Score

Ronghui Group Co., Ltd

China|2-5 years|

China|2-5 years| https://www.ronghuiforex.com/en/index.html

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Ronghui Group Co., Ltd

Ronghui Group Co., Ltd

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Ronghui Group Co., Ltd also viewed..

XM

FP Markets

STARTRADER

FXCM

Ronghui Group Co., Ltd · Company Summary

Note: Regrettably, the official website of Ronghui Group Co., Ltd, namely https://www.ronghuiforex.com/en/index.html, is currently experiencing functionality issues.

| Ronghui Group Co., Ltd Review Summary | |

| Registered Country/Region | China |

| Regulation | NFA (Suspicious Clone) |

| Market Instruments | Currency, forex, indices and commodities |

| Leverage | 1:400 |

| EUR/USD Spread | From 1.0 pips to 1.5 pips |

| Trading Platforms | N/A |

| Minimum Deposit | $1,000 |

| Customer Support | Email: Admin@ronghuiforex.com |

What is Ronghui Group Co., Ltd?

Ronghui Group Co., Ltd., based in China, offers trading services in currency, forex, indices, and commodities markets. The company provides traders with a maximum leverage of 1:400. In terms of trading conditions, Ronghui Group Co., Ltd. offers competitive spreads ranging from 1.0 pips to 1.5 pips on the EUR/USD currency pair. The company requires a minimum deposit of $1,000 to open an account, and it provides customer support via email at Admin@ronghuiforex.com.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| A Range of Trading Instruments | Regulatory Concerns |

| Inaccessible Website | |

| Lack of Trading Platforms: | |

| Withdrawal Issues |

Pros:

- A Range of Trading Instruments: Ronghui Group Co., Ltd. offers a variety of trading instruments, including currency pairs, forex, indices, and commodities, providing traders with diverse investment opportunities.

Cons:

- Regulatory Concerns: Despite claiming regulation by the NFA (National Futures Association), Ronghui Group Co., Ltd. has been flagged as a “Suspicious Clone,” raising doubts about its regulatory compliance and credibility.

- Inaccessible Website: The unavailability of the company's official website raises concerns about transparency and accessibility of information regarding its services, trading conditions, and regulatory status.

- Lack of Trading Platforms: The absence of specified trading platforms adds to the ambiguity surrounding the company's offerings, leaving potential clients uncertain about the trading tools and technology available.

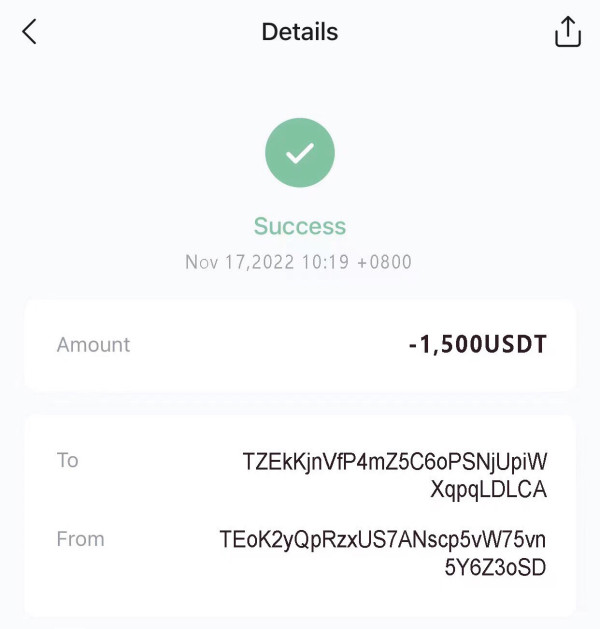

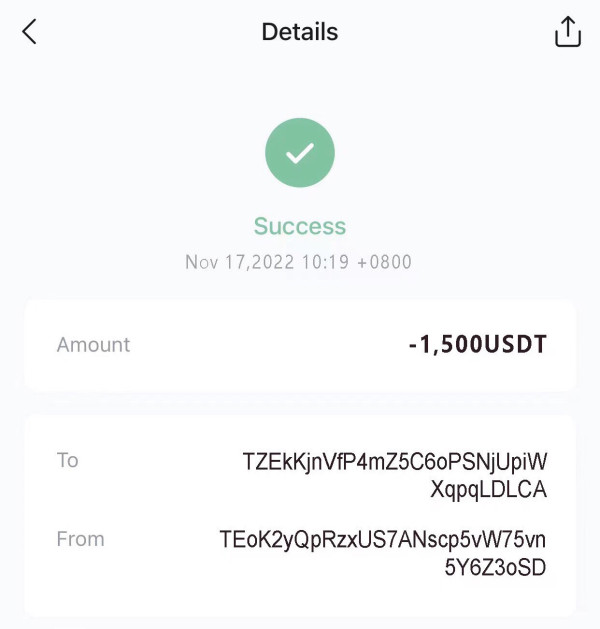

- Withdrawal Issues: Reports regarding instances of withdrawal difficulties associated with Ronghui Group Co., Ltd. suggest potential risks and challenges in accessing funds, which may deter traders from engaging with the company.

Is Ronghui Group Co., Ltd Legit or a Scam?

The National Futures Association (NFA) in the United States, known for its oversight of the derivatives industry, has cast doubt on the legitimacy of Ronghui Group Co., Ltd.'s claimed licensing. Ronghui Group Co., Ltd. purportedly holds a Common Financial Service License with license number 0546757. However, the NFA has not officially recognized Ronghui Group Co., Ltd. as a licensed entity, raising suspicions about the authenticity of their regulatory credentials. This discrepancy suggests the potential for Ronghui Group Co., Ltd. to operate with unauthorized or potentially fraudulent licensing.

Furthermore, the inaccessibility of Ronghui Group Co., Ltd.'s official website amplifies these concerns, casting uncertainty on the reliability and credibility of their trading platform. An inaccessible website not only hampers traders' ability to access crucial information but also raises doubts about the broker's operational stability and technical reliability. Such issues could indicate underlying problems like server malfunctions, maintenance issues, or deliberate attempts to conceal information from users. Regardless of the cause, the inability to access the website undermines transparency and trust, both critical aspects in the financial services sector.

Market Instruments

Ronghui Group Co., Ltd. provides a diverse range of trading instruments, including forex, currencies, indices, and commodities.

- Forex (Foreign Exchange): Forex trading involves the buying and selling of currency pairs, such as EUR/USD, GBP/JPY, and USD/JPY, among others. Traders speculate on the exchange rate movements between different currencies, aiming to profit from fluctuations in currency values relative to one another.

- Currencies: This category likely encompasses a broader range of currency pairs beyond the major ones typically associated with Forex trading. It includes both major currency pairs like EUR/USD and USD/JPY, as well as minor and exotic pairs, providing traders with a diverse set of options for currency trading.

- Indices: Ronghui Group Co., Ltd. offers access to various stock market indices, representing the performance of a group of stocks from a specific region or sector. Traders can speculate on the overall performance of the stock market without the need to trade individual stocks, with popular indices including the S&P 500, FTSE 100, and Nikkei 225.

- Commodities: Trading commodities involves buying and selling raw materials such as precious metals, energy products, and agricultural goods. Ronghui Group Co., Ltd. provides trading opportunities in commodities like gold, crude oil, silver, corn, and wheat.

Leverage

Ronghui Group Co., Ltd. provides traders with a maximum leverage of 1:400, which refers to the ratio of the size of a position relative to the margin required to open and maintain that position. Leverage allows traders to control larger positions with a relatively small amount of capital, amplifying both potential profits and losses.

With a leverage ratio of 1:400, traders can potentially control positions that are 400 times larger than their initial investment. This means that for every $1 in the trader's account, they can control up to $400 in the market. Such high leverage can significantly magnify trading gains, enabling traders to potentially generate higher returns from small price movements in the underlying assets. However, while high leverage offers the potential for greater profits, it also comes with increased risk.

Spreads & Commissions

Ronghui Group Co., Ltd. offers competitive spreads ranging from 1.0 pips to 1.5 pips on their trading instruments. Spreads refer to the difference between the buying (ask) and selling (bid) prices of a currency pair or other financial instruments. A lower spread typically indicates tighter pricing and reduced cost for traders when entering or exiting positions. The specific spread for each trading instrument may vary depending on market conditions and liquidity.

Regarding commissions, details on specific commission charges are not readily available due to the current inaccessibility of Ronghui Group Co., Ltd.'s website. Commissions can be an additional cost applied to trades, typically charged separately from spreads.

User Exposure on WikiFX

Please ensure that you carefully examine the reports on our website regarding instances of withdrawal difficulties. Traders thoroughly assess the information provided and take into account the potential risks associated with trading on an unregulated platform. Before engaging in any trading activities, we encourage you to visit our platform to access the necessary information. In the event that you encounter fraudulent brokers or have fallen victim to their practices, we kindly request that you inform us through the Exposure section.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Email: Admin@ronghuiforex.com

Conclusion

Overall, while Ronghui Group Co., Ltd. offers a variety of market instruments, clients should carefully consider the regulatory concerns, accessibility issues, and withdrawal challenges before deciding to engage with the company.

Frequently Asked Questions (FAQs)

| Question 1: | Is Ronghui Group Co., Ltd regulated by any financial authority? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | How can I contact the customer support team at Ronghui Group Co., Ltd? |

| Answer 2: | You can contact via email: Admin@ronghuiforex.com. |

| Question 3: | What is the minimum deposit for Ronghui Group Co., Ltd? |

| Answer 3: | The minimum initial deposit to open an account is $1,000. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now