Company Summary

| LINE Securities Review Summary | |

| Founded | 2018 |

| Registered Country/Region | Japan |

| Regulation | FSA (Suspicious Clone) |

| Market Instruments | Forex |

| Demo Account | / |

| Leverage | Up to 1:25 |

| Spread | From 0.2 sen - 10.0 sen (EUR/USD) |

| Trading Platform | Line FX App |

| Minimum Deposit | 1,000 yen |

| Customer Support | Live Chat, Contact Form |

| Tel: +44 330 777 22 22 | |

| Social media: X, Facebook, Line | |

| Address: 22nd Floor, Sumitomo Fudosan Osaki Garden Tower, 1-1-1 Nishishinagawa, Shinagawa-ku, Tokyo 141-0033 | |

LINE Securities Information

LINE Securities is a Japan-based broker founded in 2018, which holds a suspicious clone license of Financial Services Agency in Japan. It focuses on forex trading, with a minimum deposit of 1,000 yen and leverage up to 1:25.

Pros and Cons

| Pros | Cons |

| Live chat supported | Supicious clone license |

| Various contact channels | Limited info on trading conditions |

| Free deposit | Limited trading assets |

| Limited payment options |

Is LINE Securities Legit?

| Regulated By | Regulatory Status | Licensed Institution | License Type | License Number |

| Financial Services Agency (FSA) | Suspicious Clone | LINE証券株式会社 | Retail Forex License | 関東財務局長(金商)第3144号 |

What Can I Trade on LINE Securities?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ❌ |

| Indices | ❌ |

| Commodities | ❌ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

Leverage

LINE Securities offers leverage of up to 1:25, depending on the instrument and account type. Leverage allows traders to control larger positions with smaller capital, amplifying both potential profits and losses.

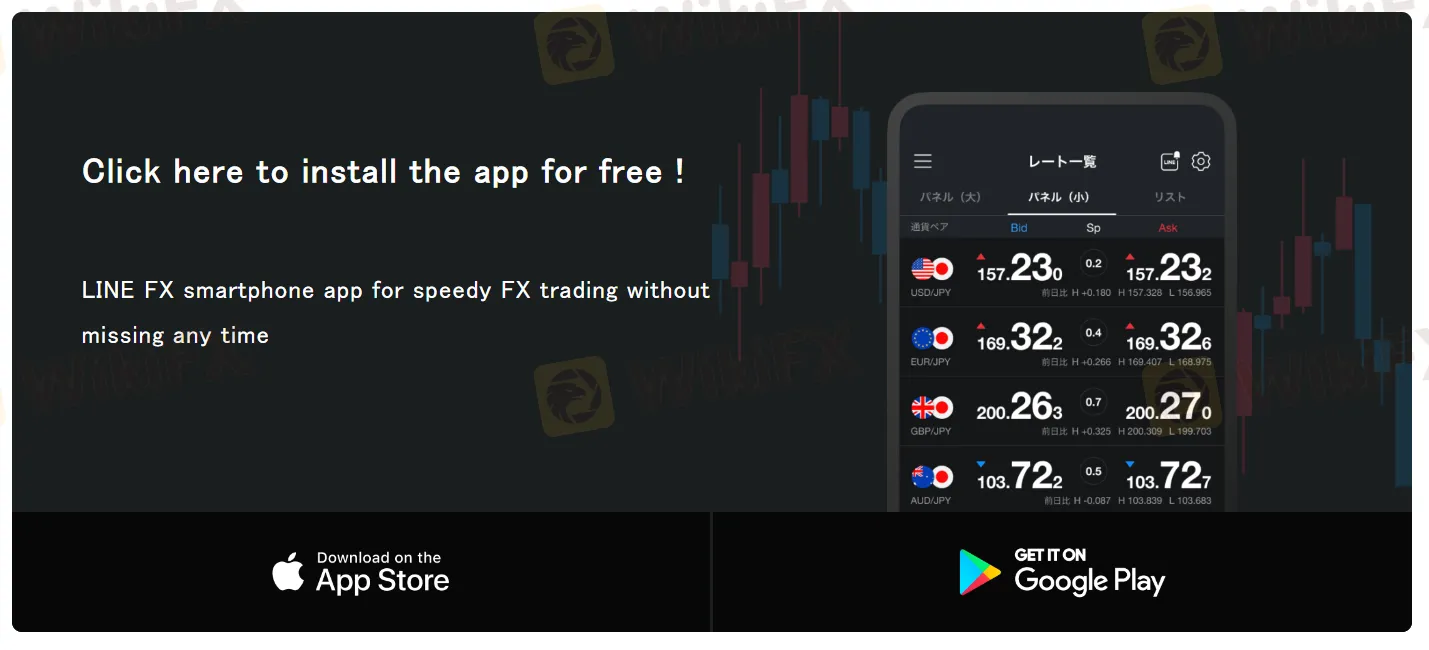

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| LINE FX App | ✔ | iOS, Android, Windows, MacOS | / |

Deposit and Withdrawal

| Deposit Method | Deposit Amount | Commission |

| Quick Cash | 1,000 yen to 100 million yen | free |

| Bank Transfer Deposit | No restrictions | free |