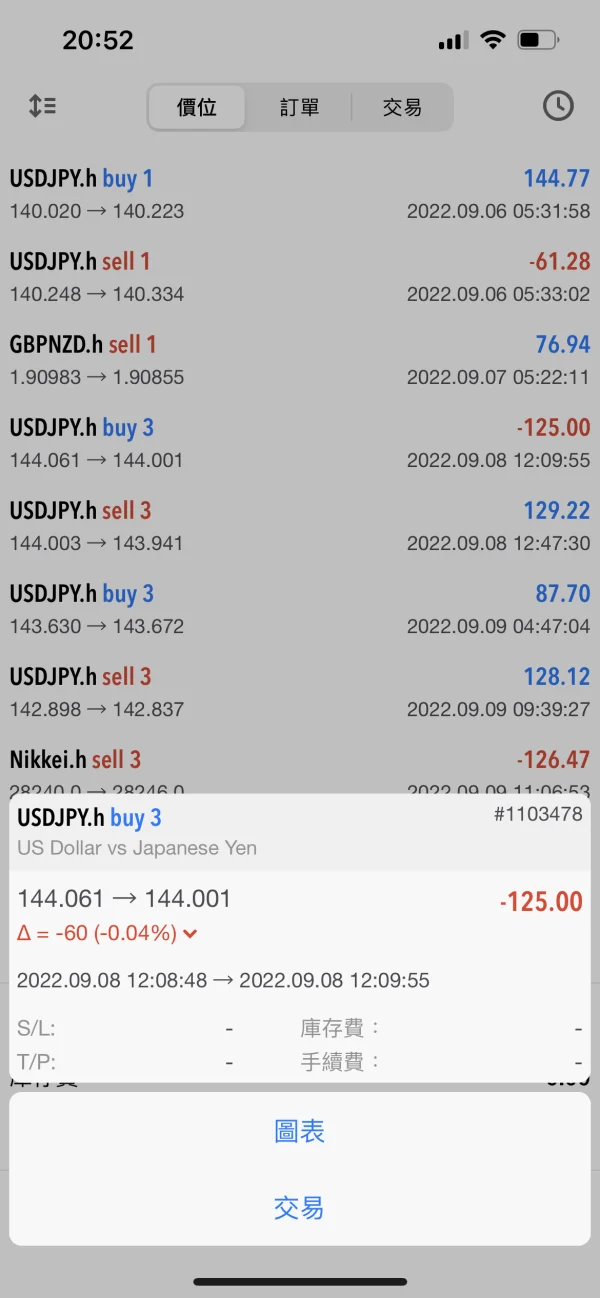

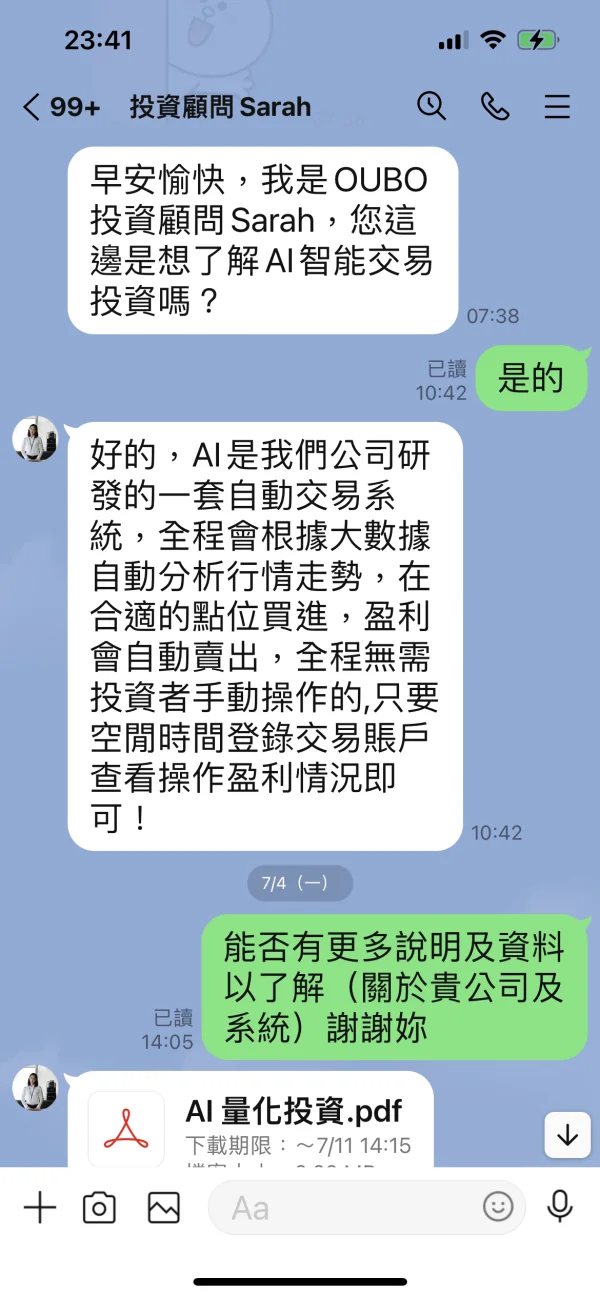

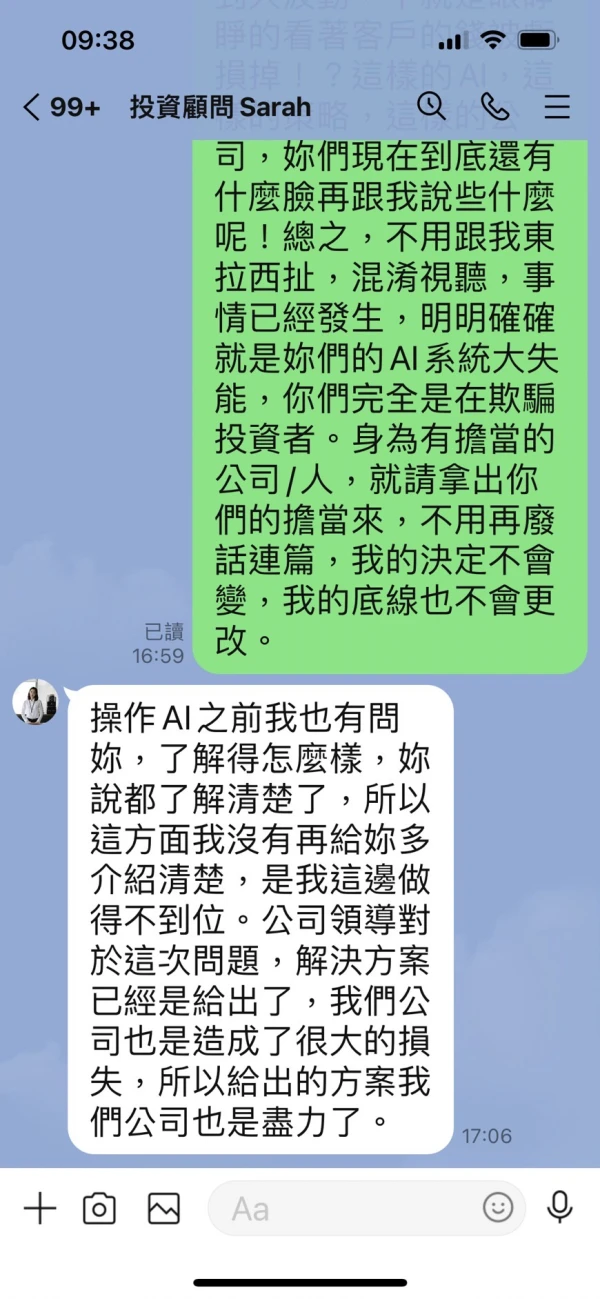

The company Oubo Global vigorously promotes a set of automatic trading AI intelligent system developed by their company, which will automatically analyze the market trend according to big data, buy at the right point, and the profit will be automatically sold. The whole process does not require investors to manually operate, as long as Log in to the trading account in your spare time to view the profit of the operation! Use this as a gimmick to attract a lot of people who are too busy to work on their own. Moreover, they claim that their investment algorithm model can make investment returns more stable and further avoid possible risks in the investment market. But in fact, it adopts the operation method of fast in and fast out, and no take profit/stop loss. As a result, many customers have liquidated their positions and caused losses, and then tell you that investment is risky...

Exposure

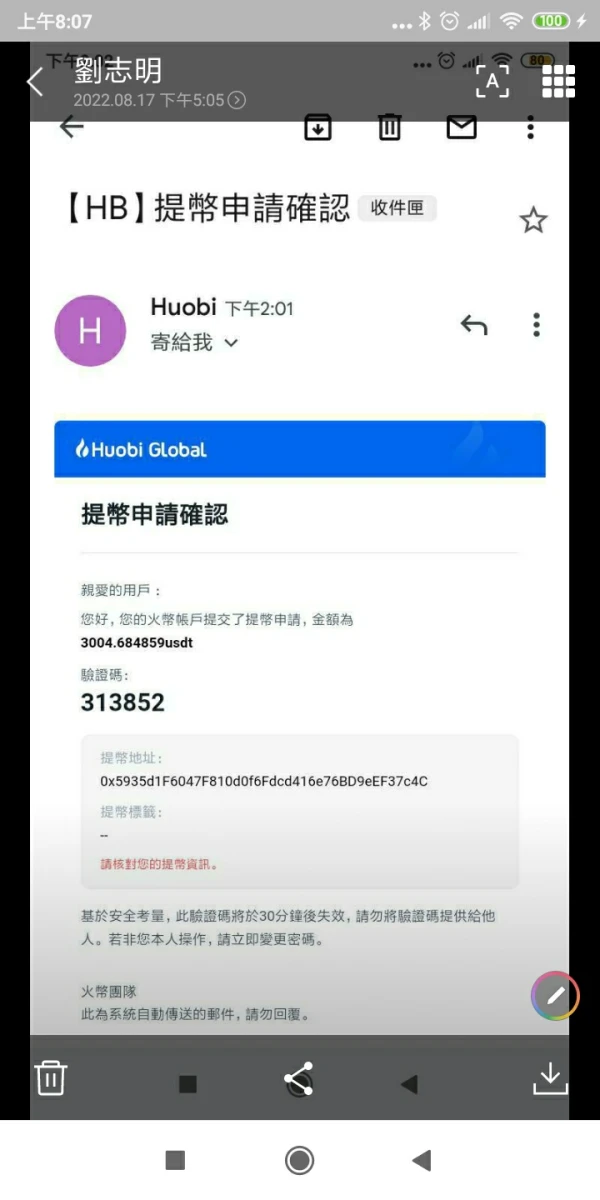

劉志明3196

Taiwan

And it said to be processed, but it was not processed. In the end, I couldn't even log in to the account.

Exposure

Lily94810

Taiwan

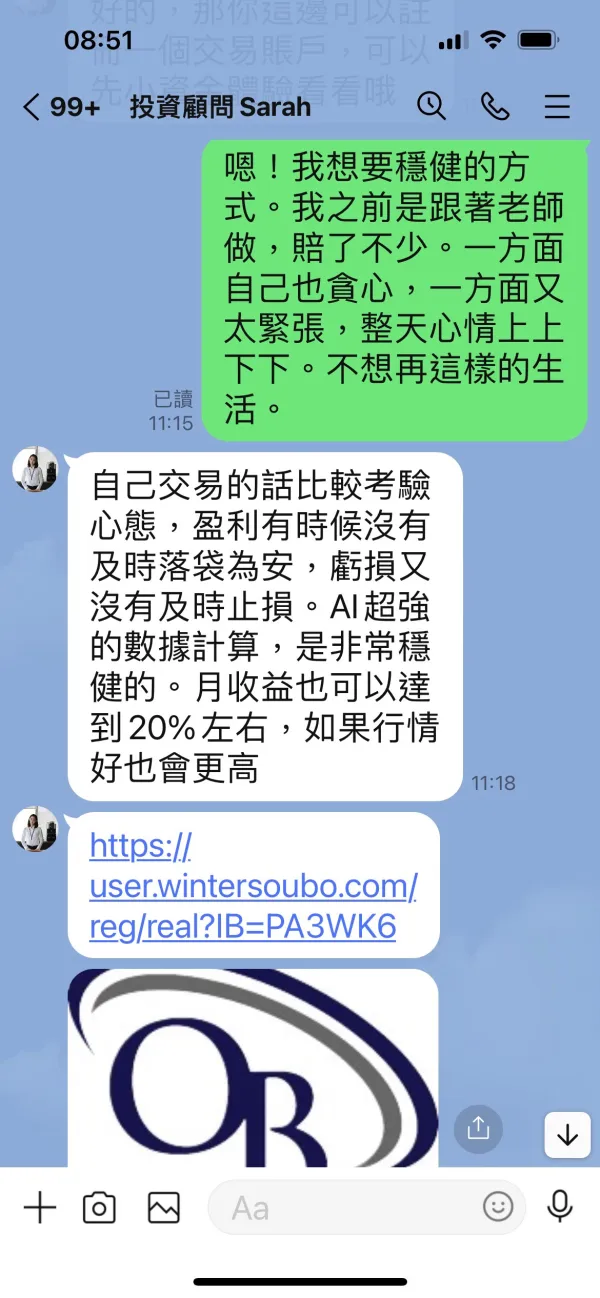

Oubo Global is a scam group, don't join in order to avoid being deceived. They advertise their self-developed AI intelligent investment system on various platforms, saying that it can operate in and out of the market by itself, help customers control investment risks, save customers time and effort, and lure many busy people to join. Let you experience it for a month, and operate it every day, so that you can see a steady small profit every day. After that, I will continue to persuade you to increase the funds you bet, saying that you can make more money. In fact, the money in your account is operated by the so-called AI, and the money in your account is defrauded, and then you are told that your investment has failed, and you will be kidnapped again. . If you don't want to inject any more funds, he will force you to close your account. They will defraud you of all your money in just over a month without paying any price and responsibility! Don't trust them anymore, this is a scam, a way to defraud the company.

Exposure

Mr.Andrew

Australia

At first, I had some confidence in this trading broker, considering their claims of being regulated by the NFA. But was I wrong! They turned out to be complete scammers. Their promises of high leverage and low spreads were nothing but deceit. I traded with them for almost a month, only to discover that their spreads were ridiculously high, and their customer service was extremely unprofessional. Don't fall for their trap, folks. They're just out to deceive you.

Neutral

Dorachs

Taiwan

Like I said in the title. I encountered a situation where I couldn’t withdraw money, I hope the police can help me get the money back, otherwise I’m really helpless

Exposure

Lily94810

Taiwan

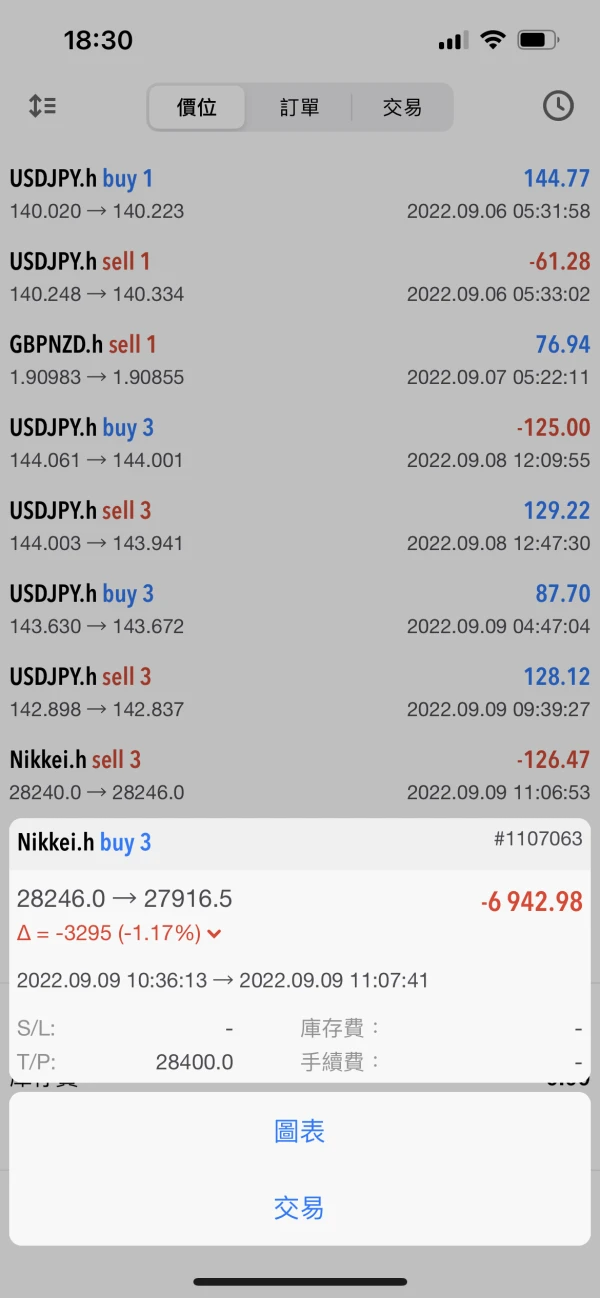

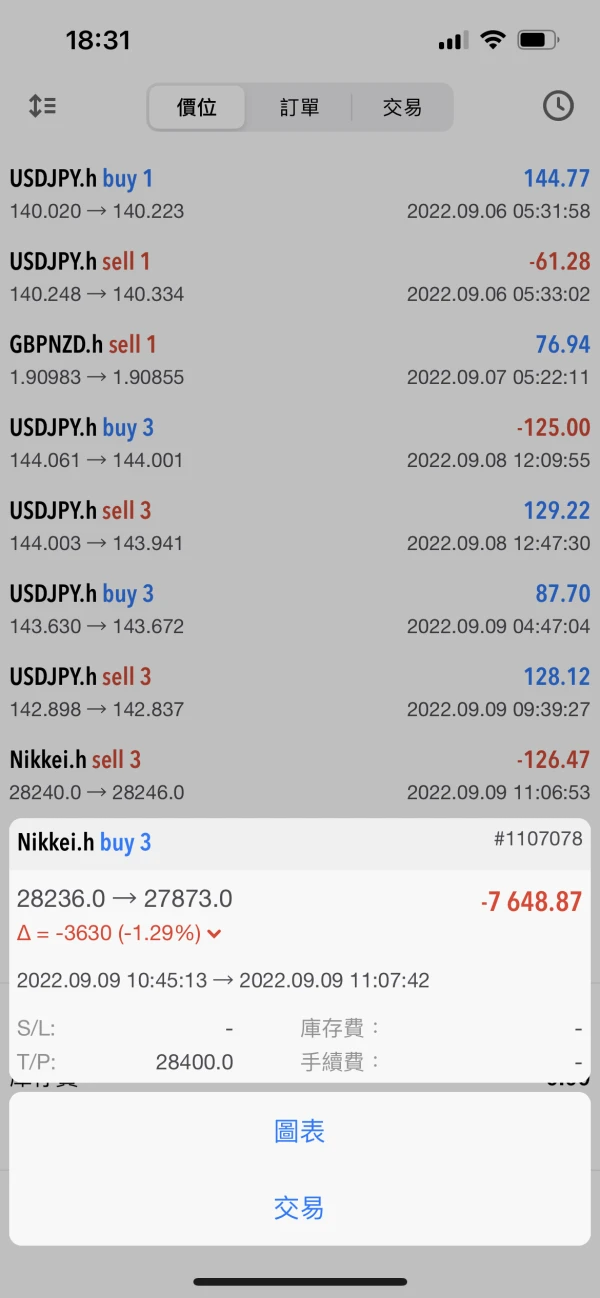

Oubo falsely advertises their AI smart investment. It is a stable and profitable type. The most important thing is that risk control is the first. It tricks investors into joining the experience first, and only tells them that they must increase their funds to 30,000 US dollars after joining for a month. , to join the official version of AI, but it has never been informed of the trial version and the official version. In the first month, start with a small number of operations, allowing you to make a small and stable profit. After one month, you will continue to advocate for gold to join the formal cooperation. After the evaluation, I could no longer deposit money, so I was told that I could only continue to use the trial version. As a result, the AI smart operation suddenly increased the lot size to 3 to trade, and did not set a stop loss, which directly let you liquidate.

Exposure

劉志明3196

Taiwan

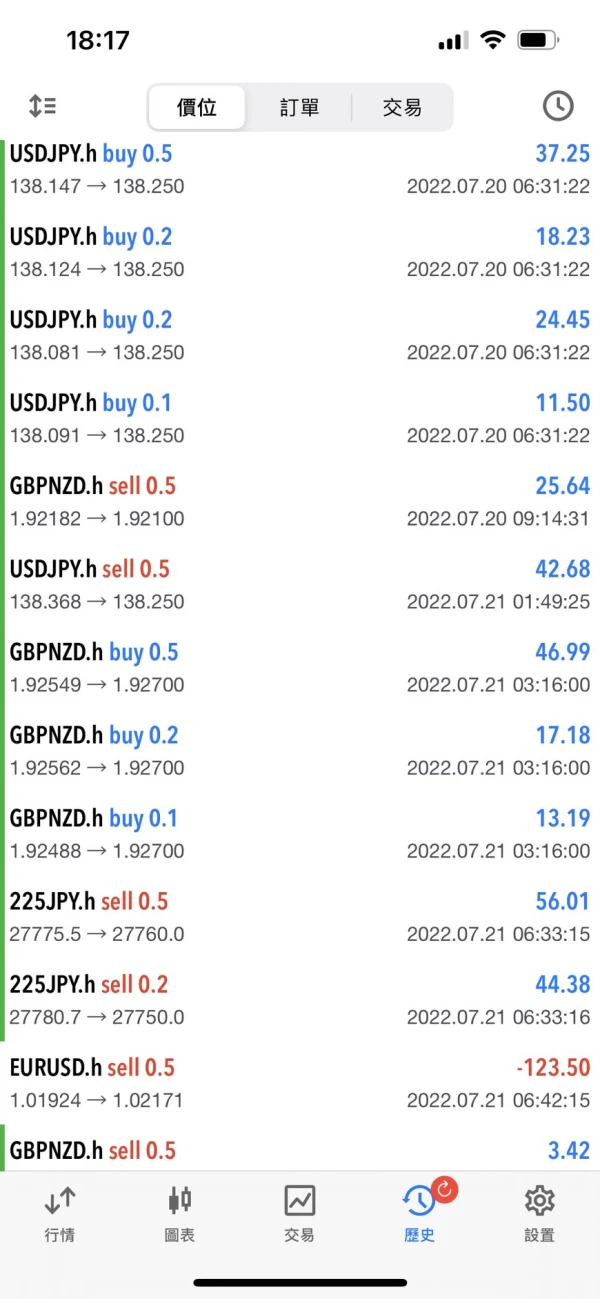

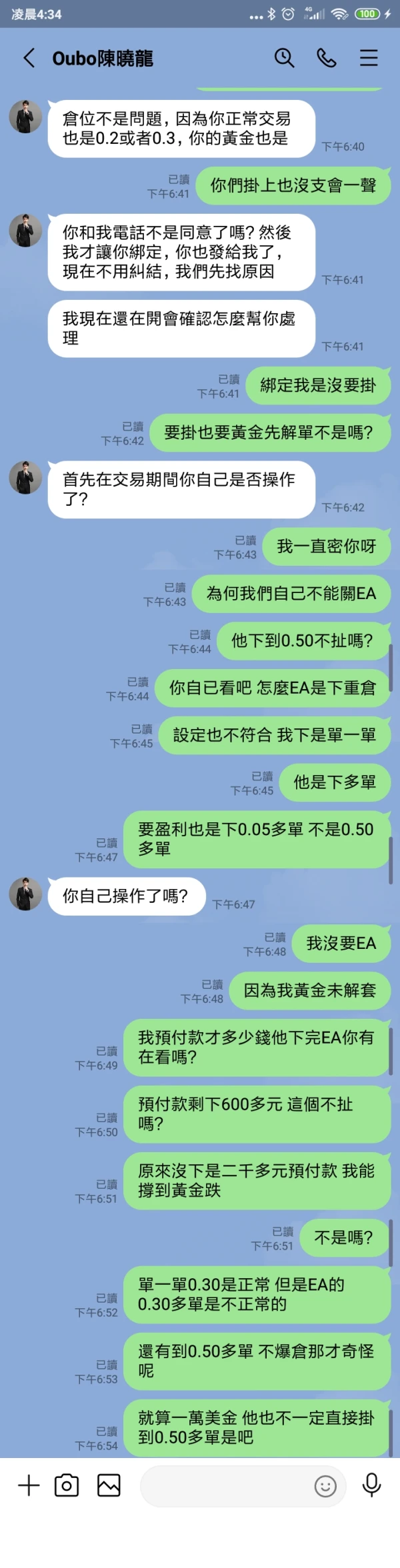

Post Oubo. They put you in a heavy position during three-day trial period and let you liquidate your position. Not long after that, you can't log in to your account. Finally, even the remaining more than 100 US dollars were transferred out. Isn't it bad enough? . Don't make money on this platform. It's really a slob. Even if you put in 100 million US dollars, he can hang a heavy position to make you explode, and they won't tell you how much. I used my wallet to deposit money. According to reason, if I want to withdraw my money, I also need my mailbox for verification. He even sent a text message to me without my mailbox verification, saying that I have withdrawn the amount of my account. They said that I did not withdraw the amount of my account, and EA also exploded the remaining more than 100 US dollars and was withdrawn for no reason. Is this platform still able to deposit money? And during the negotiation process, you are unwilling to compensate, then I will post here forever and never settle.

Exposure

劉志明3196

Taiwan

Placing for three days in the EA trail period, just placing a heavy position and liquidating the position. Won't place 0.01? You have to place three orders at 0.20, and did not tell the customer how much you palce on the EA. Compensate my three thousands dollars. If you do not pay, I will always complain to avoid the next victim.

Exposure