No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

The WikiFX Score of this broker is reduced because of too many complaints!

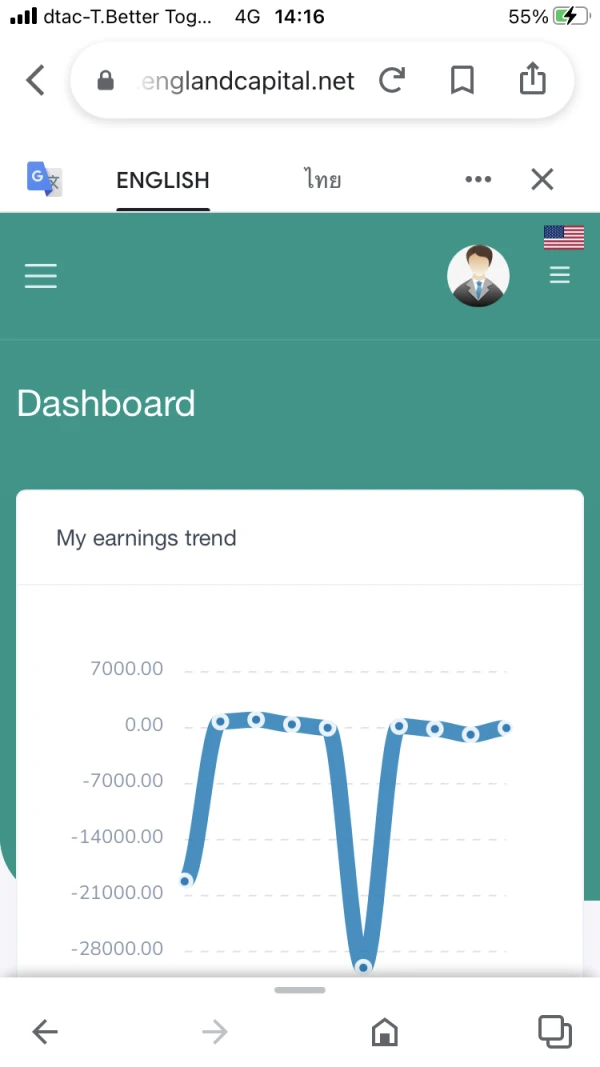

England Capital

United States | 2-5 years |

United States | 2-5 years | Suspicious Regulatory License | Suspicious Scope of Business | High potential risk

https://englandcapital.net/en/index

Website

Rating Index

Contact

https://englandcapital.net/en/index

The WikiFX Score of this broker is reduced because of too many complaints!

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

3

Basic Information

Registered Region  United States

United States

United States

United States Operating Period

2-5 years

Company Name

England Capital Management LTD

Customer Service Email Address

info@englandcapital.net

Company Website

10

Website

Comment

Users who viewed England Capital also viewed..

CPT Markets

8.53

Score ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

CPT Markets

Score

8.53

ECN Account15-20 yearsRegulated in United KingdomMarket Making License (MM)MT4 Full License

Official Website

AVATRADE

9.50

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

AVATRADE

Score

9.50

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Valetax

8.06

Score ECN Account2-5 yearsRegulated in MauritiusSecurities Trading License (EP)MT4 Full License

Valetax

Score

8.06

ECN Account2-5 yearsRegulated in MauritiusSecurities Trading License (EP)MT4 Full License

Official Website

VT Markets

8.68

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

VT Markets

Score

8.68

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Website

englandcapital.net

172.247.111.224Server LocationUnited States

ICP registration--Most visited countries/areas--Domain Effective Date--Website--Company--

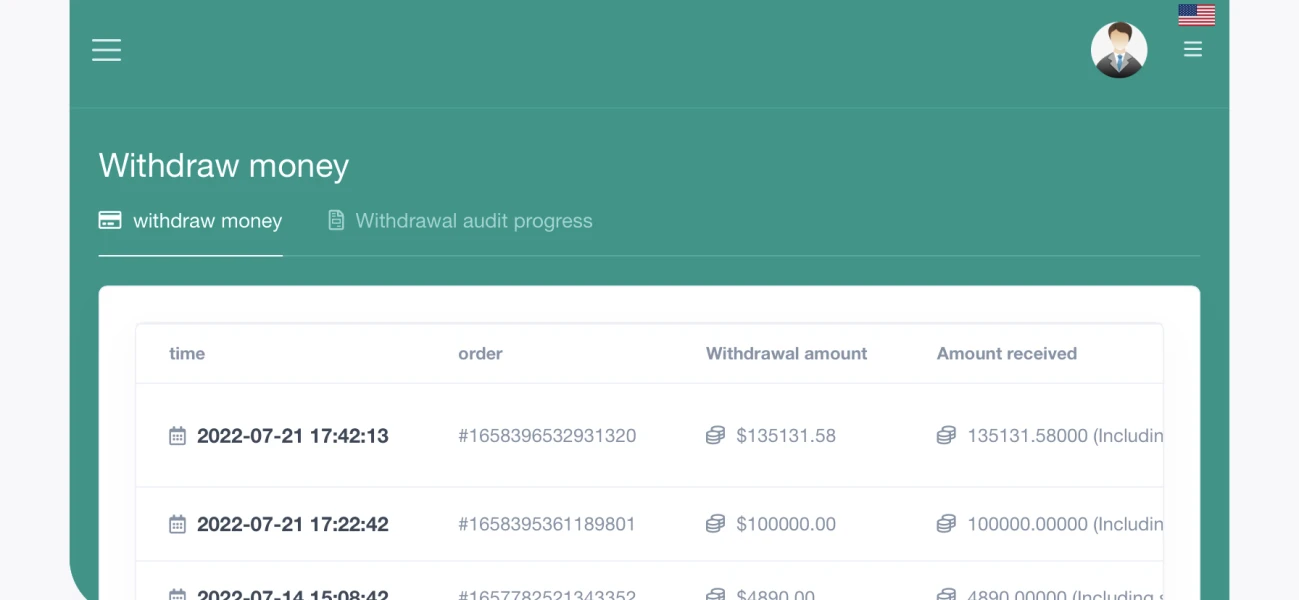

User Reviews10

Scroll down to view more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 10

Write a comment

10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Kanathip In

Thailand

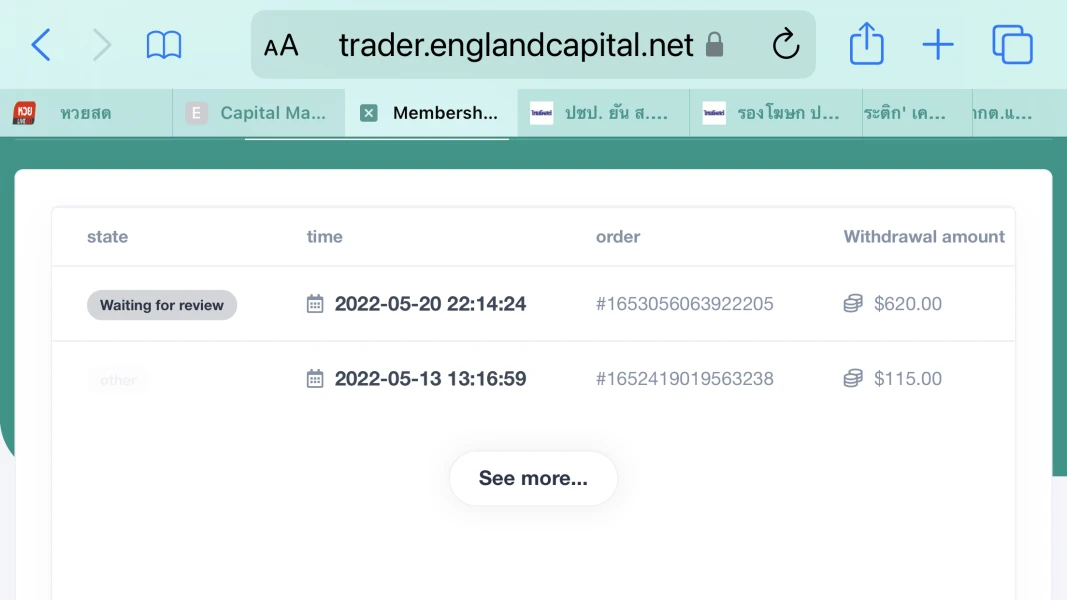

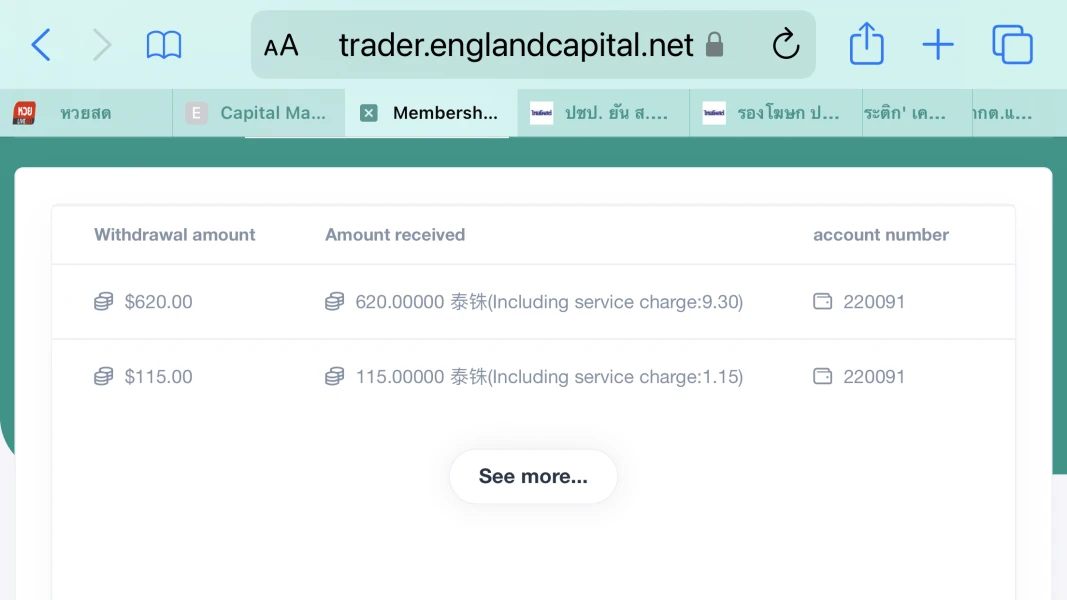

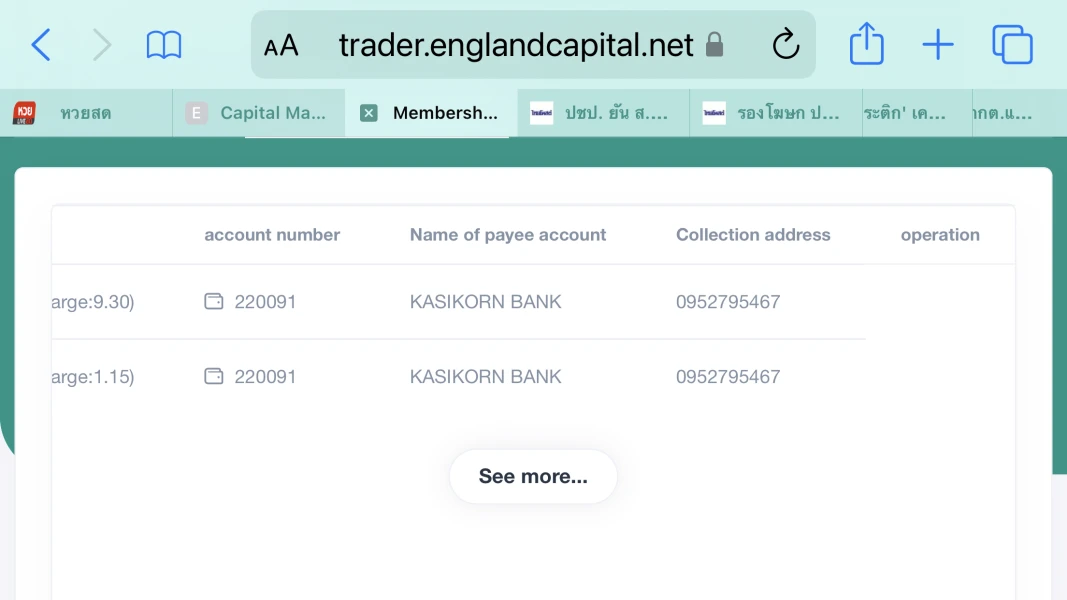

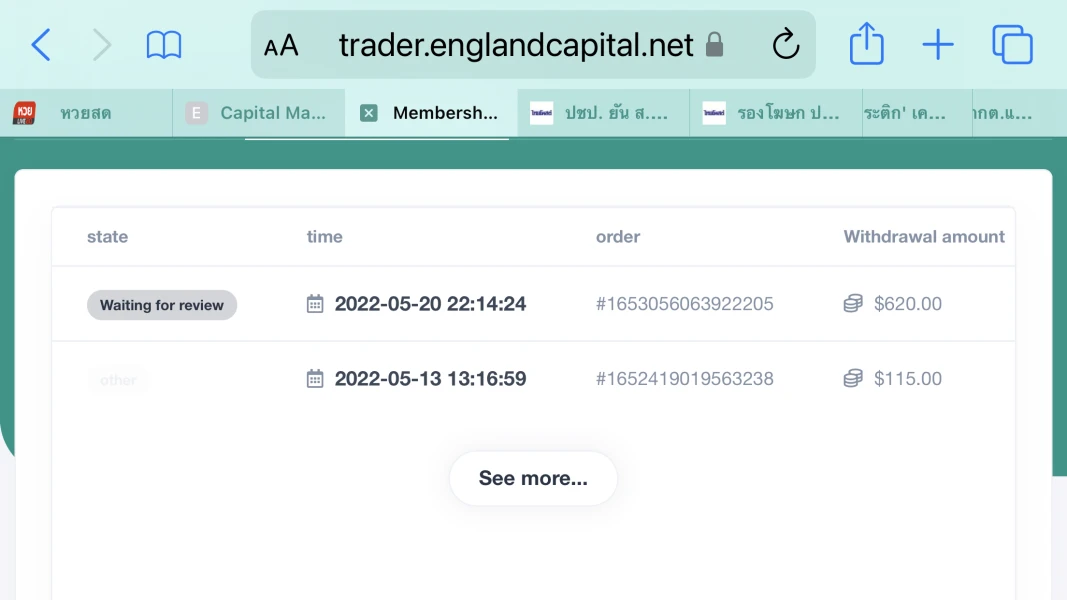

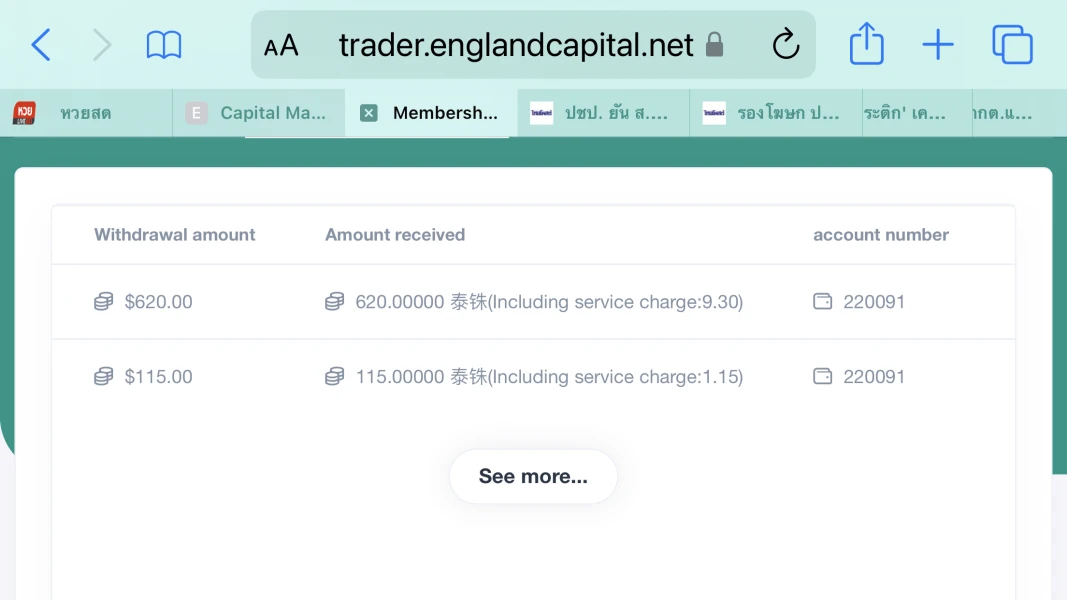

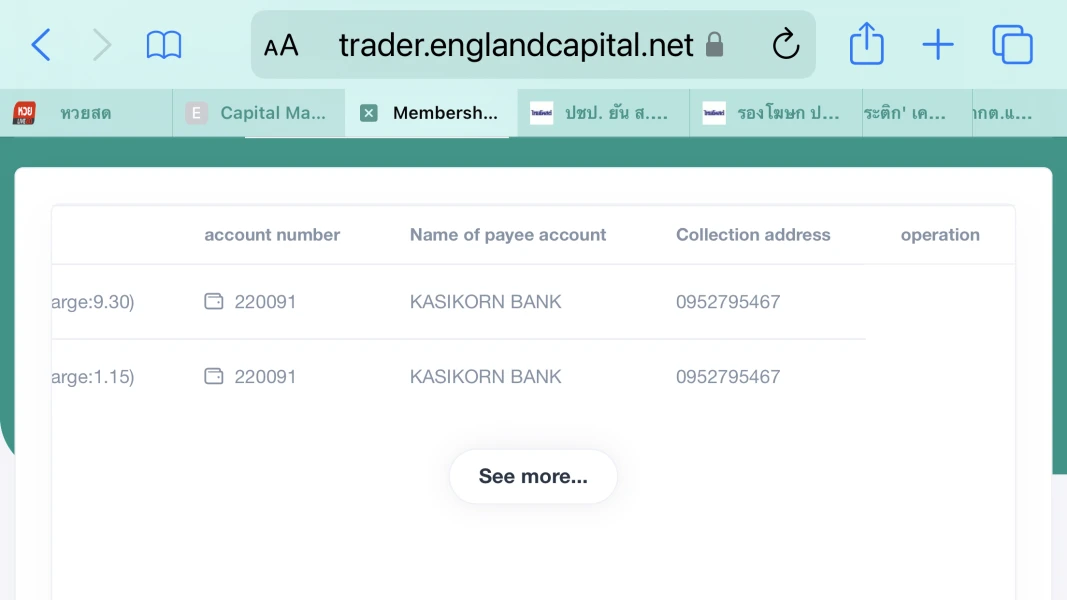

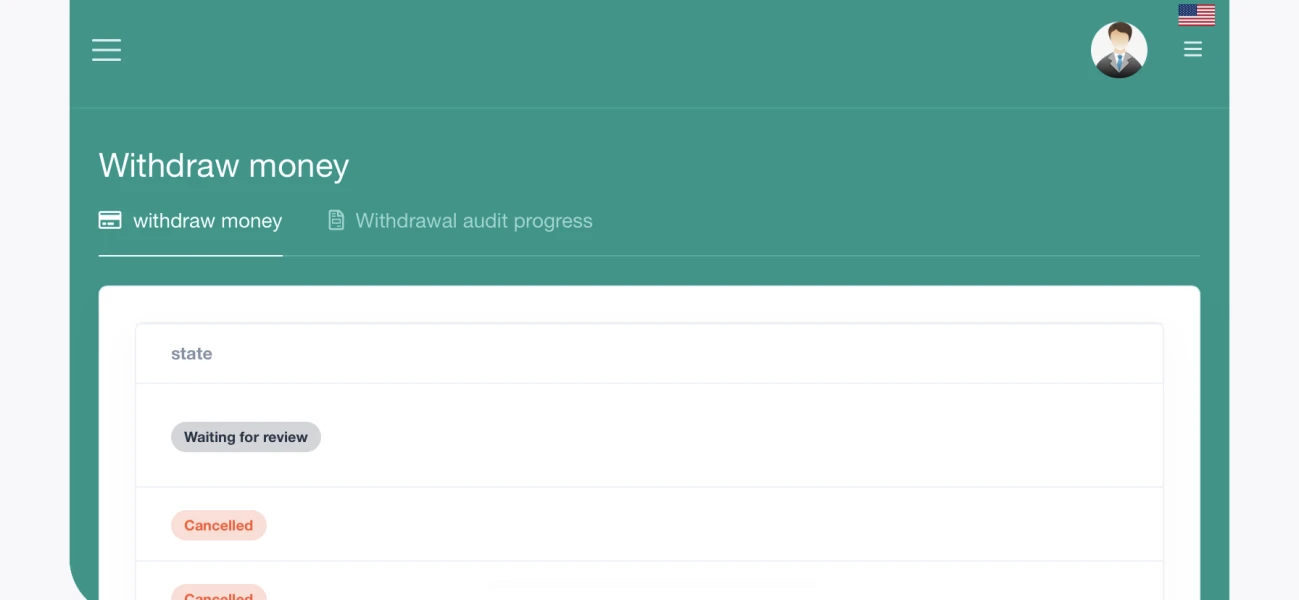

As a new trader who is trying to trade, I tried withdrawing money on 20-05-2022 time 22.14 (Thai time) with amount of 620 usd which is the second withdrawal trial. But until now, on 24-05-2022, 7.50 (Thai time), there has not been a response to the withdrawal status from this broker. Please coordinate with which step to go. And when will the withdrawal be received? which has attached a picture of making a withdrawal order

Exposure

Kanathip In

Thailand

There was a withdrawal notice of 620 usd on 22-05-2022, but until today 27-05-2022, there is no status update yet. Need an explanation of what happened? why delay and when will i get the money

Exposure

pongpipat

Thailand

I can't withdraw my money. Waited for 1 week. My funds failed to withdraw. Scam broker

Exposure

FX1506418892

United Kingdom

I've been trading with England Capital Management LTD for several years now, and I must say they have been a reliable and trustworthy broker. The wide range of trading instruments they offer allows me to diversify my trading portfolio and explore different market opportunities. I appreciate the competitive leverage options of up to 1:500, as it gives me the flexibility to amplify my gains when needed. The low spreads and fixed currency commissions for certain account types have been beneficial in keeping my trading costs low. The MetaTrader5 platform they provide is top-notch, offering sophisticated tools for technical analysis and seamless execution of trades. Moreover, the convenience of deposit and withdrawal options without any associated fees is a great advantage. Overall, England Capital has been a great partner in my trading journey, and I highly recommend them to fellow traders.

Neutral

FX1100542641

Australia

I don't know what happened, but when the company's website is opened, it will jump to the Bing wallpaper (I use the edge browser). Do you have the same situation?

Neutral

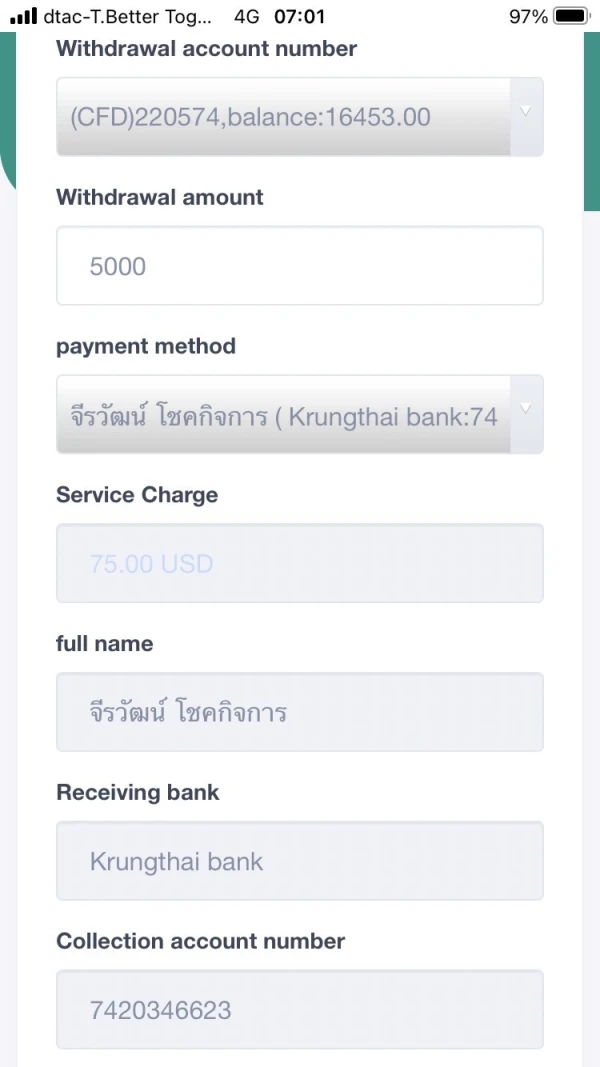

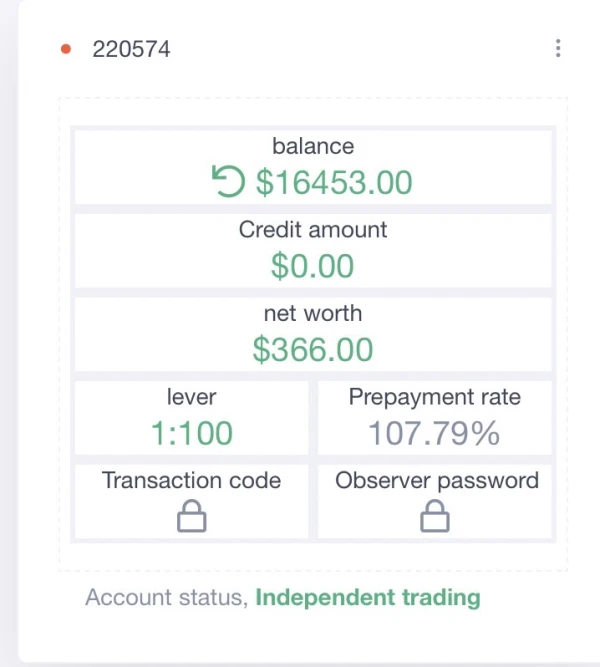

Hall Organic Rice

Thailand

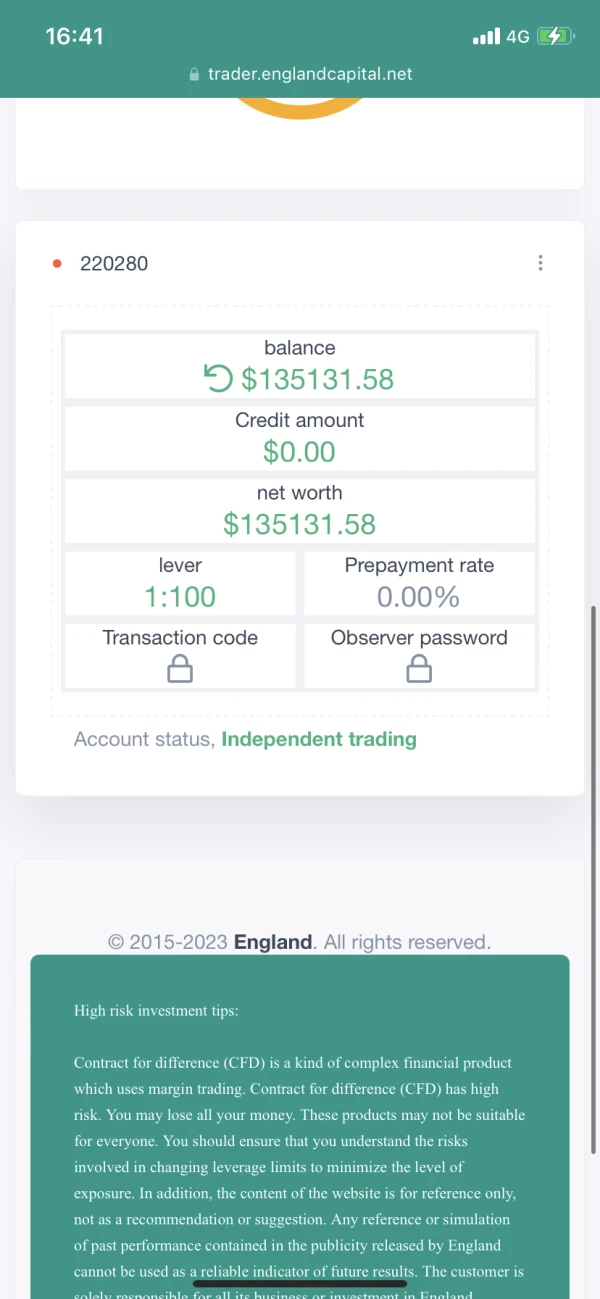

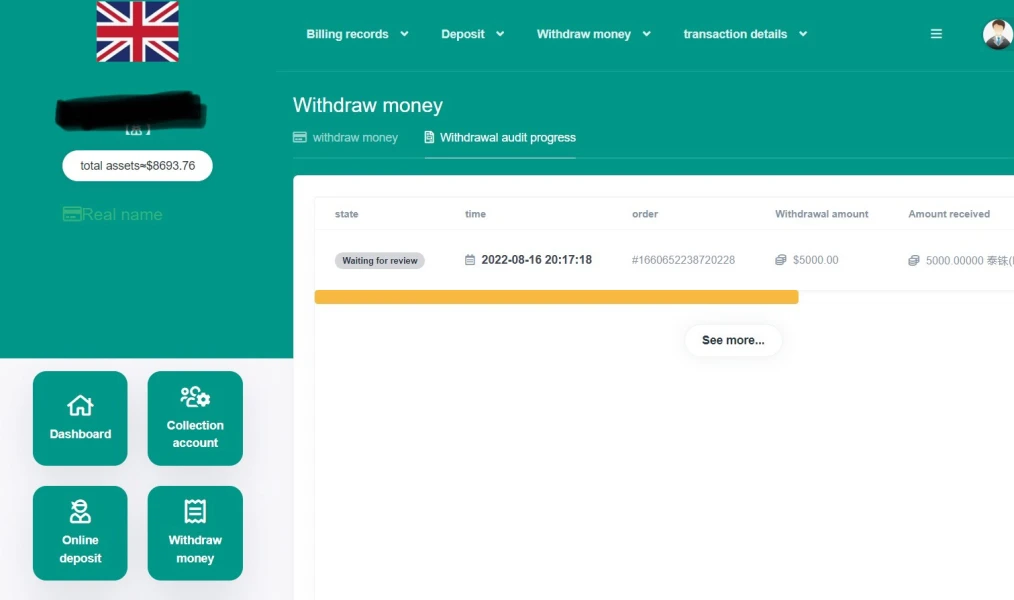

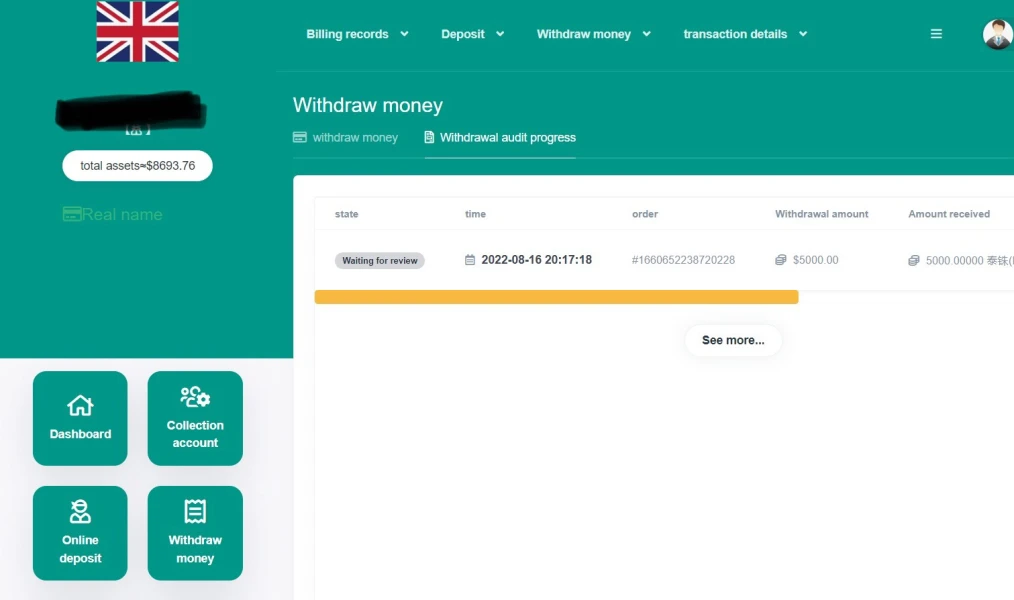

From the notification to change MT5 to KB group, I do not use the program of KB group. I want to transfer money from the system. Englandcapital Go back to linked account, from withdrawing $5000, system says balance reading failed. But I want to withdraw all the money in my account. From there contact with Englandcapital. but no reply at the moment and cannot be withdrawn

Exposure

song19321

Thailand

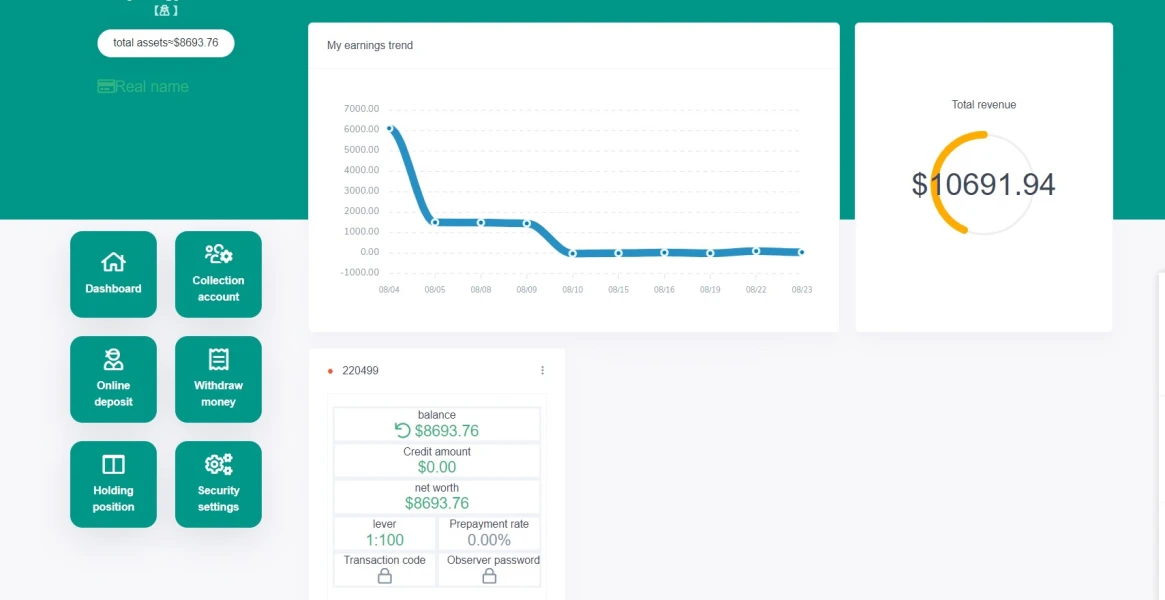

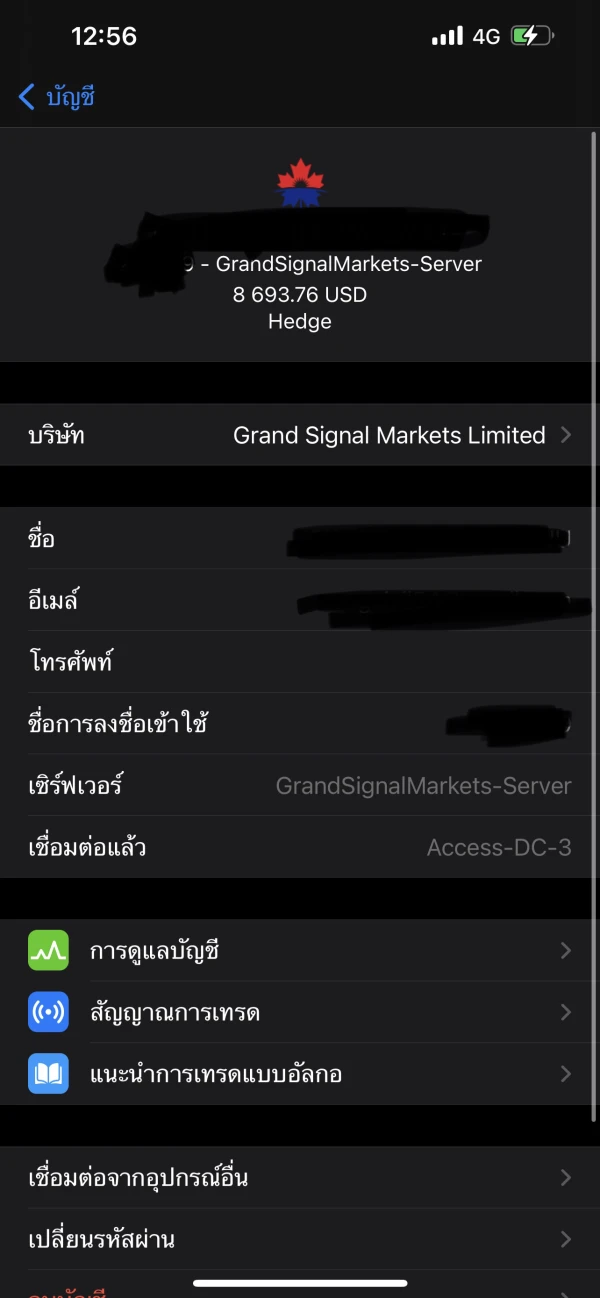

Funds added with profit earned. Brokers do not pay broker grand sinal makets limited on behalf of England capital, change the name of the broker every 2 months.

Exposure

song19321

Thailand

England capital process is to add money into the pot to make profit and inform that money can be withdrawn within 3-5 days but can't actually withdraw as scheduled. Approval account takes a long time. Changed the broker 2 times a month. Currently it is a grand signal makets limited. Whoever is trading can not quit real money.

Exposure

วัฒนากร กันทะรส

Thailand

I ordered to withdraw funds from my account but my account has a problem.

Exposure

pongpipat

Thailand

I can't contact the broker. I can't withdraw my money successfully. 160,000 dollar. Brokers are a scam. Claims that the withdrawal system is improving, it has not received any withdrawals for 2 weeks.

Exposure