No Regulation

Score

0 1 2 3 4 5 6 7 8 9

. 0 1 2 3 4 5 6 7 8 9

0 1 2 3 4 5 6 7 8 9

/10

The WikiFX Score of this broker is reduced because of too many complaints!

IMF

United Kingdom | 5-10 years |

United Kingdom | 5-10 years | Suspicious Regulatory License | Suspicious Scope of Business | High potential risk

https://www.imfspace1.net

Website

Rating Index

Contact

https://www.imfspace1.net

The WikiFX Score of this broker is reduced because of too many complaints!

Forex License

Forex License

No forex trading license found. Please be aware of the risks.

Warning: Low score, please stay away!

- This broker lacks valid forex regulation. Please be aware of the risk!

3

Basic Information

Registered Region  United Kingdom

United Kingdom

United Kingdom

United Kingdom Operating Period

5-10 years

Company Name

IMF Capital

Customer Service Email Address

service@imfspaces.net

Company Website

67

Website

Genealogy

Related Companies

Employees

Comment

Users who viewed IMF also viewed..

XM

9.11

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

XM

Score

9.11

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

FXCM

9.40

Score Above 20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

FXCM

Score

9.40

Above 20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

IC Markets Global

9.09

Score ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

IC Markets Global

Score

9.09

ECN Account15-20 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Vantage

8.70

Score ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Vantage

Score

8.70

ECN Account10-15 yearsRegulated in AustraliaMarket Making License (MM)MT4 Full License

Official Website

Website

imfspace1.net

45.207.26.97imfspace.vip

34.102.136.180imfspace.net

184.168.221.45

Genealogy

Download APP

Related Companies

IMF CAPITAL LIMITED(United Kingdom)

Deregistered

United Kingdom

Registration No.12120528

Established

Related sourcesWebsite Announcement

Employees

User Reviews67

Scroll down to view more

Write a review

Exposure

Neutral

Positive

Content you want to comment

Please enter...

Submit now

Comment 67

Write a comment

67

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

太阳初升70755

Hong Kong

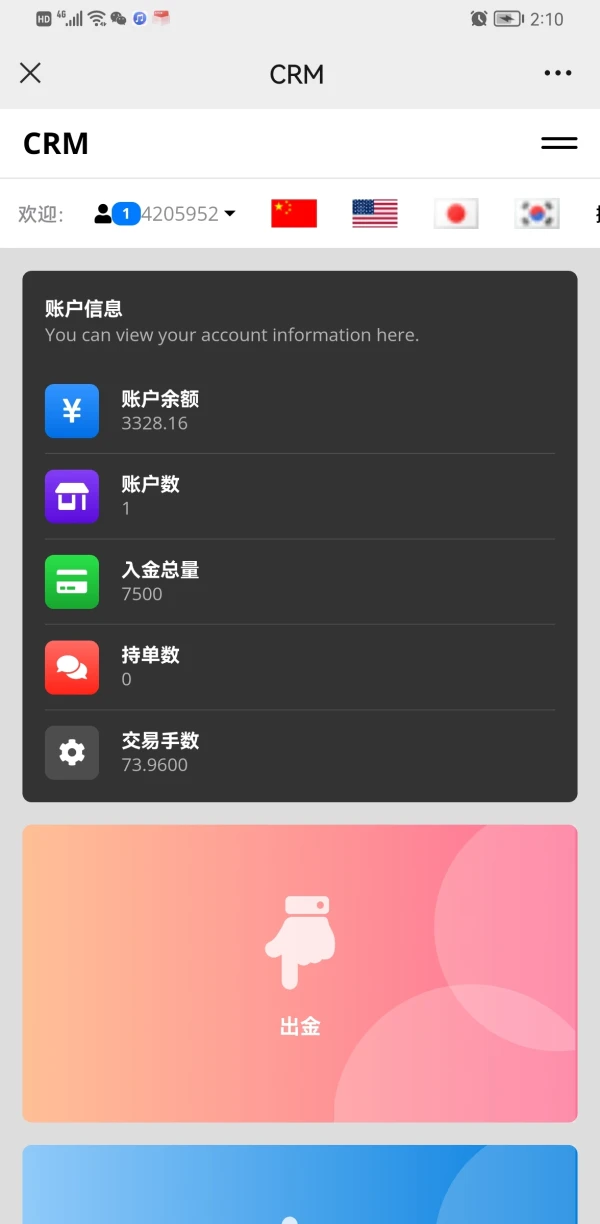

The funding channels cannot be opened, and the official website cannot be opened. The platform could not be opened for more than a month. A classic fraud platform.

Exposure

太阳初升70755

Hong Kong

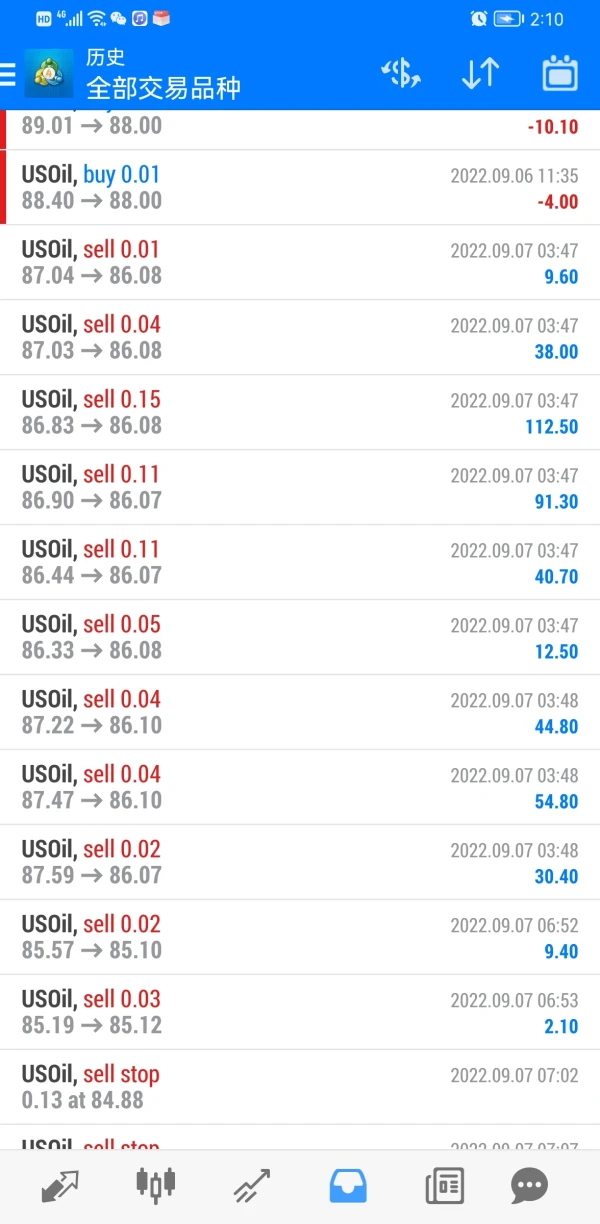

The deposit efficiency is faster than the rocket, and the withdrawal efficiency remains unchanged. The review has not passed for more than a month,. The new request has not changed for half a month

Exposure

Qi4101

Hong Kong

The imf deposit speed is very fast, but it is impossible to withdraw mmediately. The money from the account that has passed the audit is also deducted, but the account is not accounted for. It has been more than a month.

Exposure

No.1 Challenge

Cyprus

MetaTrader 4 platform is decent, but the $1,000 minimum deposit is too high.

Neutral

MeLo21361

Hong Kong

The fraud platform has absconded. It is a hedging platform that specializes in deceiving rookie to deposit. Now they have absconded

Exposure

Qi4101

Hong Kong

The review of withdrawal has passed and the money has been deducted, but they do not make the transfer. The customer service phone is also fake

Exposure

少管我

Hong Kong

The withdrawal issued on the 1st of July will not be withdrawn on the 20th of July, for various reasons. It has not been passed or failed. IMF platform does not address nor response. Ponzi scheme.

Exposure

岳31131

Hong Kong

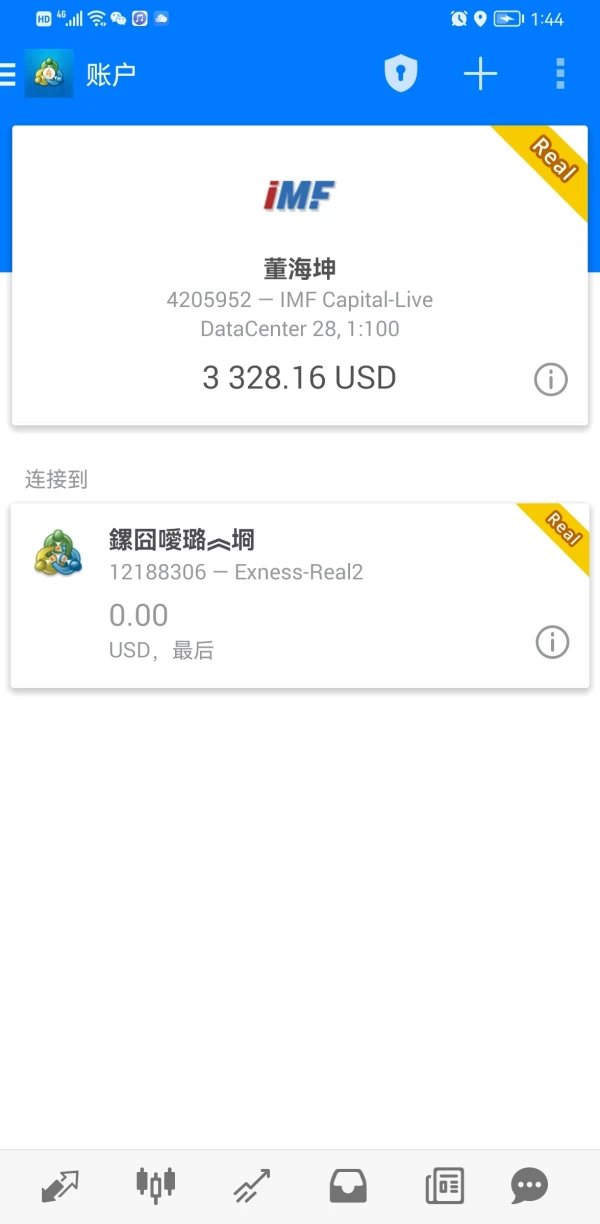

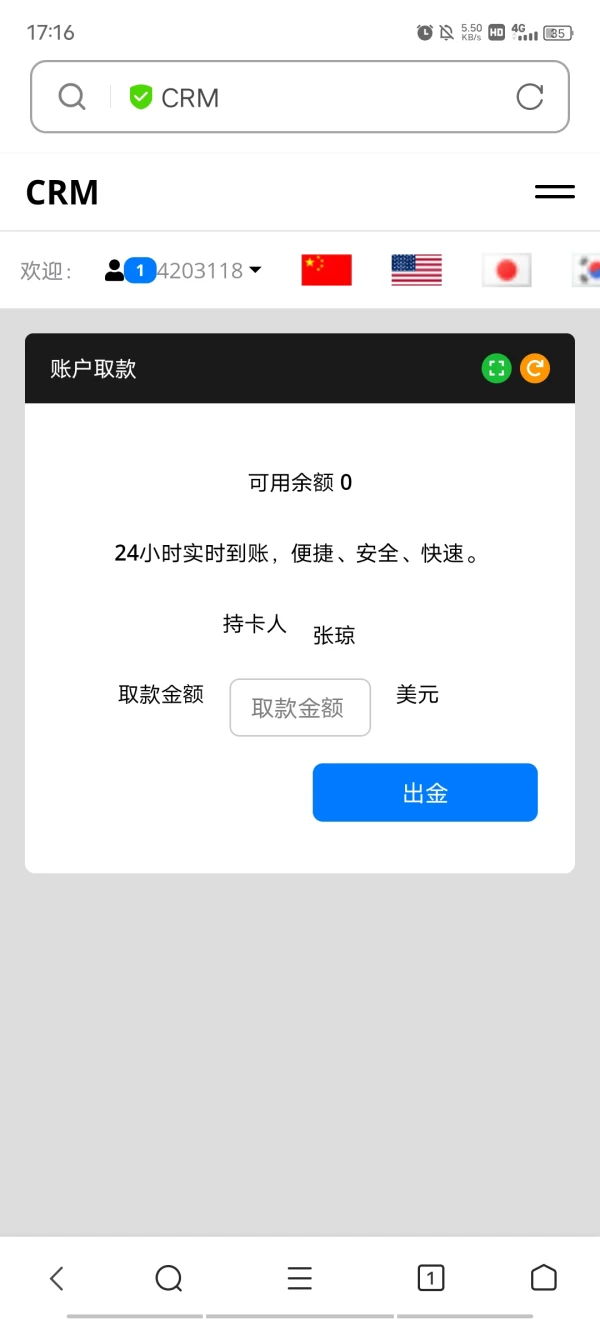

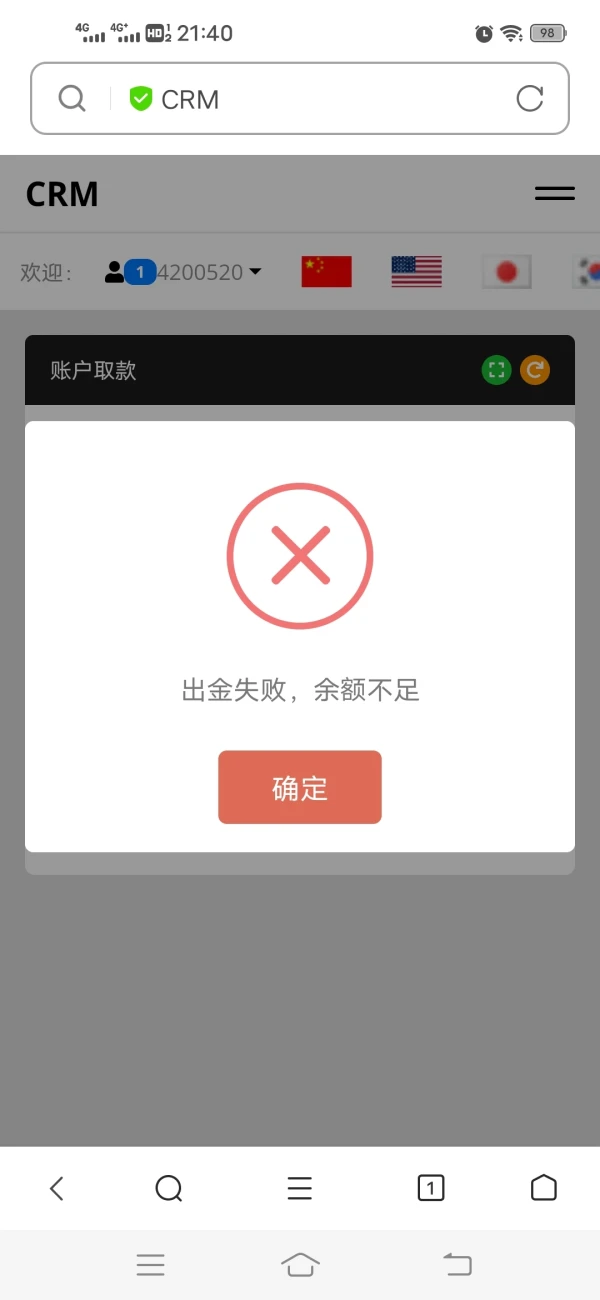

After withdrawing 200 USD today, I can no longer withdraw the money. It shows that the balance is insufficient and cannot withdraw, but the account has more than 2900 USD and there is no order in the account.

Exposure

Qi4101

Hong Kong

Withdrawal review is passed and deduction is made, but it does not arrive.

Exposure

岳31131

Hong Kong

There is more than 3000 dollars in account, but I can only withdraw 200. It shows that the balance is insufficient if you withdraw again.

Exposure

张瑞航

Hong Kong

Forced liquidation even for the locked position. The phone is empty and cannot contact the platform.

Exposure

岳31131

Hong Kong

Due to the failure of the server and the inability to operate, I got a large loss, the platform company cannot be contacted. I hope that the IMF platform can provide the contact information of the local agency company and make up for the loss of about 1,900 US dollars.

Exposure

幸.

Hong Kong

On June 17, 2022, I applied for the withdrawal of 901, and no funds have been withdrawn so far.

Exposure

Hong Kong

The website cannot log in to the account, resulting in the inability to operate the withdrawal. The trading software cannot be logged in either. The official phone number is empty now. My balance is 390.67 dollars. Please help. Thank you.

Exposure

岳31131

Hong Kong

MT4 cannot be logged in. I can log in at 6 AM, but not over 8 AM. I cannot withdraw from official website either.

Exposure

岳31131

Hong Kong

Cannot log in mt4 or open trading account. Cannot trade normally.

Exposure

岳31131

Hong Kong

The official website is a transfer of scam advertiment and cannot be opened. The opened website is imfspace1.net

Exposure

平安73752

Hong Kong

I applied for withdrawal for several months, but no one deal with it. Now, I cannot even open the official website.

Exposure

滞

Hong Kong

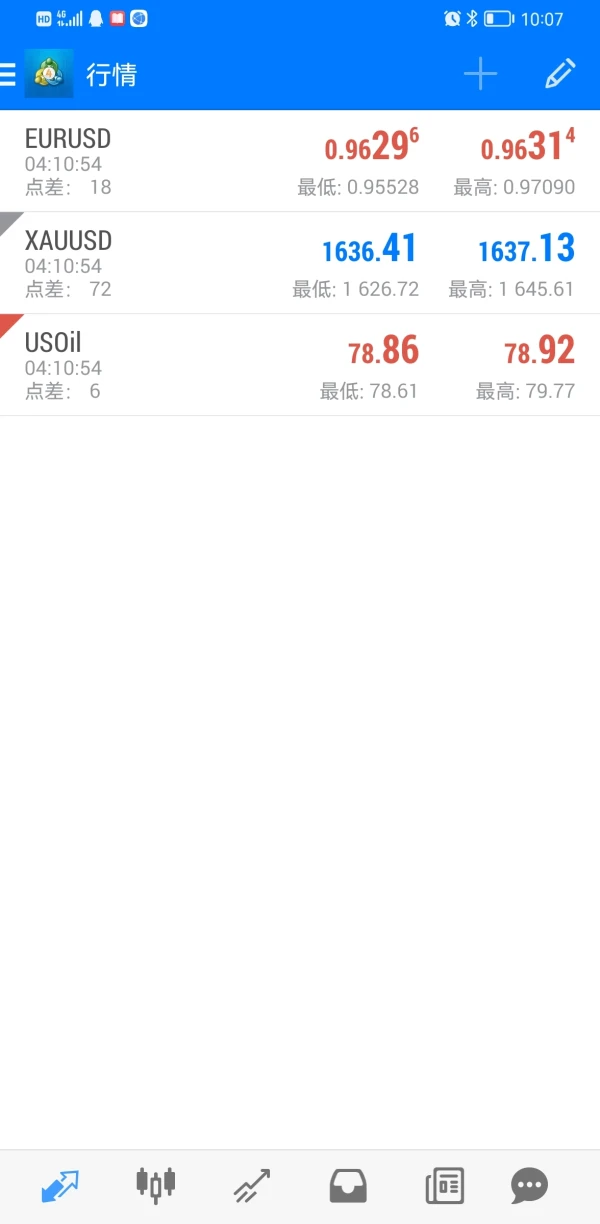

The withdrawal was made on May 10th, and the withdrawal was successful on the 11th, but it was delayed for a long time. The customer service call was either hung up or unable to get through. In addition, the comparison trend of the two softwares at the same time is completely different, and the slippage is serious compared to the old brands such as Forex.com.

Exposure

优宠猫舍

Hong Kong

I personally applied for an imf account and operated it for half a month, but I couldn't withdraw. I applied for the withdrawal on May 10, 2022. On the 5.11, it showed that the money had been withdrawn, but on the 5.13, it did not show that the account was received. I contacted the background, but there is no reply.

Exposure

Mr.Zhang47341

Hong Kong

Unable to withdraw nor contact the customer service. All the websites cannot be logged in.

Exposure

Mr.Zhang47341

Hong Kong

The website cannot be logged in nor withdrawn. The website that they change last time cannot log in either.

Exposure

Hong Kong

The spread is normally 20 pips when I buy it, and the spread is increased to more than 140 pips for no reason, and the purchase will result in a serious loss. Not following the trading rules. April 15, 2022 at 10:30 Beijing time.

Exposure