Basic Information

United States

United States

Score

United States | 2-5 years |

United States | 2-5 years |https://hyanb-fx.com/

Website

Rating Index

Forex License

Forex License No forex trading license found. Please be aware of the risks.

United States

United States  hyanb-fx.com

hyanb-fx.com  hyanbfx.cc

hyanbfx.cc  hyanbfx.com

hyanbfx.com  hyanbglobal.com

hyanbglobal.com | HYANB Group Review Summary | |

| Company Name | HYANB GROUP LIMITED |

| Founded | 2024 |

| Registered Country | United Kingdom |

| Regulation | NFA (Exceeded) |

| Market Instruments | Forex, precious metals, crude oil, indices, cryptocurrencies |

| Demo Account | ✅($100 000 in virtual capital) |

| Leverage | 1:400 |

| Spread | From 0.0 pips |

| Trading Platform | All-In-One CFD Trading Platform |

| Min Deposit | / |

| Customer Support | 24/7 email: info@hyanbmarts.com |

HYANB Group is a company established in 2024 and is currently registered in the United Kingdom, offering access to trading Forex, precious metals, crude oil, indices, and cryptocurrencies.

| Pros | Cons |

|

|

|

|

|

|

|

|

No. HYANB Group currently only holds an exceededNational Futures Association (NFA) license.

| Regulatory Agency | National Futures Association (NFA) |

| Regulatory Status | Exceeded |

| Regulated by | United States |

| Licensed Institution | HYANB GROUP LIMITED |

| Licensed Type | Common Business Registration |

| Licensed Number | 16301803 |

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious metals | ✔ |

| Crude oil | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

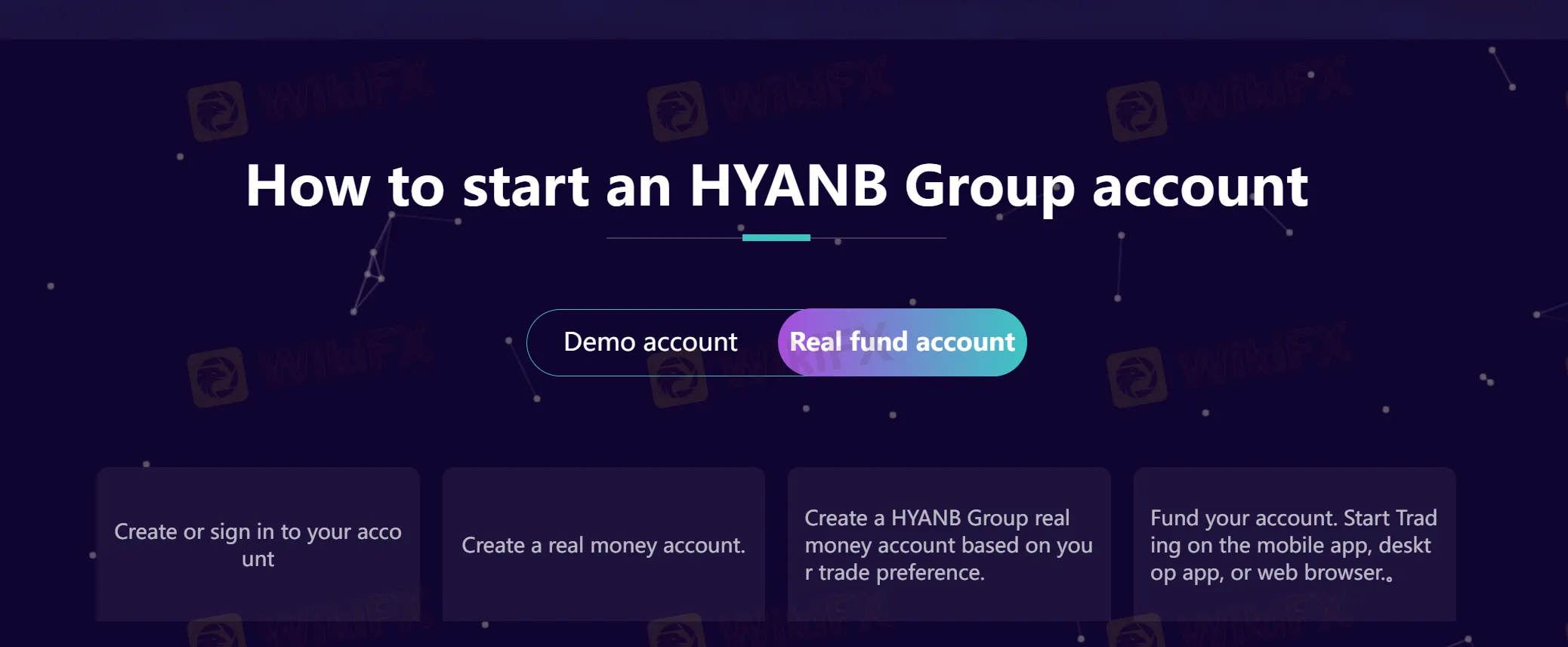

HYANB Group offers two types of accounts to its clients.

The first is demo account ($100 000 in virtual capital), which allows users to practice trades with virtual money. It's designed for those who are looking to gain experience in trading before handling actual funds.

The second type of account is the Real fund account, which is for actual trading with real money. This type of account is for traders who are comfortable with trading and want to earn real profits.

HYANB Group offers a high leverage of up to 1:400. This means that traders can trade up to 400 times their initial deposit. High leverage can provide the potential for higher profits, but it also comes with a high risk, as losses can also be multiplied. It is therefore important for traders to manage their risk properly when trading with such high leverage.

HYANB Group provides a starting spread of 0.0 pips, promising traders competitively low transaction costs. However, it's worth noting that there is no explicit information about the commission charges on the official website. This could mean potential hidden fees not immediately apparent to traders. Therefore, clients should exercise caution and seek clarity about these charges to avoid any unexpected costs.

HYANB Group offers an All-In-One CFD Trading Platform that is accessible via Windows, iPhone, and Android devices.

Is demo accounts available on HYANB Group?

Yes, they provide demo accounts with $100 000 in virtual capital.

What leverage does HYANB Group provide?

HYANB Group offers a high leverage up to 1:400.

Is HYANB Group regulated?

HYANB Group falls under the scrutiny of the National Futures Association (NFA) in the United States, yet it currently holds an “exceeded” status.

What trading platform does HYANB Group use?

Instead of the industry-leading MT4 and MT5 platforms, HYANB Group only uses an All-In-One CFD Trading Platform.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now