Company Summary

| Feature | Information |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instrument | 200+ trading instruments, including FX, cryptocurrencies, stocks, precious metals, and indices |

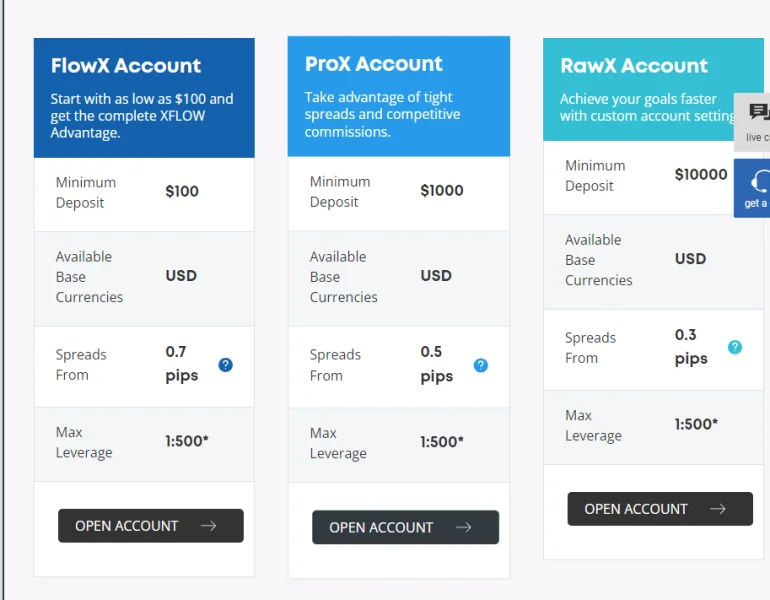

| Account Type | FlowX, ProX and RawX |

| Demo Account | Yes |

| Maximum Leverage | 1:500 |

| Spread | 0.3 pips |

| Commission | No |

| Trading Platform | MetaTrader4, MT4 WebTrader, MT4 for iPhone, Android, and iPad/Tablet, XFlow WebTrader, XFM Tab, XFM Mobile, XFM API |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | VISA, MasterCard, Local Transfers, PaySera, Alipay, Skrill, Neteller, PayPal, UnionPay, SEPA, Bitcoin, Bank Transfers |

XFlow Markets Information

XFlow Markets, a trading name of XFlow Markets LLC, is a forex brokerage registered in Saint Vincent and the Grenadines, allegedly offering its clients access to over 200 trading instruments, variable spreads from 0.3 pips, leverage up to 1:500, as well as 24/5 customer support service.

The company provides different account types, such as the FlowX Account, ProX Account, and RawX Account, catering to different trading needs and preferences. Each account type has its own minimum deposit requirement and offers access to a range of financial instruments with varying trading conditions.

XFlow Markets offers a range of trading platforms, including MetaTrader 4 (MT4) and their own proprietary platforms like XFlow, xTab, xMobile, and xAPI. These platforms provide traders with various features, such as charting tools, real-time data, and automated trading options.

Here is the home page of this brokers official site:

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments | Lack of regulatory oversight |

| Market calendar, news, and macro data | Potential risks associated with trading unregulated instruments |

| Availability of popular cryptocurrencies | Lack of investor protection |

| Empowerment for robots, algorithms, and trading apps | Higher minimum deposit requirements for ProX and RawX accounts |

| Wide range of payment options available | |

| Real-time data export (MT4 platform) |

Is XFlow Markets safe to trade with?

XFlow Markets is just an offshore forex broker and it has been verified that this broker is not authorized or regulated by any regulatory authorities.

Market Instruments

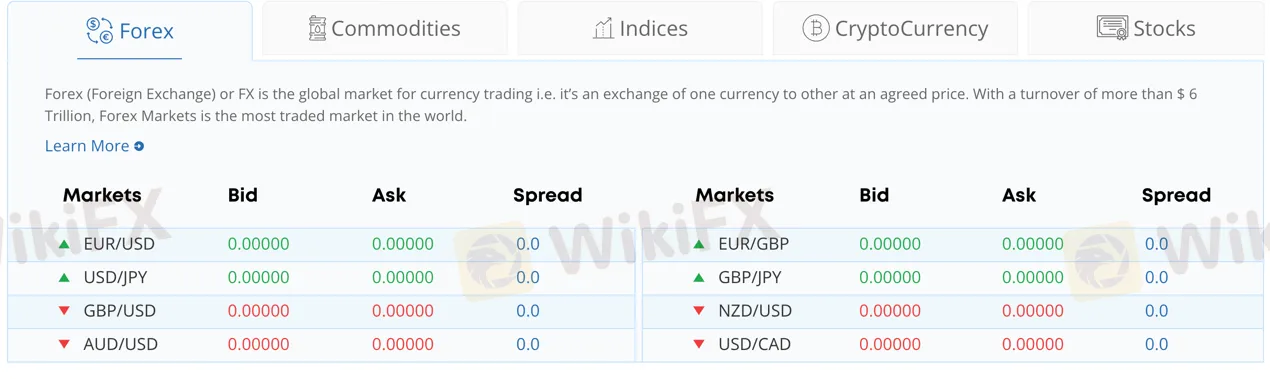

With the XFlow Markets platform, traders can get access to 200+ trading instruments, such as FX, cryptocurrencies, stocks, precious metals, and indices.

Forex:

XFlow Markets provides access to the forex market, allowing traders to participate in currency trading. This includes major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, among others. Forex trading offers opportunities to profit from fluctuations in exchange rates.

Commodities:

Traders can also engage in the trading of various commodities through XFlow Markets. This includes popular commodities like oil, natural gas, precious metals such as gold, silver, and platinum, as well as agricultural products like cocoa, soybeans, cotton, sugar, corn, and wheat. Additionally, industrial metals like copper, zinc, nickel, and aluminum are available for trading.

Indices:

XFlow Markets offers trading opportunities in major stock indices from around the world. Traders can access and trade popular indices like the S&P 500, NASDAQ, FTSE 100, DAX 30, and many others. Trading indices allows investors to speculate on the performance of a basket of stocks representing a particular market or sector.

Cryptocurrencies:

XFlow Markets provides access to a range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), among others. Crypto trading allows traders to take advantage of price movements in digital currencies and potentially profit from their volatility.

Stocks:

Through XFlow Markets, traders can also engage in stock trading. This includes well-known stocks from companies like Amazon, Facebook, Microsoft, Netflix, Google, Alibaba, Apple, and IBM, among others. Stock trading offers investors the opportunity to buy and sell shares in publicly listed companies.

Account Types

| Account Type | FlowX Account | Prox Account | RawX Account |

|---|---|---|---|

| Minimum Deposit | $100 | $1,000 | $10,000 |

| Available Base Currencies | USD | USD | USD |

| Spreads From | 1.5 pips | 2.1 pips | 0.3 pips |

| Max Leverage | 1:500* | 1:500* | 1:500* |

How to Open an Account?

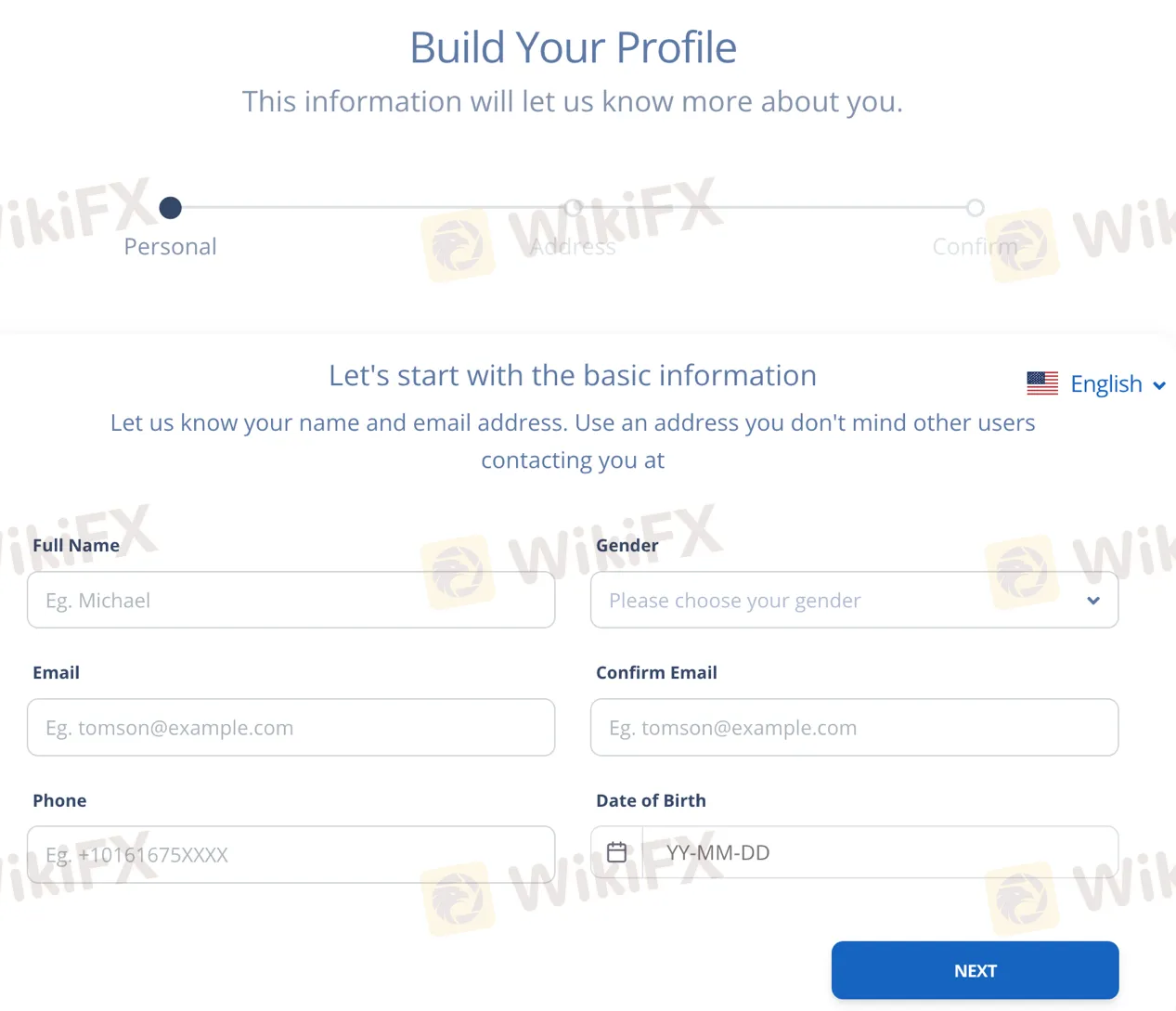

To open an account with XFlow Markets, follow these steps:

- Visit the XFlow Markets website and locate the “Open your XFLOW ACCOUNT” button. Click on it to initiate the account opening process.

2. Personal Information: Provide your full name, gender, email address, and confirm the email address by entering it again. Enter a phone number including the country code. Enter your date of birth.

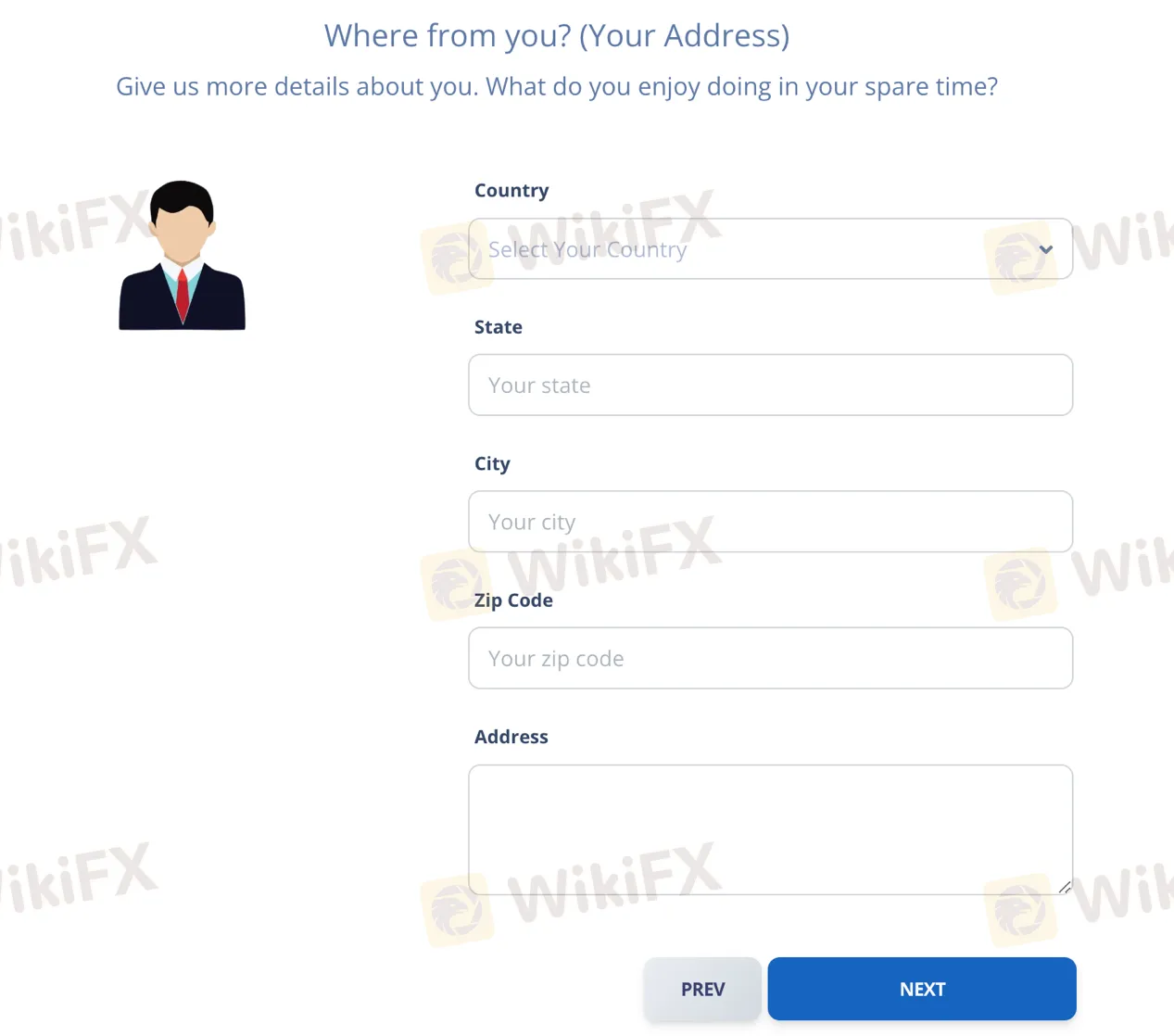

3. Address: Fill in your address details. Specify your country, state, city, and zip code. Enter your complete address.

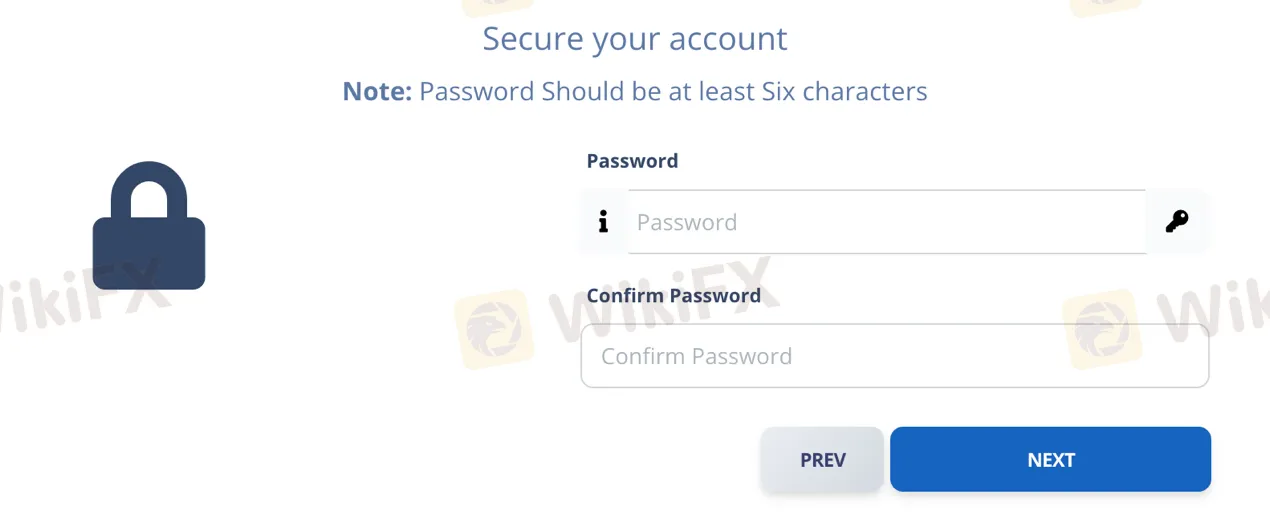

4. Secure Your Account: Create a secure password for your XFlow Markets account. The password should be at least six characters long. Enter your chosen password and confirm it by entering it again.

After completing these steps, review the information you have provided to ensure accuracy. Once you are satisfied, click on the confirmation button to submit your account application to XFlow Markets.

Leverage

XFlow Markets provides traders with a maximum trading leverage of up to 1:500.

Spreads & Commissions

AMP Globals fee structure varies across its account types. The FlowX Account requires a minimum deposit of $100, with spreads starting from 1.5 pips and leverage of up to 1:500*. The Prox Account has a higher minimum deposit of $1,000, offering tighter spreads starting from 2.1 pips, while the RawX Account, designed for advanced traders, requires a $10,000 minimum deposit and offers the tightest spreads starting from 0.3 pips, with the same leverage of 1:500*. All accounts use USD as the base currency.

Trading Platform

XFlow Markets has enhanced the MT4 platform to support No Dealing Desk Forex execution. This means there are no third-party bridges or auto account syncs involved. The key features of MT4 include a Market Watch Window, Navigator Window, multiple order types, 85 pre-installed indicators, analysis tools, multiple chart setups, automated trading, and order execution capabilities. Clients can enjoy real-time data export via DDE protocol, first-class charting with an unlimited quantity of charts, and access to a free MT4 download and demo account.

MT4 WebTrader:

The MT4 WebTrader is a browser-based version of the MT4 platform, designed for a user-friendly interface. It offers 24 analytical instruments, updates on financial market news, collaborative symbol charts, trade history, and the ability to trade from anywhere in the world, 24/5. Traders have complete control over their trading accounts through this web-based platform.

MT4 for Android:

The MetaTrader 4 Android OS App is a comprehensive trading platform for Android mobile devices. It provides a wide range of features, including 24 analytical instruments, financial market news updates, collaborative symbol charts, trade history, and the ability to trade from anywhere in the world, 24/5. Traders can have complete control over their trading accounts using this app.

MT4 for iPad:

MetaTrader 4 for iPad/iPhone is known as the world's most efficient platform for iOS-powered devices. It offers a vast selection of brokers and servers to trade from. The platform includes 24 analytical instruments, financial market news updates, collaborative symbol charts, trade history, and the ability to trade from anywhere in the world, 24/5. Traders can also enjoy chat options, audio notifications, and push notifications.

XFlow, xTab, xMobile, and xAPI:

XFlow Markets introduces its own trading platforms, namely XFlow, xTab, xMobile, and xAPI. XFlow is an ultra-fast web-based trading platform that supports over 300 tradable assets, including forex pairs, indices, commodities, cryptocurrencies, and global stocks. It offers advanced chart trading, market calendar, news, and macro data, and various customization options.

xTab is designed for trading on the move from iPad or Android tablets, offering advanced charting, fast performance, market calendar, news, and macro data.

xMobile provides trading capabilities on Android and iOS phones, featuring advanced charting, fast performance, and access to market calendar, news, and macro data.

xAPI empowers traders with the ability to operate robots, algorithms, and trading apps. It supports coding in any language, ultra-fast execution, and the development of various trading applications without restrictions.

Trading Tools

XFlow Markets offers a range of trading tools to assist users in their trading activities. These tools include Technical Analysis, Daily Outlook, Weekly Outlook, Economic Calendar, Rollover Table, and Margin Calculator.

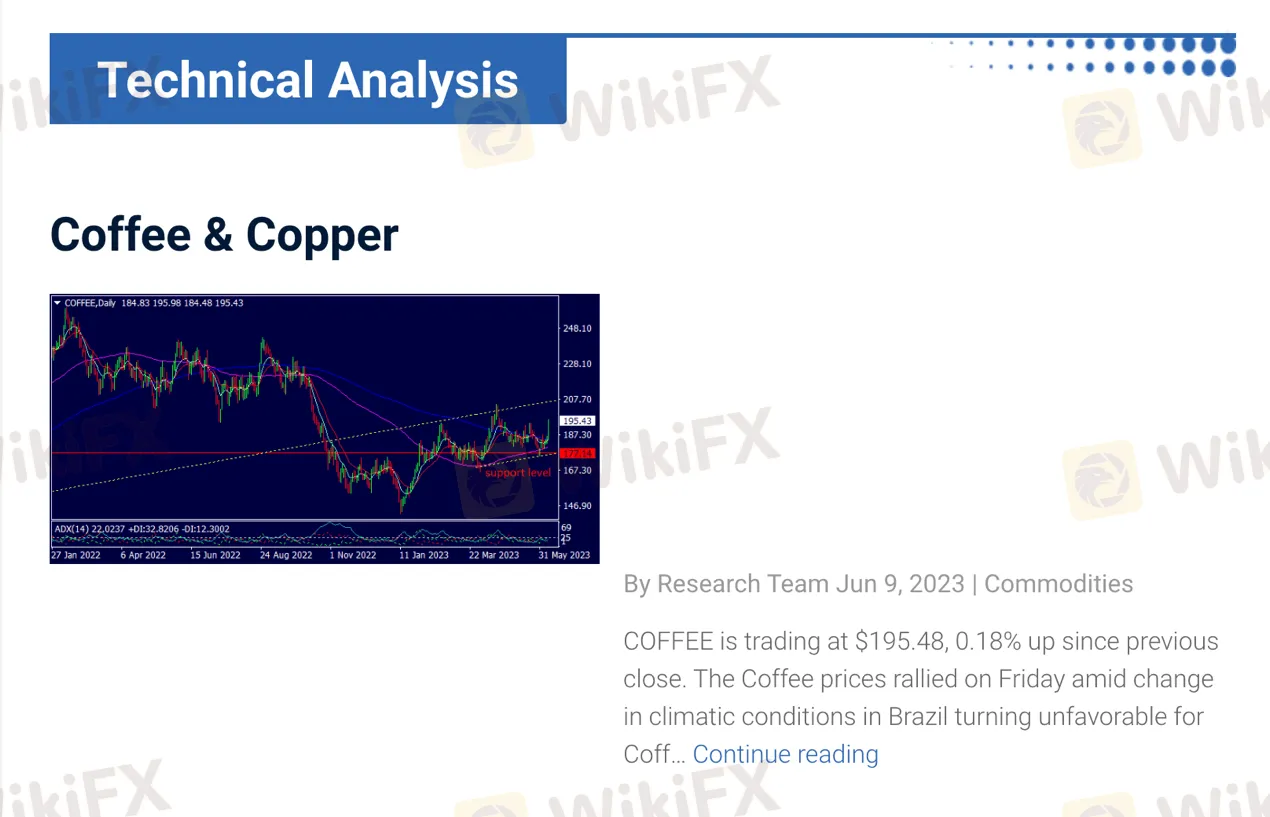

Technical Analysis:

The Technical Analysis tool provides insights into the market trends and price movements of various commodities, such as coffee and copper. It includes graph images and analysis conducted by the research team. Users can stay updated with the latest information on commodity prices and make informed trading decisions.

Daily Outlook:

The Daily Outlook tool offers a comprehensive overview of the market for specific currency pairs, such as USD/CAD, USD/JPY, and other assets like oil and indices. It provides graph images, analysis, and commentary on the recent performance and factors influencing the market. Traders can gain valuable insights to guide their daily trading strategies.

Weekly Outlook:

The Weekly Outlook tool focuses on providing a broader perspective of the market. It offers detailed analysis and graph images for assets like XAUUSD (Gold). Traders can access information on recent market trends, upcoming events, and potential trading opportunities to plan their strategies for the week.

Economic Calendar:

The Economic Calendar tool helps traders keep track of important economic events and announcements that can impact the financial markets. It provides a schedule of key economic indicators, central bank meetings, and other significant events. By staying informed about these events, traders can anticipate potential market volatility and adjust their trading positions accordingly.

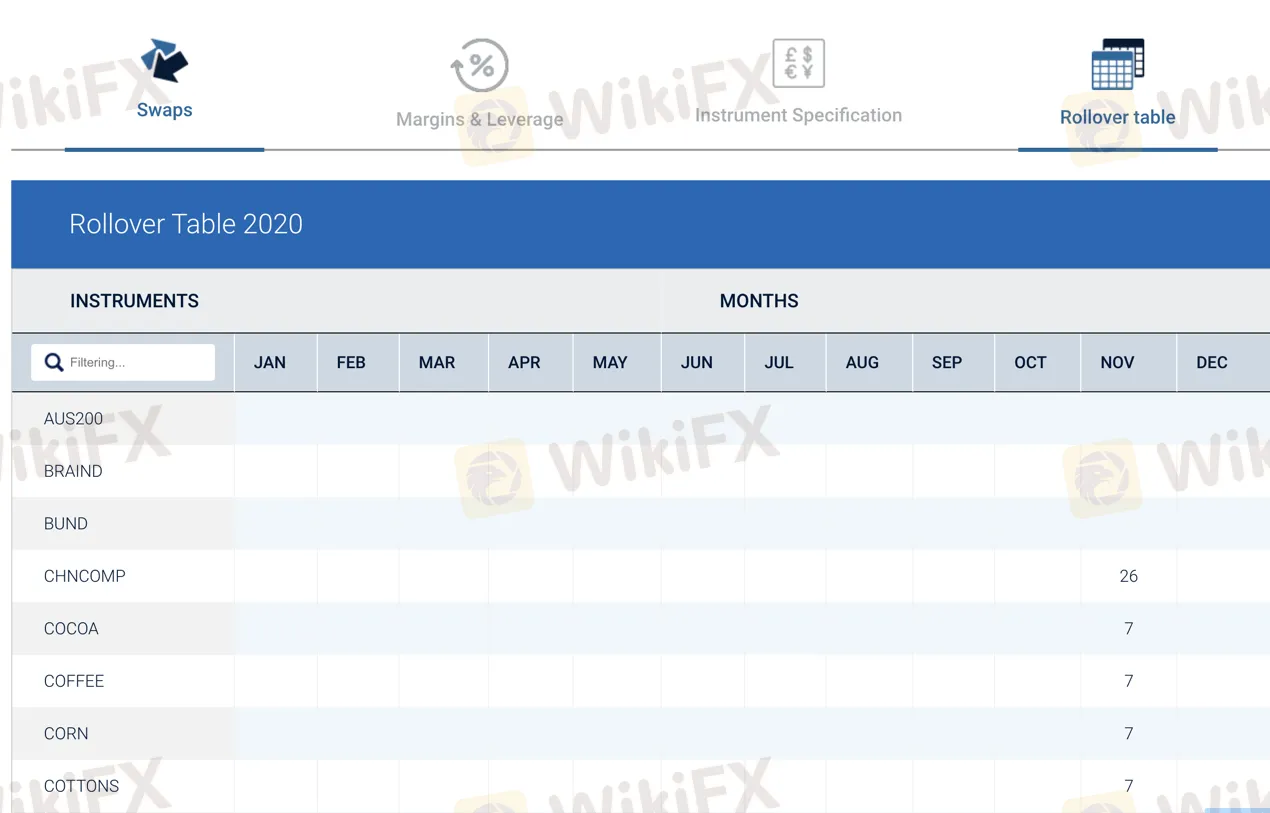

Rollover Table:

The Rollover Table tool displays information related to the rollover dates for various trading instruments. It allows traders to see the months in which rollover occurs for different instruments, such as AUS200, BRAIND, BUND, CHNCOMP, and COCOA. This information is useful for traders who wish to manage their positions and adjust their trading strategies based on rollover dates.

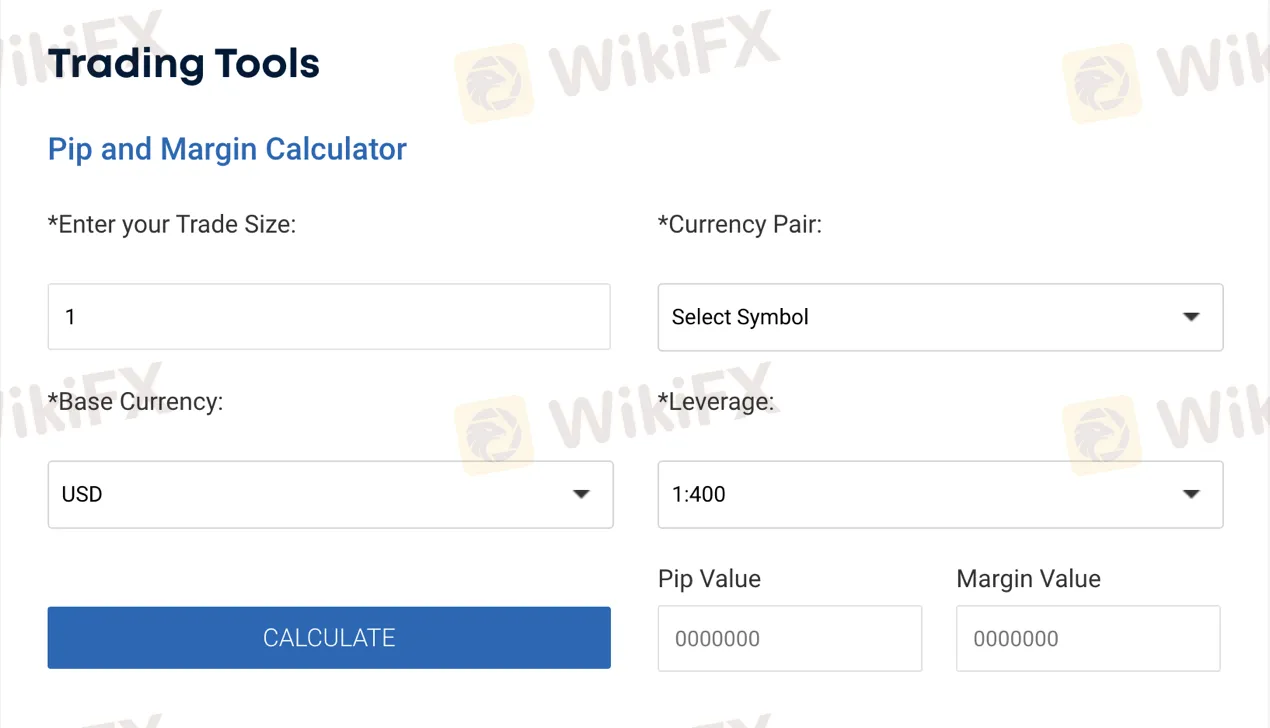

Margin Calculator:

The Margin Calculator tool helps traders calculate the required margin for their trades based on the leverage and position size. By entering the necessary parameters, traders can quickly determine the margin requirements for their trades, enabling them to manage their risk.

Deposit & Withdrawal

The minimum deposit amount is $100. XFlow Markets allows its clients to make a deposit and withdrawal through an array of payment options, which include: VISA, MasterCard, Local Transfers, PaySera, Alipay, Skrill, Neteller, PayPal, UnionPay, SEPA, Bitcoin, Bank Transfers.

Customer Support

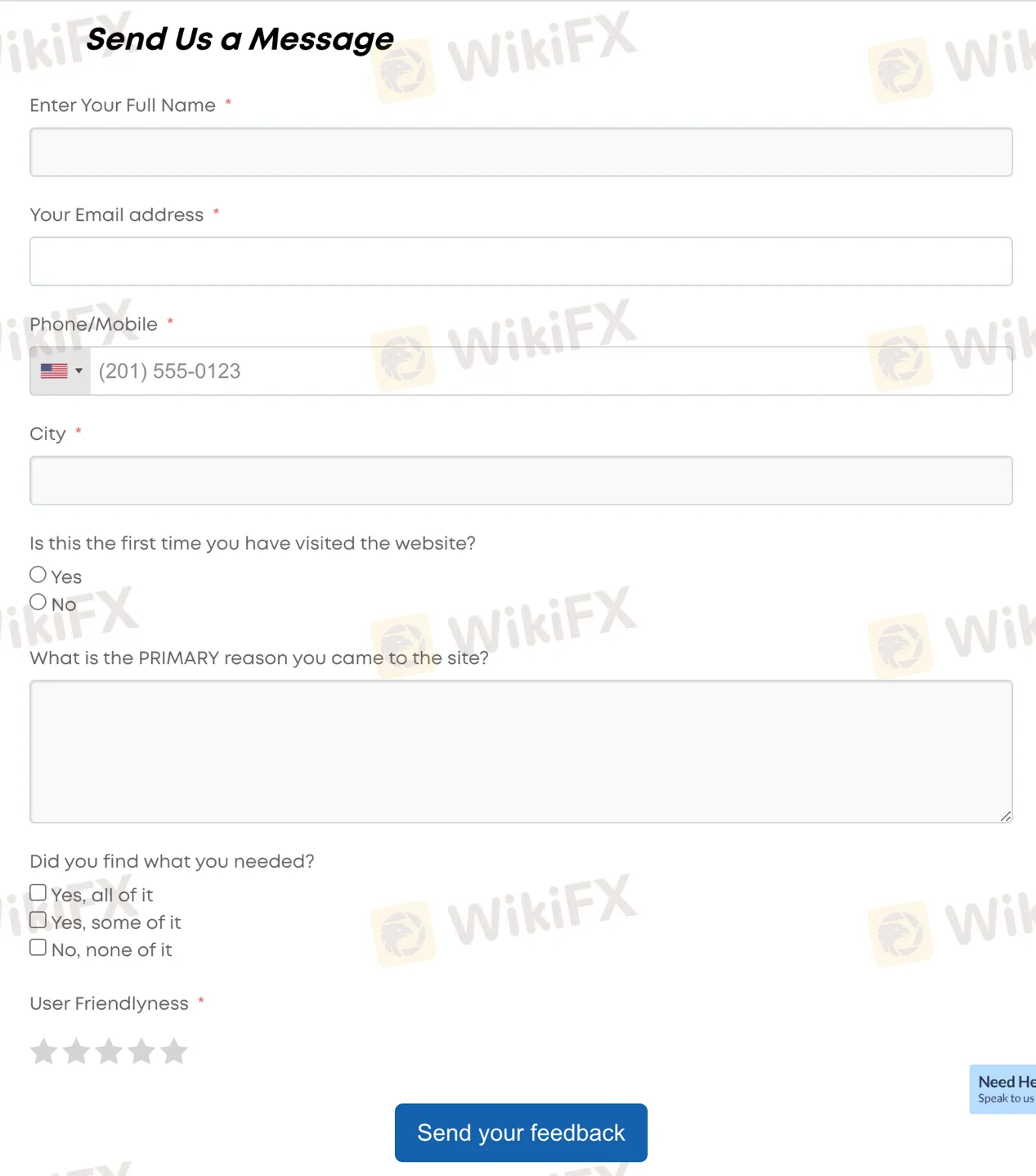

XFlow Markets offers various channels for traders to reach out for customer support regarding inquiries and trading-related issues. The available options include:

- Telephone: Traders can contact XFlow Markets' customer support team by dialing +44 20 3835 5241.

- Email: Another way to get in touch with customer support is through email at support@xflowmarkets.com. Traders can send their queries or concerns to this email address for assistance.

- Contact Form: XFlow Markets provides a contact form on their website, allowing traders to submit their messages or questions directly through the form.

- Social Networks: XFlow Markets can also be followed on various social networks such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. Traders can connect with the broker through these platforms for additional support or updates.

Conclusion

XFlow Markets is an online forex and CFD broker that offers a range of trading services to its clients. It provides access to various financial instruments, including currencies, commodities, and indices, allowing traders to speculate on price movements. One advantage of XFlow Markets is its user-friendly trading platform, which offers a range of tools and features to assist traders in making informed decisions. However, the broker has faced criticism for its customer support, with some users reporting slow response times and unhelpful assistance. Additionally, XFlow Markets has been accused of lacking transparency in its pricing structure, leading to concerns about hidden fees and potential conflicts of interest.

Frequently Asked Questions (FAQs)

| Q 1: | Is XFlow Markets regulated? |

| A 1: | No. It has been verified that XFlow Markets currently has no valid regulation. |

| Q 2: | At XFlow Markets, are there any regional restrictions for traders? |

| A 2: | Yes. XFlow Markets does not offer CFDs to residents of certain jurisdictions including Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries. |

| Q 3: | Does XFlow Markets offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does XFlow Markets offer the industry-standard MT4 & MT5? |

| A 4: | Yes. XFlow Markets supports MetaTrader4, MT4 WebTrader, MT4 for iPhone, Android and iPad/Tablet, XFlow WebTrader, XFM Tab, XFM Mobile, and XFM API. |

| Q 5: | What is the minimum deposit for XFlow Markets? |

| A 5: | The minimum initial deposit to open an account is $100. |

Pankaj933

India

is a xflow market froud not withdrawal $. is a 7dey proses accept is waiting is froad web series is not money back 😭😭😭🔙🔙

Exposure

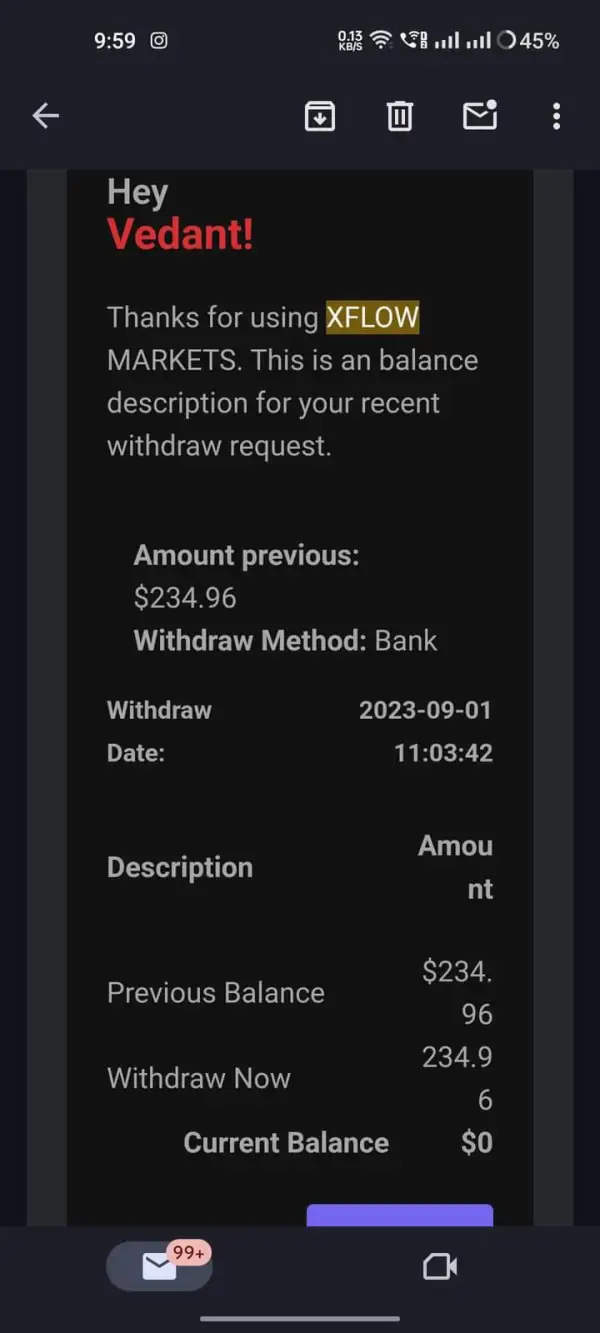

Vedant

India

I started trading on Xflow markets in September and just in few days I requested for withdrawal of the amount given in the photo which was $238 I also uploaded all the bank details on the site but didn't receive any payment till now I also raised ticket on their site, mailed them, wrote a review on trustpilot but didn't get any response anywhere and now I also can't access my account on their site so the issue has been worsen more and more and I don't feel any broker safe because of this and have stopped forex trading and as I am from India I feel brokers like this scam us more.

Exposure

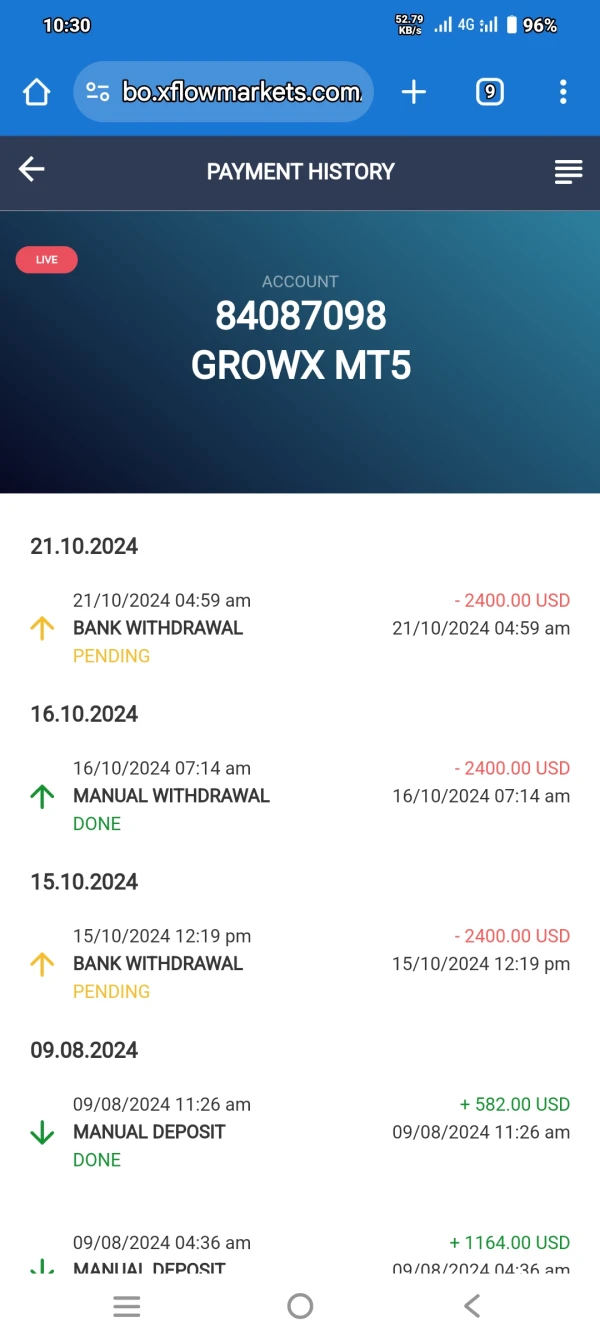

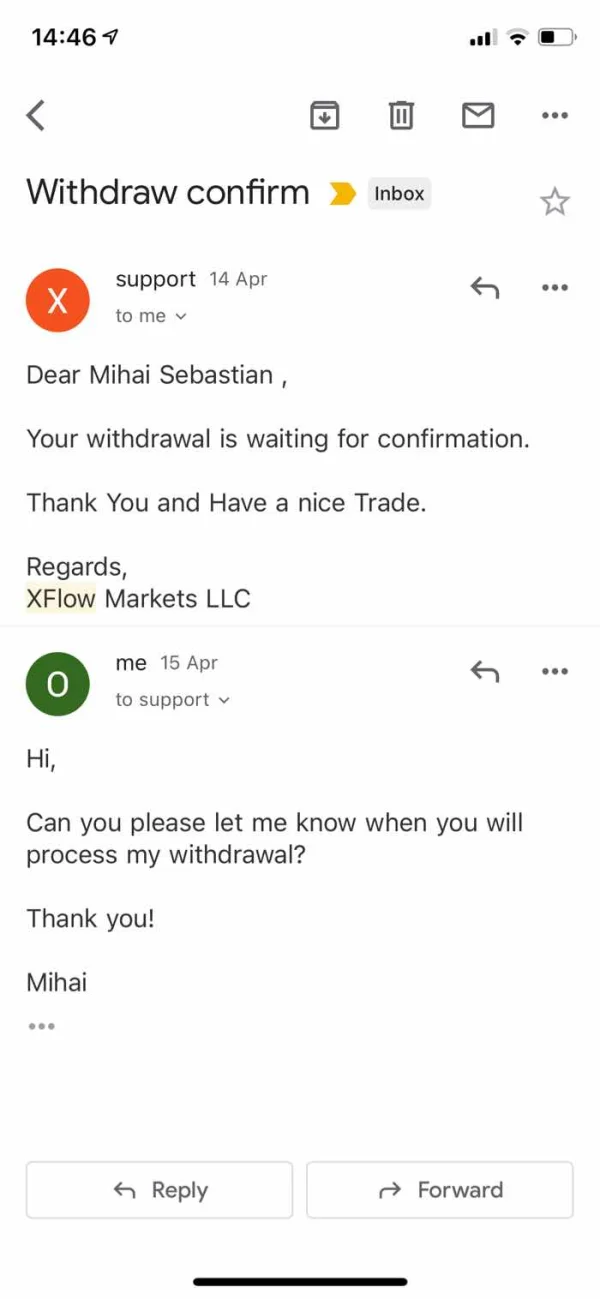

Onocan Mihai

Romania

Hi, Please stay away because this broker is a big fraud, the stole my profits and also my deposit, as you can see in the picture, i have made the withdrawal in april, and since then , they stop replying me and also disabled my account. Stay away!

Exposure

Contter

United States

I checked out three kinds of accounts in total, and the RawX account really caught my eye. Or, maybe I could start with a virtual account first just to get my feet wet. It left a really good impression on me!

Positive

bala874

India

XflowMarket borker provides risk management tools such as stop-loss orders and take-profit levels to help traders manage their positions effectively. support team very friendly and helpful it's good for investor and trader

Positive

FX1916272973

India

ONE OF THE BEST APPS TO TRADE THE FOREX MARKETS OUT HERE. SPREADS AND COMMISITION ARE GREAT.IMMEDIATE WITHDRAWALS AND DEPOSITE. FAST EXECUTION OF ORDERS.XFLOW MARKETS IS THE FIRST PLATFORM I STARTED TO TRADE NEVER CHANGED OR HAD A NEED TO CHANGE.

Positive

FX4550910320

India

one of the best borker xflow markat good broker time to time withdrawal servive and clint persnol support

Positive

VINAY2959

India

xflow markets is the best broker in india you can trust this broker ,very help full staff and suppport team , deposit and withdrwal comfortable all method , its best for clients ,investor and IB

Positive

FX8514463952

India

This is a very good platform and they guided me very well thankyou xflomarket.

Neutral

Jitendra20

India

Very Good Broker. Fast withdrawal. on time trade execution. over all good services and reliable. No issues so far. Top-notch service. Fast response and amazing support team. Thanks for their professional service and excellent work.

Positive

胡叔

Hong Kong

I am very happy I found XFlow Markets. No issues so far. Top-notch service. Fast response and amazing support team. Thanks for their professional service and excellent work.

Positive

Daksh

India

The entire team at Xflowmarkets is beyond fantastic. I have been with them since 2017 and honestly, I have gotten nothing but exceptional service from them always. Payments are credited on time and sometimes even before the stipulated date. They are courteous and respectful. I cannot praise them enough.

Positive

石振

United States

Excellent broker with a 5-star support team! A friend persuaded me to try XFlow Markets and I am so grateful I listened! A fast, reliable broker with decent spreads and a wide range of assets on offer.

Positive